Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--ETH/USD Forecast: Holds Steady Above $3,000 After Monday’s

- 【XM Market Review】--EUR/GBP Forecast: Clings to Support

- 【XM Decision Analysis】--USD/TRY Forecast: Extends Losses

- 【XM Market Analysis】--ETH/USD Forecast: Ethereum Hits a Brick Wall

- 【XM Market Analysis】--USD/JPY Forecast: USD/JPY Pulls Back Before FOMC

market news

The trade war between the two sides and the two sides, the gold and silver sun is back to the top

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Union-Long-Long-Long trade war, gold and silver big sun retreats back to a long time". Hope it will be helpful to you! The original content is as follows:

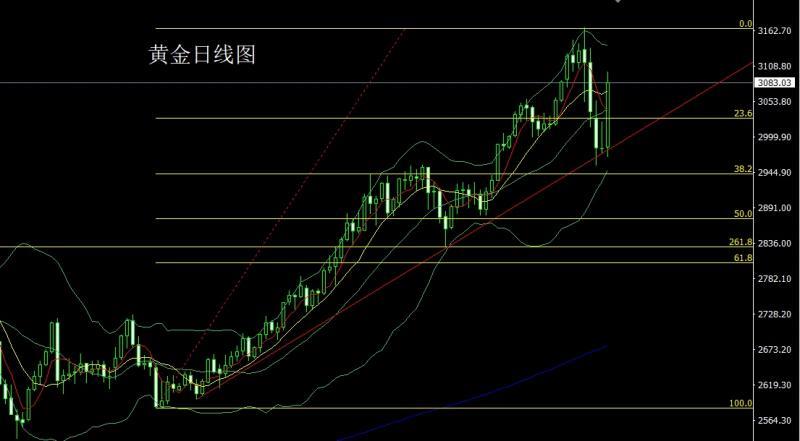

Yesterday, the gold market opened at 2984.1 in the morning and then the market fell first. The daily line was at the lowest point of 2969.1. After the market was stimulated by fundamentals, the market rose strongly. After breaking the high point of the previous day's shooting star at 3023, the market xmserving.completed a 4-hour double bottom structure and strongly pulled up. The daily line reached the highest point of 3100 and then the market consolidated at a high level. After the daily line finally closed at 3083, the daily line closed with a large positive line with an upper and lower shadow line. After this pattern ended, today's market fell back to a long time. At the point, today's market fell back to more than 3050 and stop loss 3044. The target was 3085 and 3095 and 3100. If it broke, look at pressures of 3120 and 3132 and 3145.

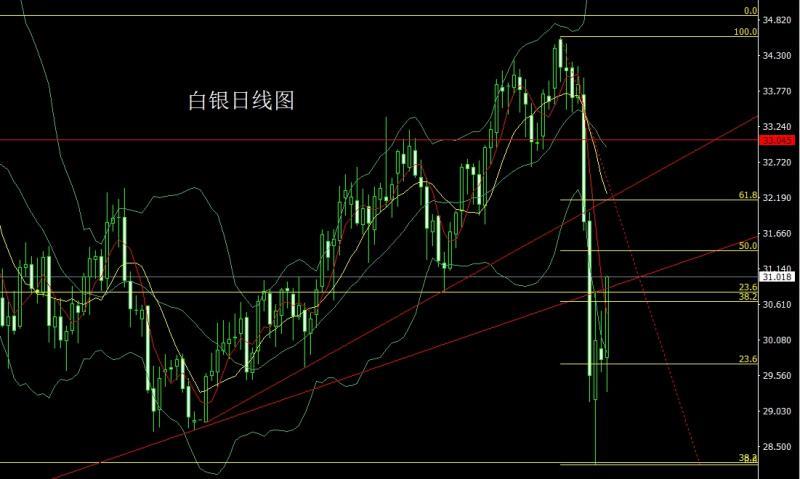

The silver market opened at 29.819 yesterday and the market fell first. The market rose strongly. The daily line reached the highest point of 31.033 and then the market consolidated. The daily line finally closed at 31.018 and then closed with a large positive line with a very long lower shadow line. After this pattern closed, the daily line xmserving.completed the break. Today's market fell back to a long position. At the point, the stop loss was 30.5 today. The target was 31 and 31.2 and 31.5-31.7 pressure.

