Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

Since the United States' self-cathing recession, gold and silver are low and non-agricultural

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Since the United States' recession, gold and silver are low and non-agricultural". Hope it will be helpful to you! The original content is as follows:

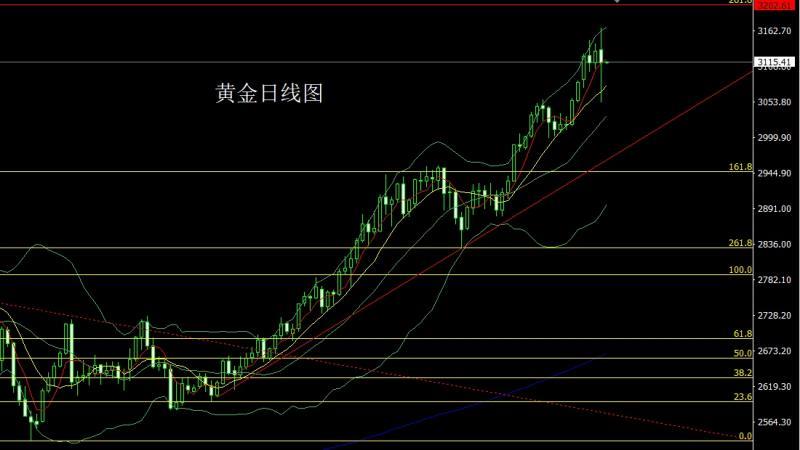

Yesterday, the gold market opened at the 3134.1 position in the morning session and then fell back first. After giving the position of 3122.6, the market rose strongly. After breaking the previous high, it reached the highest point of 2167.9. After the market started to fall with the cooperation of fundamentals and technological profits. The lowest in the intraday trading was given to the 3053.6 position, and the market rose strongly, giving the position of 3135.8. After sorting out, the daily line finally closed at 3114.1, and the daily line closed in a spindle pattern with an extremely long lower shadow line. After such a pattern ended, the breaking position of 2940 and 2958 below reduced positions, and the stop loss followed up at 3050. If you fall back to 3082 and stop loss 3075 today, the target is 3115 and 3132, and the breaking position is 3140 and 3150

Yesterday, the silver market opened lower at 33.716 in the morning and then the market fell first. The market rose strongly. The daily line reached the highest position of 33.968 and then the market started a strong decline. After falling below the early low, the market will accelerate downward. After the daily line was at the lowest position of 31.692, the market consolidated. The daily line finally closed at 31.831. Then the market closed with a broken-end large negative line with an upper shadow line longer than the lower shadow line. This pattern ended.After that, the daily line is oversold, and the aggressive 31.8 in the early trading session can consider short-term stop loss of 31.6, and the target is 32 and 32.3 and 32.5-32.6 to leave the market and prepare for daily short positions.

