Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

Tariffs and weak data hit, the market is waiting for non-agricultural data to be revealed

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Tariffs and weak data are hit, and the market is waiting for the non-agricultural data to be announced." Hope it will be helpful to you! The original content is as follows:

Macro

Trump's xmserving.comprehensive tariff plan has attracted global attention. The plan imposes a 10% benchmark tax on major trading partners such as the EU, up to 25% for Canada and Mexico, and up to 46% for Vietnam. After its announcement, global markets plummeted, and the S&P 500 index of the U.S. stock market hit its biggest single-day decline since June 2020. Economists predict that the U.S. economy may decline and the era of trade liberalization may end. Gold has risen due to rising demand for safe-haven, but HSBC expects physical and financial market factors to put pressure on it by the end of 2025. The domestic economic data in the United States is poor, the service industry slows down, and the non-manufacturing PMI declines, which triggers concerns about stagflation and the US dollar index falls. Fed Vice Chairman Jefferson said that in view of tariffs pushing up inflation and uncertain economic outlook, he tends to maintain policy interest rates. In addition, the US non-farm employment report in March and the speech of Federal Reserve Chairman Powell have attracted much attention. The uncertainty brought about by Trump's tariff policy is still continuing, and the subsequent direction remains to be seen.

Dollar Index

In terms of the US dollar index, the price of the US dollar index generally showed a sharp decline on Thursday. The price rose to the highest level of 103.931 on the day, the lowest level of 101.232 on the spot, and the closing price was 101.937 on the spot. Looking back at the price performance of the US index on Thursday, the price continued to fall in the short term after the opening in the morning, and then the price was weak all the way and there was almost no rebound. The price fluctuated and consolidated in the short term after the US session. Finally, the daily line ended with a big negative end, and continued to pay attention to further pressure in the future.

From doing cyclical analysis, we continue to pay attention to the 106.60 position on the weekly line. This position is the key to the mid-line trend, and the price is short at this position. At the same time, according to the daily level, you need to pay attention to the 103.70 position, which is a band moveThe key to the trend is that the price will continue to be under pressure below this position, and you can continue to pay attention to it in the future. At the same time, we temporarily pay attention to the 102.80 area resistance and 102.40 area over four hours. The price is under multi-cycle resistance, so we will continue to pay attention to further pressure in the future. There are signs of adjustment in the short term in one hour. Therefore, we will pay attention to the pressure after the price falls back later. Focus on the 101.30-100.70-100.20 area below.

The US dollar index was short in the range of 102.50-60, defending 5 US dollars, targeting 102.80-102.30