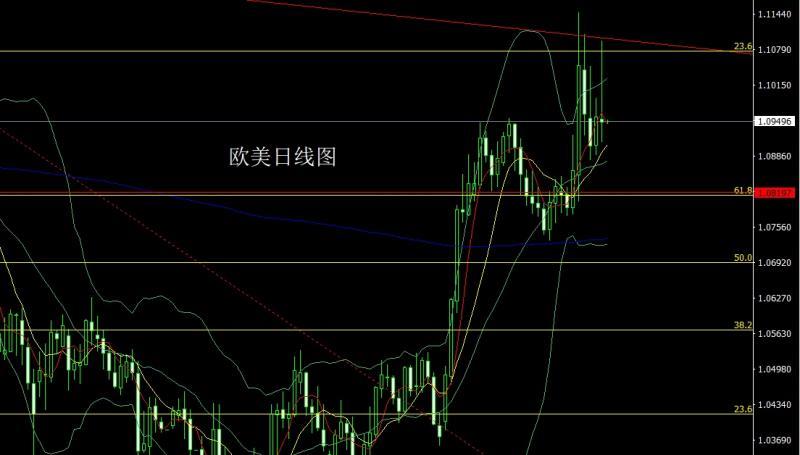

Yesterday, the European and American markets opened at 1.09520 in the morning, and the market rose first. The daily line reached the highest point of 1.10955 and then fell back. The daily line was at the lowest point of 1.09121 and then the market consolidated. After the daily line finally closed at 1.09468, the daily line closed with a shooting star with a very long upper shadow line. After this pattern ended, today, 1.10050 short stop loss 1.10250, the target below is 1.09500 and 1.09100. If it falls below, 1.08800 and 1.08500.

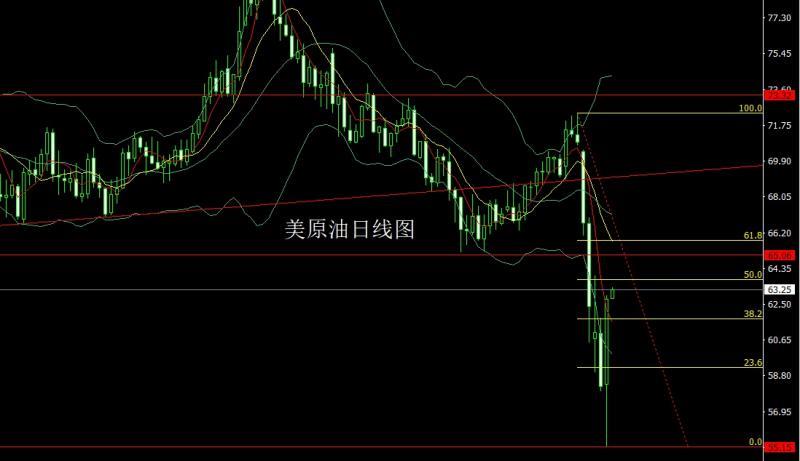

The U.S. crude oil market opened at 58.37 yesterday and the market fell first. The daily line was at the lowest level of 55.15. After the market rose strongly due to the news that the United States suspended reciprocal tariffs for 90 days. The daily line reached the highest level of 63 and then the market consolidated. The daily line finally closed at 62.75. After the market closed with a lower shadow line with a large positive line with a large amount of low-degree positive line. After this pattern ended, the short position of 71.9 last week and the short position of 70.3 left the market in the early trading session, and today the 60.5 stop loss was 59.9, with a target of 62 and 63.5, and a break of 64 and 65 pressure.