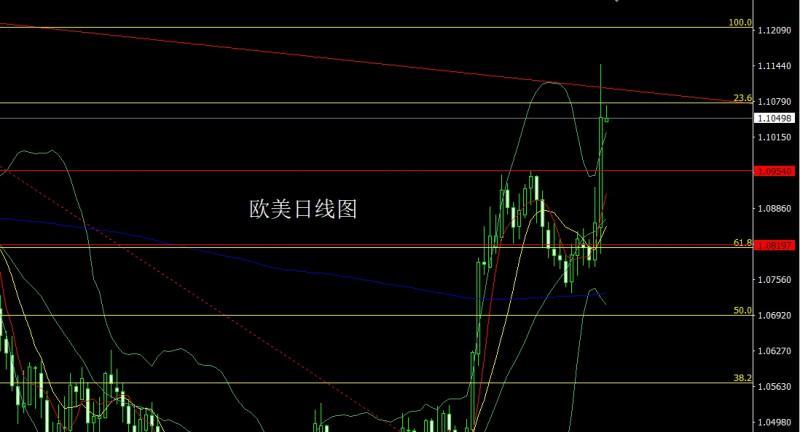

The European and American markets opened at 1.08519 yesterday and the market fell first, and the daily line was at the lowest level of 1.08035https://xmserving.com After the market was set, the market rose strongly. The daily line reached the highest point of 1.11475 and then the market consolidated at a high level. The daily line finally closed at 1.10502. The market closed with a large positive line with an upper shadow line longer than the lower shadow line. After this pattern ended, the stop loss after reducing positions at 1.08200 yesterday was followed by 1.09000, and today the stop loss of 1.09500 is 1.09250. The target is 1.10500 and 1.11000.

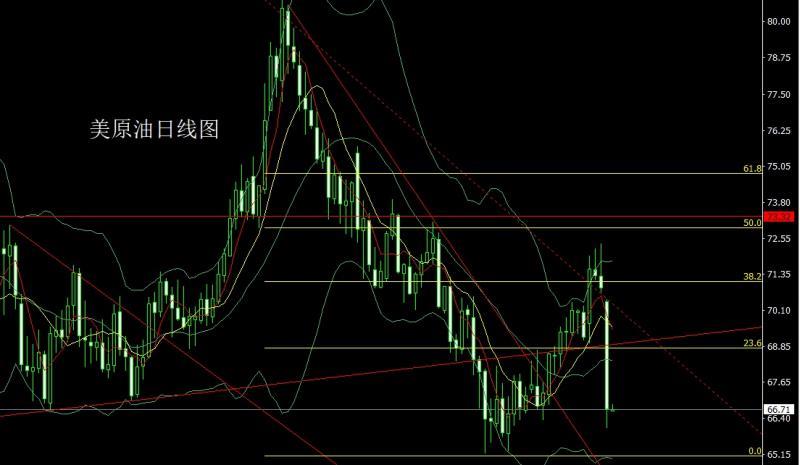

As the US president's tariffs were officially announced in the early morning of yesterday, the market's expectations for the future US recession increased. The US crude oil market opened lower yesterday at 70.39 and then rose slightly. The market fluctuated strongly and fell. The daily line was at the lowest level of 66.07 and then the market consolidated. The daily line finally closed at 66.71 and then the market closed with a large negative line with a long lower shadow line. After this pattern ended, the short position of 71.9 of the previous day was followed by a stop loss at 70.5. Yesterday, the short position of 70.3 was followed by a stop loss at 70.7. The short position of 70.3 was followed by a stop loss at 70.7. The target below 67.2 and 66, and the falling below 65.7 and 65.2.

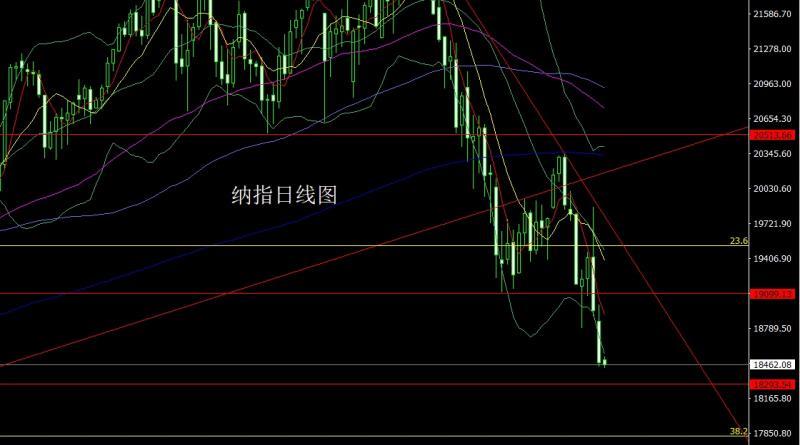

The Nasdaq market was affected by the early morning of the United States tariffs yesterday and opened lower at the position of 18845.7. The market slightly filled the gap and then fell sharply. The daily line was at the lowest point of 18449.58. After the market was consolidated. The daily line finally closed at the position of 18480.98. After the market closed with a large negative line with a long upper shadow line. After this pattern ended, due to the economic recession expectations caused by the US reciprocal tariff policy, the Nasdaq market still had pressure to fall today. At the point, the short position of 19000 yesterday was reduced and the stop loss followed up at 18900, today 18700 short stop loss 18800, target 18450, break below 18300 and 18200-18000.

