Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--NASDAQ 100 Forecast: Index Runs into Ceiling on Thursday

- 【XM Decision Analysis】--Dax Forecast: DAX Extends Gains as ECB Rate Cut Looms

- 【XM Market Analysis】--USD/CAD Forecast: US Dollar Dips Slightly Against Loonie

- 【XM Market Review】--GBP/USD Forecast: Testing Major Support

- 【XM Market Analysis】--Weekly Forex Forecast –EUR/USD, USD/JPY, USD/CAD, NZD/USD

market news

Whether gold can continue to be under pressure on the US market, Europe and the United States are expected to continue again

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and xmserving.companionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Whether gold can continue to be under pressure in the US market, Europe and the United States are expected to continue again." Hope it will be helpful to you! The original content is as follows:

Macro

The US financial market has been turbulent recently, and the situation in the fields of Treasury bonds, gold and stock markets is xmserving.complex. In the Treasury bond market, the yield on 10-year Treasury bonds rose to 4.283%, and the U.S. Treasury yield curve steepened, due to concerns about long-term bond supply and the additional margin in the stock market, causing leveraged investors to sell out, which intensified market volatility and increased gold holding costs. In terms of trade policy, the US imposes tariffs on Asian powers near and there is no exemption. Foreign capital may sell US bonds to counter, and long-term debts are under pressure. Although safe-haven funds flow into gold, they are subject to liquidity restrictions. The stock market performed poorly, with the S&P 500 falling below 5,000 points, falling more than 12% in four days, VIX soaring, the stock market sell-off may trigger a crisis, and the gold safe-haven attributes were weakened in the short term. There are differences in monetary policy expectations. The market bets that the Federal Reserve cut interest rates by 105 basis points before the end of the year, and the probability of the first rate cut in May exceeds 50%, but the chairman of the San Francisco Fed held a different opinion. In the future, we need to pay attention to the results of the 10-year Treasury bond bid, the minutes of the Federal Reserve meeting, and corporate financial reports. The worsening of the trade war may result in U.S. stocks may continue to fall or benefit gold, otherwise it will be under pressure. Investors need to make careful decisions.