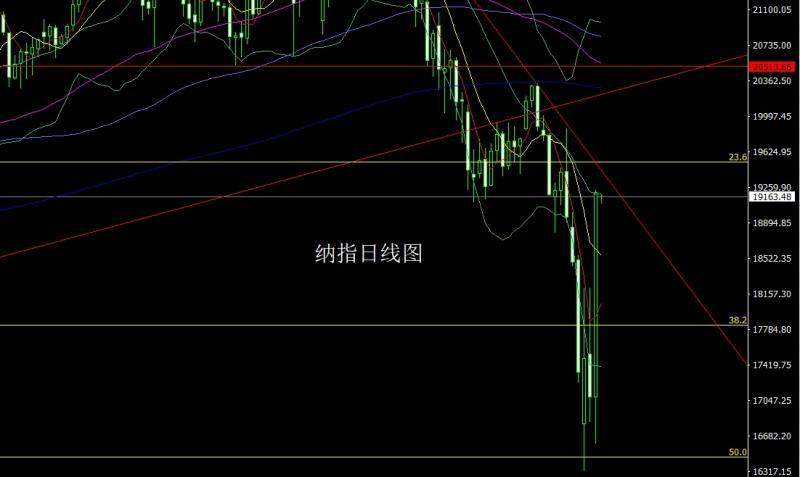

The Nasdaq market opened at 17084.74 yesterday and the market fell first. The daily line was at the lowest point of 16590.5 and then the market rose strongly. The daily line reached the highest point of 19233.5 and then the market consolidated. After the daily line finally closed at 19202, the daily line closed with a super big positive line with a long lower shadow line. After this pattern ended, the stop loss of more than 18500 today, and the target was around 19250 and 19500 and 19700.

State, yesterday's fundamentals were the main factor causing the market shock. The US President announced that the implementation of reciprocal tariff policies for most economies, with a deadline of 90 days for negotiations. He also said that he had been considering suspensions in the past few days. The White House said that 10% global tariffs were still imposed during the negotiations, and the industry tariffs previously announced by automobiles, steel and aluminum are not included in the suspension. Tariff measures between Mexico and Canada remain unchanged. U.S. officials: It believes the EU will postpone planned retaliation measures. The EU voted to impose a 25% tariff on the United States (the goods are worth 21 billion euros) to counter US steel and aluminum tariffs. Japanese media: Japan is considering issuing cash to the public to alleviate the impact of tariffs ⑥ Trump explains why he suspended reciprocity measures: I feel that everyone's reaction is a bit too much, and it seems a little panicked and a little scared. It will consider exempting some American xmserving.companies, and in response to the US's 104% tariff increase on China, China imposed 84% tariffs on the US yesterday. China firmly counterattacks and then takes another "combination punch". So yesterday the market fluctuated violently, and the US President slugged yesterdayThe 90-day reciprocal tariff policy against the United States is obviously used to reduce the impact of this policy on the US and to fully respond to the impact of China's reciprocal tariffs. This method is used to xmserving.compete with the global countries' trade-offs and the ability of a protracted war. China's strategy of unification and alliance during the Warring States Period can reflect the main policy trends of the current Sino-US game. Therefore, under such a general background, the US index and gold market rose strongly yesterday, and non-US currencies fell. Today's fundamental treatment continues to pay attention to the tariff policy, mainly looking at China's March CPI annual rate at 9:30, with an expected 0.1% in this round. At the evening, the US's March unseasonal CPI annual rate at 20:30 and the US's seasonally adjusted CPI monthly rate in March and the US's March seasonally adjusted CPI monthly rate, as well as the number of initial unemployment claims in the week from April 5, the current round is expected 2.6%.

In terms of operation, gold: Today's market will fall back to 3050 and stop loss of 3044, the target will be 3085 and 3095 and 3100, and if the break is 3120 and 3132 and 3145 pressure.

Silver: 30.7 long stop loss 30.5 today, with a target of 31 and 31.2 and 31.5-31.7 pressure.

Europe and the United States: 1.10050 short stop loss today 1.10250, the target below is 1.09500 and 1.09100, if it falls below, it looks at 1.08800 and 1.08xmserving.com500.

U.S. crude oil: 71.9 short and 70.3 short stop loss last week, 60.5 long stop loss today 59.9, the target is 62 and 63.5, and the break is 64 and 65 pressure.

Nasdaq: Today's stop loss of more than 18,600 is 18,500, with the target being around 19250 and 19500 and 19700.

The above content is all about "[XM Foreign Exchange Market Analysis]: Trade War of the Union and the Long-Term, Gold and Silver Strike Back Long", which was carefully xmserving.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here