Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--ETH/USD Forecast: Price Drops Rapidly at Open

- 【XM Market Analysis】--Weekly Forex Forecast –EUR/USD, USD/JPY, USD/CAD, NZD/USD

- 【XM Decision Analysis】--EUR/USD Forex Signal: Double-Bottom Pattern Points to a

- 【XM Market Analysis】--USD/JPY Forecast: Struggles Below 150

- 【XM Forex】--GBP/USD Analysis: Selling Strategy May Strengthen in Coming Days

market news

The daily line is expected to break the level, and gold and silver are low and waiting for new highs

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: The daily line is in the middle of the positive position and the gold and silver are in the low and waiting for the new high." Hope it will be helpful to you! The original content is as follows:

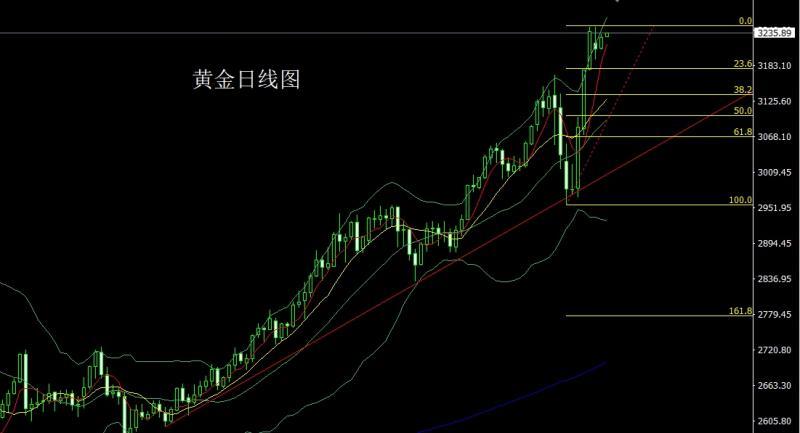

The gold market opened at 3211.6 yesterday and the market fell slightly. The market fluctuated and rose. The daily line reached the highest point of 3233.6. After the market consolidated. The daily line finally closed at 3229.2. After the market closed with a small positive line with a longer upper shadow line. After this pattern ended, it rose in the morning today, and today it fell back to 3232 long stop loss 3226. The target was 3242 and 3247 to break the position and see 3252 and 3260-3267.

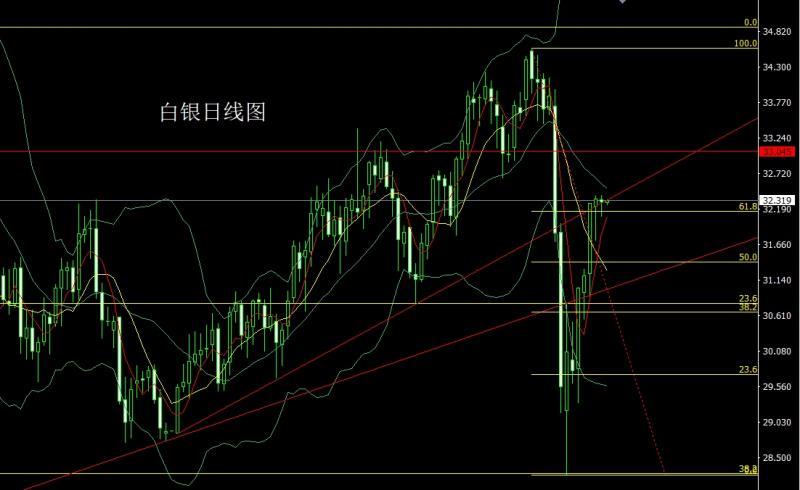

The silver market was consolidated yesterday. The market was consolidated at the opening of 32.332 in the morning. The daily line reached the highest position of 32.396 and the market fell. The daily line was at the lowest position of 32.071 and the market was consolidated. The daily line finally closed at the position of 32.3. After the market closed with a very long lower shadow line, the market closed with a star pattern. After this pattern ended, today 32 tried to stop loss at 31.8, with the targets looking at 32.4 and 32.7 and 33-33.2

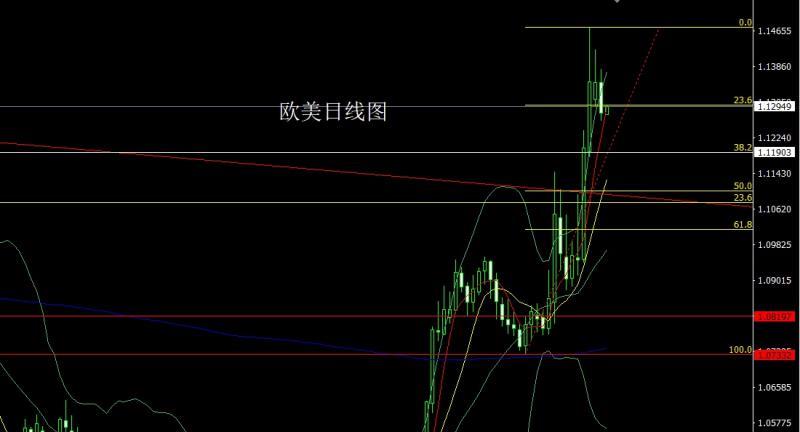

European and American markets opened at 1.13489 yesterday and the market fell first, giving the position of 1.13149, and then the market fluctuated and rose. The daily line reached the highest point of 1.13791 and then fell strongly. The daily line was the mostAfter the low is given to the position of 1.12629, the market consolidated. The daily line finally closed at the position of 1.12806. The market closed with a large negative line with an upper shadow slightly longer than the lower shadow. After this pattern ended, the daily line was yin and yang. Today, the short stop loss of 1.13400 is 1.13650. The target below is 1.12600, and the falling below is 1.12300 and 1.12100.