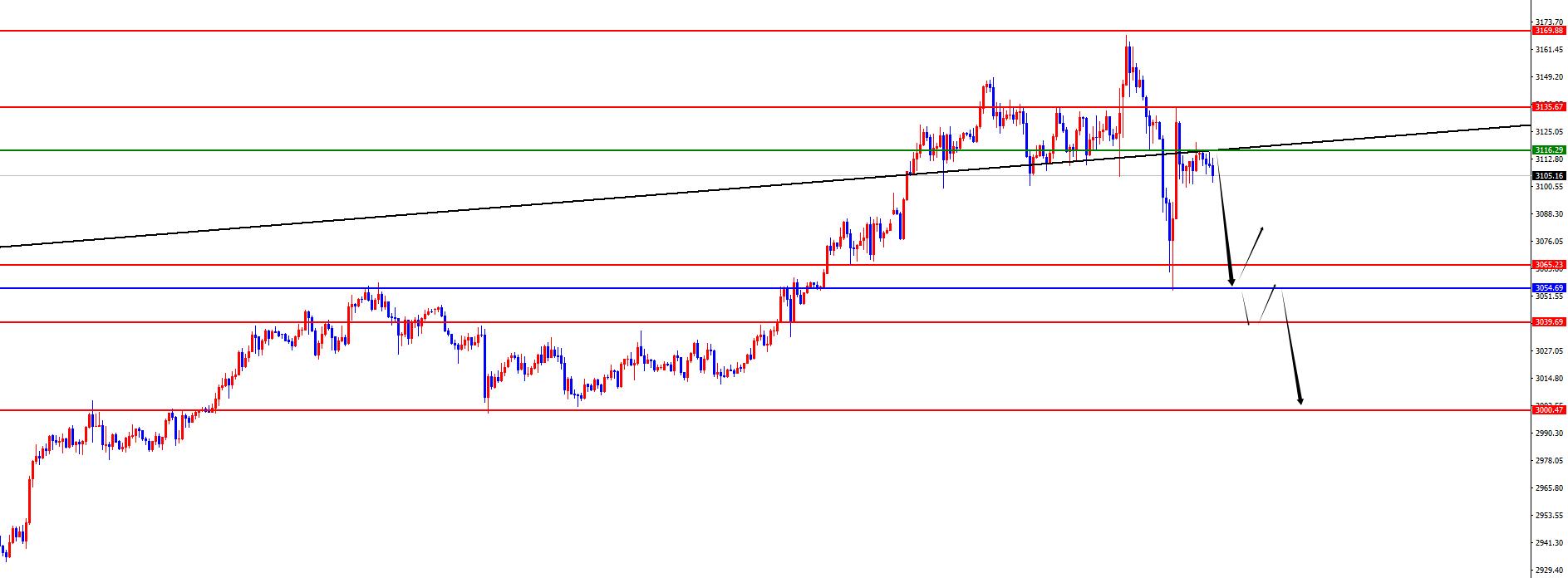

Gold

In terms of gold, the overall price of gold showed a sharp fluctuation on Thursday. The price rose to the highest point of 3167.54 on the day, and fell to the lowest point of 3054.03, and closed at 3114.06. In response to the short-term surge in the early trading session on Thursday, the market has continued to maintain this rhythm in recent days, but the price broke the four-hour support during the European trading session, so the rhythm has changed. It has been weak all the way to the daily support area, and then it soared again at the US time point. From the position, it retraces back to band support, and the time point is also in the US. The final big negative ends. At present, gold still has room for a rebound. We need to pay attention to the daily support performance.

From a multi-cycle analysis, the price is currently above the weekly, monthly and daily support, so many cycles are in the long position. The subsequent price is above the daily support 3054 position. Although the price did not actually break down yesterday, you need to pay attention to the gains and losses of this position in the future and beware of the price breaking down again. In the other four hours, the regional resistance of the 3115 position is temporarily paid attention to the current short-term watershed. At present, the current price is the pressure below this position. At the same time, the 3135 position above is the high point in the early morning of yesterday. If the price does not break, rely on the four-hour support to further look at the pressure. Below, the 3065 regional support and the gains and losses of yesterday's low point will be paid attention to the 3040-3000 area. At present, the overall base has become larger, so the space and profits will increase overall, so everyone should control their positions.