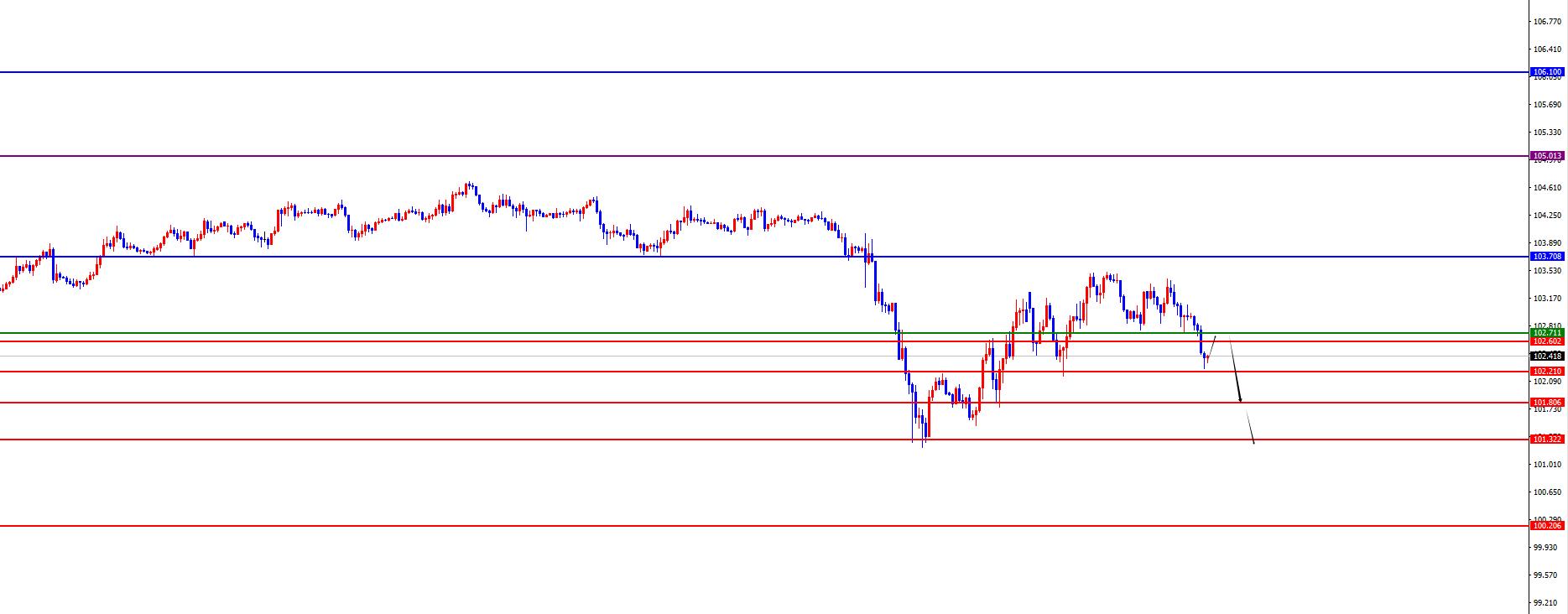

Dollar Index

In terms of the US dollar index, the price of the US dollar index generally showed a decline on Tuesday. The price rose to 103.489 on the day, the lowest was 102.724 on the spot, and the closing price was 102.933 on the spot. Looking back at the price performance of the US dollar index on Tuesday, the price was directly under pressure after the opening in the morning, and the intraday price remained above the four-hour support. At the same time, there was no breaking the early high and daily resistance above. At the same time, it finally broke the daily support overnight, and further pressure performance will be performed in the future.

When conducting cycle analysis, from the weekly level, the position of 106.10 is worthy of continuous attention, and it is a key point for judging the mid-line trend. Once the price is below 106.10, the mid-term market tends to be bearish.

Switch to the daily level, you need to pay attention to the position of 103.70, which is the key to the band trend. If the price is below 103.70, the market under pressure will continue, and this situation needs to be closely tracked in the future.

Looking at the four-hour level, we should pay attention to the resistance range of 102.90-103. After the price fell below yesterday, it became a short-term key resistance, and the price was treated with a short side.

At the same time, from the one-hour level, yesterday's big negative ended, and today's morning session was under pressure again and broke through the previous day's low point. We will pay attention to the rebound and further pressure after further support, and pay attention to the 102.20-101.80 regional support below.

The US dollar index was short in the range of 102.90-103, with a defense of 5 US dollars, and a target of 102.20-101.80