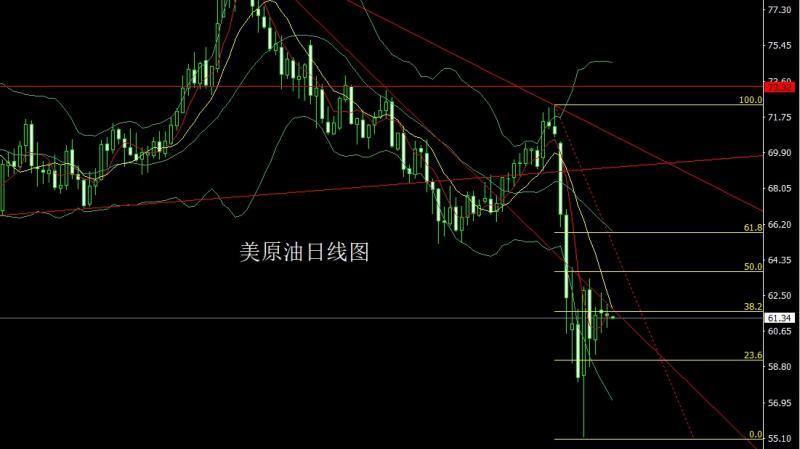

The US crude oil market opened at 61.45 yesterday and the market rose slightly, and then the market fluctuated and fell. The daily line was at the lowest point of 60.81 and then the market consolidated. The daily line finally closed at 61.45 and then the market closed with a cross star with an upper and lower shadow line. After this pattern ended, today's short short stop loss of 62.5, and the target below was 61.5 and 60.8, falling below to 60.2 and 59.5.

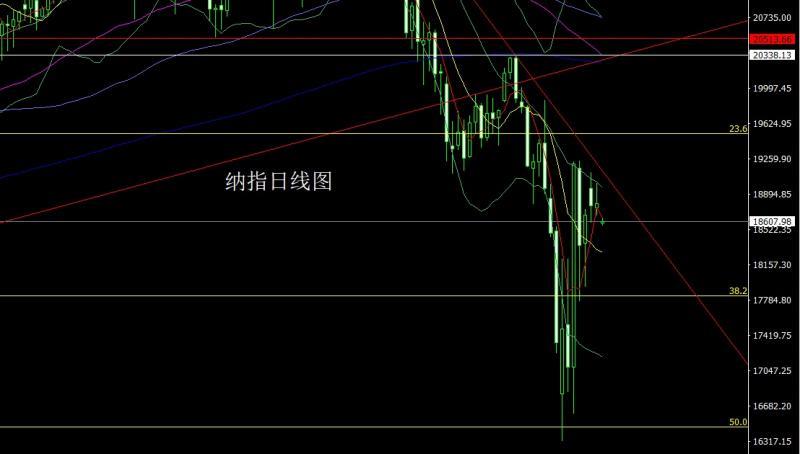

The Nasdaq market opened at 18743.94 yesterday and the market fell first, giving the position of 18662.56, and then the market fluctuated and rose. The daily line reached the highest point of 19010.86, and the market fluctuated and fell. The daily line finally closed at 18792.03, and the market closed in an inverted hammer head with a long upper shadow line. After this pattern ended, it opened low today. The retracement continues short. At the point, yesterday's short position of 18960 was reduced and the stop loss followed up at 18970. Today's short position is only you 18950. The target below looks at 18550 and 18450 and 18300.

The fundamentals, yesterday's fundamentals tariff policy is still the theme of market fluctuations. The US President said that the suspension of tariffs is because this is a transition period and is out of the need for flexibility. All necessary licenses will be accelerated to Nvidia. The latter faced $5.5 billion in fees due to U.S. export restrictions, and its share price fell 6% after the market closed. The United States initiates an investigation into the national security risks posed by key minerals and their derivatives that rely on imported processing. Canada will suspend tariffs on some American goods for six months and will be exempted from some countermeasures against imported cars against the United States. Mexico has stepped up its scrutiny and fuel imports from the U.S. Texas border have stalled. According to US media: Due to the small progress in negotiations, the EU expects US tariffs to continue. U.S. import prices fell 0.1% from the previous month, the first month-on-month decline since September last year. Today's fundamentals focus mainly on China's first-quarter GDP annual rate of 10:00. At night, focus on the US retail sales monthly rate in March at 20:30, then look at the US industrial output monthly rate in March at 21:15 and the US April NAHB real estate market index and the US February xmserving.commercial inventory monthly rate. Then look at the EIA crude oil inventories and the United States from 22:30 to April 11 in the weekEIA Cushing crude oil inventories in the week of April 11 and the U.S. strategic oil reserve inventory in the week of April 11. Fed Chairman Powell, who is following 01:15 tomorrow morning, delivered a speech at the Chicago Economic Club.

In terms of operation, gold: today's retracement of 3232 long stop loss 3226, target 3242 and 3247 breaking, 3252 and 3260-3267.

Silver: today's 32 try to stop loss 31.8, target 32.4 and 32.7 and 33-33.2

Europe and the United States: today's 1.13400 short stop loss 1.13650, target below 1.12600, break below 1.12300 and 1.12100.

US crude oil: today 62 short short Stop loss is 62.5, the target card below is 61.5 and 60.8, and the target card below is 60.2 and 59.5.

Nasdaq: Yesterday, the short position of 18960 was reduced and the stop loss followed at 18970. Today, the short position of 18850 is only you 18950, and the target below is 18550 and 18450 and 18300.

The above content is all about "[XM Forex Official Website]: The daily line is in the middle of the positive position and gold and silver are waiting for new highs". It is carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here