Gold 3115-16 has a short range, defense is 3136, target is 3060-3040-3000

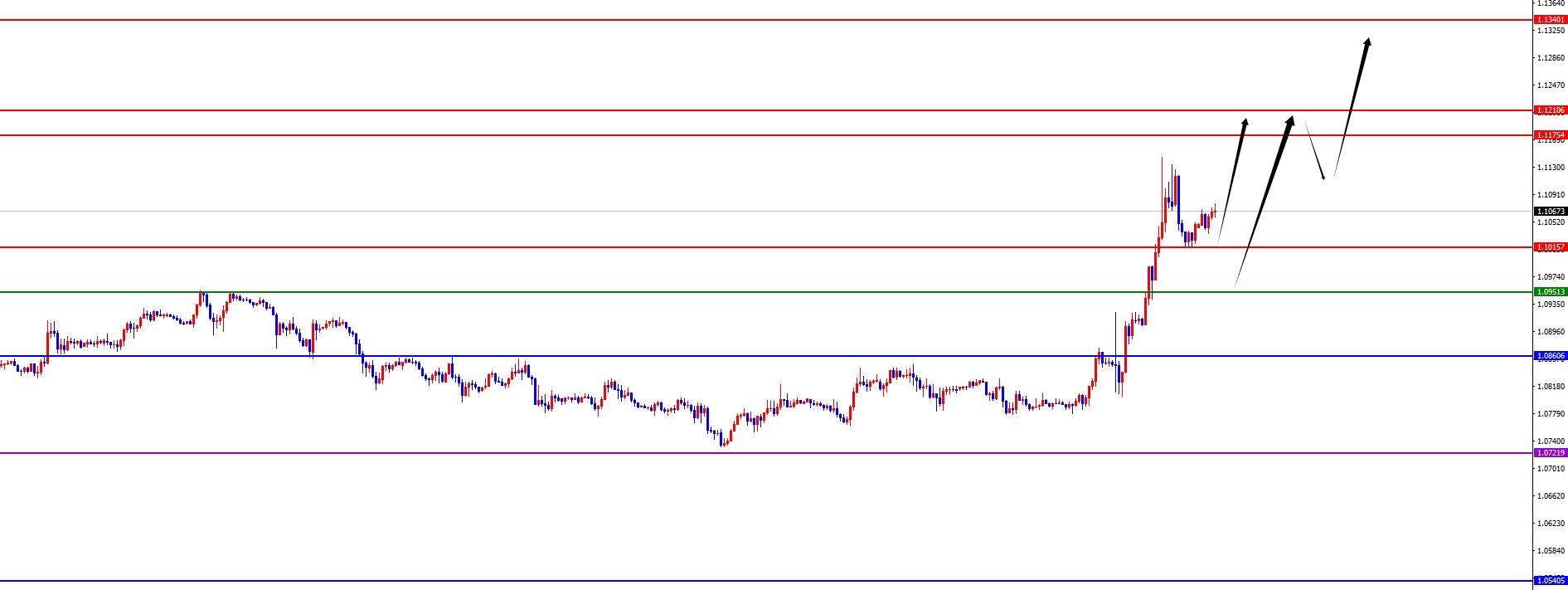

European and the United States

In terms of Europe and the United States, prices in Europe and the United States generally showed an upward trend as scheduled on Thursday. Prices fell to 1.0804 on the day and rose to 1.1145.>xmserving.com is set to close at 1.1047. Looking back at the performance of European and American markets on Thursday, the opening price in the morning tested downward to four-hour support and soared rapidly. Then, it maintained a very strong operation during the day, and finally the price ended with a big positive. Overall, as the author said, the adjustment in the medium and long-term rise of Europe and the United States continued to soar, and we continued to pay attention to low-floors in the future.

From the perspective of multiple cycles, Europe and the United States are above support in the medium and long term, and the price is above 1.0540, then the midline is more treated. From the daily level, we need to pay attention to the 1.0860 position for the time being, and the price has once again stabilized and continues to pay attention to further band rises. At the same time, from the four-hour perspective, it is temporarily focused on the 1.0950 area. The price is treated short-term bullishly above this position. At the same time, the low point of the retracement in the early morning of yesterday is also a key support. We will focus on the gains and losses of this position in the future. If we do not break, we will continue this position to support and rise. However, if we break down, we will pay attention to the 1.0950 area in the four-hour area and then look at the rise.

Europe and the United States have a large range of 1.1010-20, with a defense of 40 points, and a target of 1.1170-1.1210-1.1340

[Finance data and events that are focused today] Friday, April 4, 2025

①13:45 Switzerland's seasonally adjusted unemployment rate

②14:45 France's February industrial output monthly rate

③20:30 Canada's March employment

④20:30 United States March unemployment rate

⑤20:30 United States' seasonally adjusted non-agricultural employment population

⑥20:30 United States' average per small person in March Annual rate of wages

⑦20:30 The average hourly wage rate in the United States in March

⑧22:00 The United States Global Supply Chain Pressure Index in March

⑨23:25 Federal Reserve Chairman Powell delivered a speech

⑩ The next day was 00:00 Fed Director Barr delivered a speech

00:45 Fed Director Waller attended the symposium

The next day was 01:00 The next day was the total number of oil drilling rigs from the United States to April 4

Note: The above is only personal opinions and strategies, for reference and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Foreign Exchange]: Tariffs and weak data are hit, the market is waiting for the non-agricultural data to be announced". It is carefully xmserving.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transactions! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and exploration on the following issuesDiscussion:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--Nasdaq Forecast: Continues to Grind Back and Forth

- 【XM Forex】--USD/MYR Forecast: US Dollar Finds Support Against Ringgit

- 【XM Market Analysis】--USD/PHP Forecast: Stays Resilient

- 【XM Forex】--USD/BRL Analysis: Lower Depths Explored as Crucial Questions Remain

- 【XM Forex】--Gold Forecast: Gold Holds Near $2,600