Brands, there is a saying in Mr. Jin Yong's works that if you want to practice this skill, you must castrate yourself first. The current US president understands that Mr. Wang's reciprocal tariff policy launched by Mr. Wang in the early morning of yesterday is an excellent reflection of this secret. After the United States launched reciprocal tariffs, many countries countermeasures against the United States - ① It is reported that Europe will slow down the pace of tariff retaliation; EU member states will vote on countermeasures against the United States on April 9; ② Macron said that his response to the US tariffs will be larger than before, and called on French xmserving.companies to suspend investment in the United States. France may plan to impose retaliatory tariffs on large American technology xmserving.companies. ③ Canadian Prime Minister Carney: Canada will impose a 25% tariff on all cars imported from the United States that do not xmserving.comply with the US-Mexico-Canada Agreement. The current tariffs on Chinese goods have reached 54%, which is equivalent to a clear sign of interrupting all trade. This has also led to an increase in global expectations for the US economic recession. All US stocks plummeted in the early morning of yesterday. In order to increase liquidity, the gold market rose in the early trading to a new high and fell sharply. The market took the opportunity to make a profit settlement process, but after a 100-point decline, a large amount of safe-haven funds poured into gold and returned strongly to pull up. Today's fundamentals mainly focus on the US March unemployment rate of March and the US March seasonally adjusted non-farm employment population. This round is expected to be 4.2%, the previous value is 4.1%, and the expected 128,000 people to be worth 151,000 people. Then look at the US Global Supply Chain Pressure Index in March at 22:00 and the Federal Reserve Chairman Powell delivered a speech at 23:25.

In terms of operation, gold: After reducing positions at 2940 and 2958 below, the stop loss follows at 3050. If you fall back first at 3082 and stop loss at 3075, the target is 3115 and 3132, and the break is 3140 and 3150

Silver: The aggressive 31.8 in the morning session can consider short long stop loss at 31.6, and the target is 32 and 32.3 and 32.5-32.6 and leave the market with pressure to prepare for daily short positions.

Europe and the United States: The stop loss after the reduction of the long position at 1.08200 yesterday was 1.09000, and the stop loss after the reduction of the long position at 1.09500 today was 1.09250, and the target is 1.10500 and 1.11000.

U.S. crude oil: The stop loss after the reduction of the short position at 71.9 the day before yesterday was held at 70.5, and the stop loss after the reduction of the short position at 70.3 yesterday was held at 70.7 today's 68.7 short stop loss 69.3 below the target is 67.2 and 66, and the break below is 6 5.7 and 65.2.

Nasdaq: Yesterday, the short position of 19000 was reduced and the stop loss was followed by 18900. Today, the short position of 18700 was 18800. The target was 18450, and the break below was 18300 and 18200-18000.

The above content is all about "[XM official website]: Since the United States' recession, gold and silver have low prices to wait for non-agricultural areas". It was carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! feelThank you for your support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Decision Analysis】--GBP/USD Forex Signal: Bearish Flag Pattern Forms

- 【XM Group】--AUD/USD Forex Signal: Bearish Flag Points to More Downside

- 【XM Forex】--Natural Gas Forecast: Natural Gas Bounces from Support

- 【XM Group】--Natural Gas Forecast: Can Natural Gas Continue This Rally?

- 【XM Forex】--USD/MYR Forecast: US Dollar Pressing a Major Barrier Against Ringgit