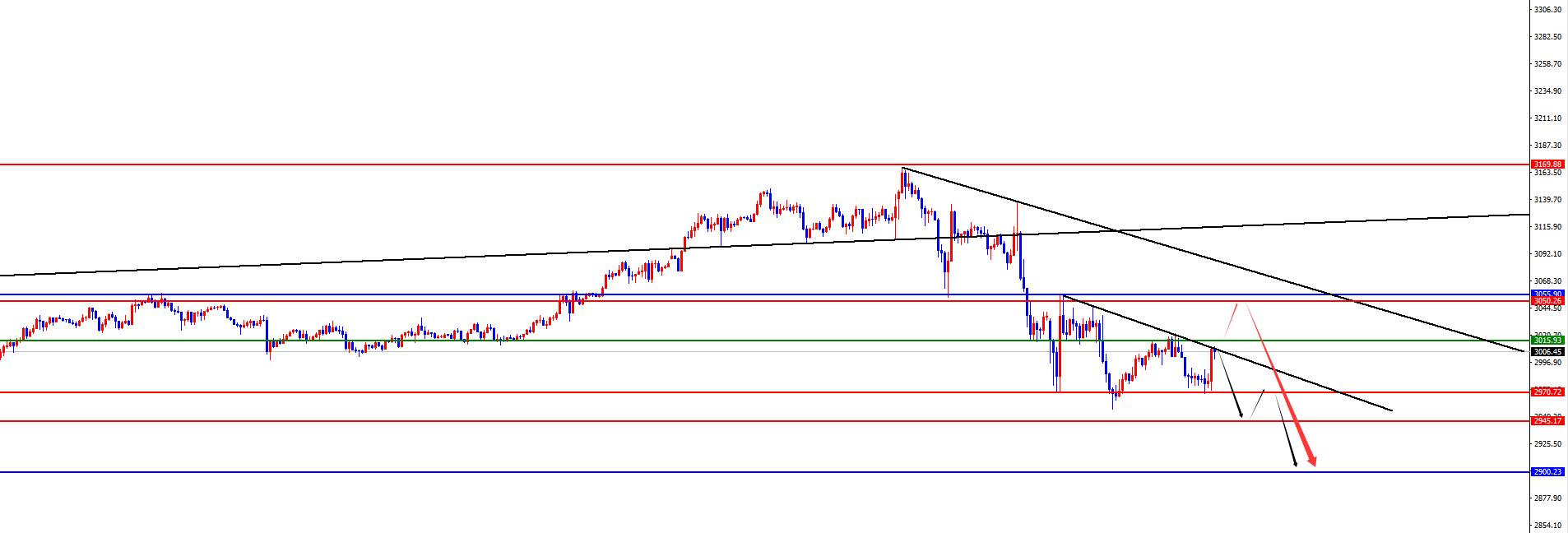

Gold

In terms of gold, the overall price of gold showed a decline on Tuesday. The price rose to the highest point of 3022.56 on the day, and the lowest point fell to 2974.63 on the spot, and the closing price was 2981.89 on the spot. In response to the short-term rise in prices during the early trading session on Tuesday, and the European session fluctuated during the European session, and the price of the US fell under pressure after the trading session, which was also in line with our expectations for the market. At present, we need to pay attention to the daily resistance under pressure in the short term and maintain short treatment before breaking.

Through multi-cycle xmserving.comprehensive analysis, we can have a clearer understanding of the current price trend. Currently, the price is above the support levels of the weekly, monthly and daily lines, which shows that from a medium- and long-term perspective, the market is in a bullish trend. Specifically, the support level at the weekly level is near the 2900 area, and this position needs to be paid attention to in subsequent analysis.

Looking at the daily level again, the resistance level is near the 3050-3055 area, while the resistance level at the short-term four-hour level is in the 3015 area. Since the price is currently below the multi-cycle resistance level, we still recommend treating it with a bearish approach in terms of operational strategies. At the same time, you need to beware of short-term fluctuations in prices.

Further observe the one-hour trend, gold prices rose again in the morning session today. In the short term, there are signs of further correction. Therefore, in the short term, pay attention to the gains and losses of yesterday's high. If the price cannot break through yesterday's high, the market will continue to be bearish; if it successfully breaks, you need to pay attention to the daily resistance level of 【XM Forex】Check whether the price will encounter obstacles and fall here. In addition, from the point of time, we still need to focus on the US trading period. Therefore, it is recommended to keep a more watch and less movement during the day, and wait for the US trading period before layout operations.

Gold 3014-3015 is empty in the range, with a defense of US$10, with a target of 2970-2945-2900

ps: If the US test the 3050-3055 area before the market is still empty

European and the United States

European and the United States, the prices in Europe and the United States were generally on Tuesday. The price fell to 1.0888 on the day and rose to 1.0991 on the spot and closed at 1.0957 on the spot. Looking back at the performance of European and American markets on Tuesday, the morning opening price first gained support and rose in the short term, and then fell under pressure after hitting the four-hour resistance for the first time. After the session, the price made a strong move upward and broke through the four-hour resistance. Finally, the daily line ended with a big positive. At present, the price has shown further increase.

When conducting multi-cycle analysis, from the perspective of monthly lines, we need to pay attention to the support situation in the 1.0720 area in April, which is the key dividing point for judging long-term trends.

Switch to the weekly level, we should pay attention to the support of the 1.0590 area. It plays a key role in judging the mid-term trend and is an important watershed in the mid-term trend.

Looking at the daily level again, we need to pay attention to the support in the 1.0870 area. This position is the key to the band trend and determines the development direction of the band market.

From the short-term four-hour level, the 1.0960 regional support has become the current key support after breaking up yesterday. Follow-up attention is paid to further support for the upward trend.

In addition, from the one-hour level, the price shows a trend of further upward movement. So, pay attention to the support near the early trading low, and this position resonates with the four-hour support. After a subsequent retracement, pay attention to further testing the 1.1050-1.1120 area.

Europe and the United States have a range of 1.0950-60, with a defense of 40 points, and a target of 1.1050-1.1120

[Finance data and events that are focused today] Wednesday, April 9, 2025

①10:00 New Zealand to April 9 Fed interest rate decision

②12:01 US reciprocal tariffs officially take effect

③14:15 Bank of Japan Governor Kazuo Ueda made a speech

④22:00 US February wholesale sales monthly rate

⑤22:30 US to April 4th week EIA crude oil inventories

⑥22:30EIA Cushing crude oil inventories in the week from the United States to April 4

⑦22:30EIA strategic oil reserve inventories in the week from the United States to April 4

⑧The next day, the Federal Reserve Barkin participated in the dialogue event

⑨The next day, the 10-year Treasury bond auction from the United States to April 9-winning interest rate

⑩The next day, the 10-year Treasury bond auction from the United States to April 9-winning 10-year Treasury bond auction from the United States to April 9-winning multiple

The next day, the Federal Reserve announced the minutes of the March monetary policy meeting

Note: The above is only personal opinions and strategies, for review and exchange only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Foreign Exchange Platform]: Whether gold can continue to be under pressure in the US market, Europe and the United States are expected to continue again". It was carefully xmserving.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here