Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

Gold daily resistance highlights pressure, European and American support levels showdown

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM official website]: The daily resistance of gold highlights the pressure, and the European and American support level is duel". Hope it will be helpful to you! The original content is as follows:

Macro

On April 2 local time, Trump signed an executive order for "reciprocal tariffs", setting a 10% "minimum benchmark tariff", imposing higher tariffs on some countries, and the US-Mexico-Canada Agreement goods are exempted, and the effective time of different tariffs varies. Trump said policies promote prosperity and are willing to negotiate, while the U.S. xmserving.commerce Secretary warned other countries about the risk of retaliation. Many countries are actively responding, Canada imposes retaliatory tariffs on US cars, the EU is planning measures, and the French president urges European xmserving.companies to suspend US investment and counter-revolution. The European Central Bank, the Bank of Japan and the Federal Reserve Chairman respectively pointed out that tariffs hit the economy and affected inflation, and the Federal Reserve kept interest rates unchanged. The US non-farm report in March showed that employment growth exceeded expectations and the unemployment rate rose slightly. Traders adjust Fed's expectations for a rate cut. Richmond, the chairman of the New York Fed and the vice chairman of the Federal Reserve expressed their views on tariff policies. This week, the outlook for U.S. tariffs are unclear, and investors are paying attention to the agreement between the U.S. and other countries. The New Zealand Fed will announce its interest rate decision, and the market is expected to cut interest rates. US dollar traders focused on US March CPI data on Thursday, which may affect rate cut bets. In addition, the minutes of the FOMC meeting and the March PPI data were released on Thursday, and the initial value of the University of Michigan Consumer Confidence Index was released on Friday, with investors keeping a close eye on inflation data.

Dollar Index

In terms of the US dollar index, the price of the US dollar index generally showed an upward trend last Friday. The price rose to the highest level of 103.161 on the day, the lowest level of 101.51 on the spot, and closed at 102.868 Position. Looking back at the price performance of the US dollar index last Friday, the price fluctuated in the morning after the opening in the morning and then directly broke the high point of the previous day's retreat in the early morning of the previous day. After that, the price continued to rise, and the daily line ended with a big positive.

From doing cyclical analysis, we continue to pay attention to the 106.10 position on the weekly line. This position is the key to the mid-line trend, and the price is short at this position. At the same time, according to the daily level, you need to pay attention to the 103.70 position. This position is the key to the band trend. Below this position, the band pressure will continue to be under pressure. You can continue to pay attention to it in the future. At the same time, we temporarily focus on the 102.80 regional resistance and 102.40 in four hours. After breaking through last Friday, this position becomes a key short-term support. The subsequent price first looks at the rebound at this position, and follow the follow-up after paying attention to the daily resistance and breaking in the four-hour range.

The US dollar index has a long range of 102.40-50, with a defense of 5 US dollars, and a target of 103-103.70

Gold

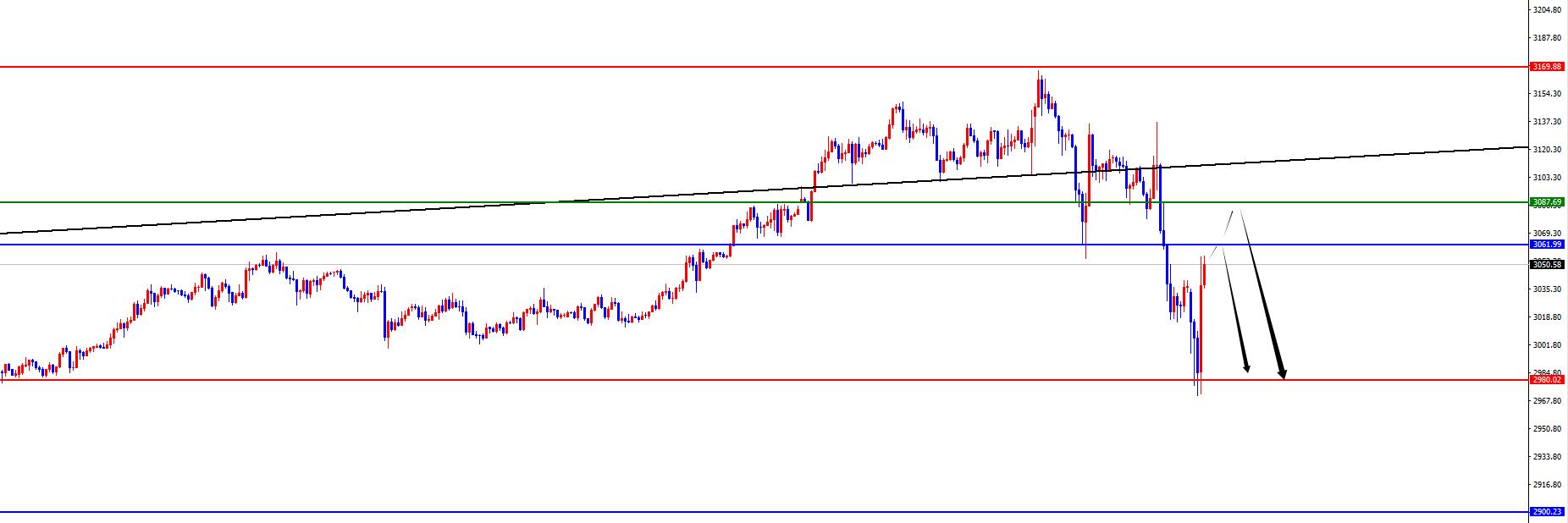

In terms of gold, the overall price of gold showed a sharp decline last Friday. The price rose to the highest point of 3136.36 on the same day, and fell to the lowest point of 3015.64 on the spot, closing at 3036.81. In view of the short-term pressure four-hour resistance position during the early trading session last Friday, then the price fell in a volatile manner, and then rose and fell near the US market. The price fell very weakly and broke the daily support position as expected. Both the weekly and the daily line ended in a big negative way. The subsequent focus will be on the gains and losses of the weekly watershed.

From a multi-cycle analysis, the overall price is currently above the weekly, monthly and daily line support, so both are bullish at the medium and long term. However, last week, the price fell below the daily support position, so the subsequent attention will be paid to the continued pressure on the band, and the position will temporarily focus on the resistance of the 3062 area. At the same time, the short-term four-hour viewing is temporarily focused on the resistance of the 3087 area. The subsequent focus is on the price. The price will continue to be under pressure when there is an anti-K area in this area. Conservatives can wait for the 3087 area to pay attention to the pressure. The following focus is on the 2975-2900 area.

Gold 3085-86 is empty in the range, with a defense of US$10, and a target of 3030-3000-2970-2900

European and American

European and American

European and American prices overall declined as scheduled last Friday. The price fell to 1.0924 on the day and rose to 1.1107 on the spot and closed at 1.0961 on the spot. Looking back at the performance of European and American markets last Friday, the price of the morning opened in the short term first continued to retrace upward, and then the price continued to fall weakly. Then the European session hit four-hour support.The position stopped upwards, but then the price was under pressure again and broke down to the support position for four hours, and finally the daily line ended with a large negative state.

From the multi-cycle perspective, from the monthly perspective, we need to pay attention to the 1.0720 regional support in April. This position is a key watershed in the long-term trend. At the same time, if you look at the weekly level, you need to pay attention to the 1.0590 regional support at the moment, this position is a key watershed in the mid-line trend. At the same time, we need to pay attention to the 1.0850 regional support at the daily level. This position is a key watershed in the band trend. For the short-term four-hour view, you need to pay attention to the resistance in the 1.1000 area. This position is the key to the short-term trend. Under this position, the price will be under pressure for the time being. The subsequent focus will be on the gains and losses of the daily support. Once it breaks down, you will pay attention to the monthly and weekly support areas in the future.

Europe and the United States have a short range of 1.0990-1.1000, defense is 40 points, target 1.0860-1.0780

[Finance data and events that are focused today] Monday, April 7, 2025

①To be determined China's March foreign exchange reserves

②14:00 Germany's February seasonally adjusted industrial output monthly rate

③14:00 Germany's February seasonally adjusted trade Yishu

④14:00 UK March Halifax Seasonal Adjusted House Price Index Monthly Rate

⑤16:30 Eurozone April Sentix Investor Confidence Index

⑥17:00 Eurozone February Retail Sales Monthly Rate

Note: The above is only personal opinion and strategy, for reference and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM official website]: The daily resistance of gold highlights the pressure, and the European and American support level showdown" is carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--SP 500 Forecast: Takes Off for Monday Session

- 【XM Group】--Gold Forecast: Continues to Rally

- 【XM Decision Analysis】--EUR/AUD Forecast: Euro Rallies Against the Aussie on Wed

- 【XM Market Analysis】--BTC/USD Forex Signal: Risky Pattern Points to a Potential

- 【XM Decision Analysis】--ETH/USD Forecast: Price Drops Rapidly at Open