Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The expectation of interest rate cuts helps the US rebound, but politicized data

- Narrow fluctuations, waiting for the Fed interest rate meeting to break

- A collection of positive and negative news that affects the foreign exchange mar

- Practical foreign exchange strategy on August 13

- President Trump puts further pressure on the Fed, U.S. non-farms become the focu

market analysis

Gold is under pressure near its early trading high, Europe and the United States pay attention to daily support

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Gold is under pressure near its early trading high, and Europe and the United States are paying attention to daily support." Hope it will be helpful to you! The original content is as follows:

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a bottoming out and rebounding on Wednesday. The price of the US dollar index rose to 97.047 on the day, and fell to 96.188 at the lowest point, and finally closed at 97.003. Looking back at the market performance on Wednesday, the price first corrected upward during the early trading session, and continued to fluctuate during the European and US sessions. The Federal Reserve quickly fell under pressure after cutting interest rates by 25 basis points overnight. However, Powell's speech stimulated the US index to soar again, and finally closed at a high level. From the closing point of view, there will be further increase performance in the future.

From a multi-cycle analysis, the price has recently been consolidating up and down on the weekly level. Currently, the weekly resistance is in the 97.80 area, and the price is short-shouldered below this position. The price will only turn long after the subsequent weekly closing above this position. From the daily level, as time goes by, the daily resistance is currently in the 97.60 area. I am short at this position. For the future, it is the key to pay attention to whether the price can stabilize the daily and weekly resonance resistance range. From the four-hour perspective, after the recent fluctuation and decline of the US dollar index, but it bottomed out and rebounded yesterday, the price has now broken through the four-hour resistance position. It is currently supported in the 96.80-90 range for four hours. The price is expected to rise in the short term, and pay attention to the daily and weekly resistance areas above.

The US dollar index has a long range of 96.80-90, with a defense of 5 US dollars, and a target of 97.30-97.60-97.80

Gold

In terms of gold, the overall gold price on WednesdayIt was in a downward state, with the highest price rising to 3707.3 on the day, falling to 3646.03 on the lowest price, closing at 3659.79 on the day. Regarding the price of gold fluctuated first and then fell under pressure during the early trading session on Wednesday, and then broke down to the four-hour support position of 3674, it means that the overall situation is still bearish. At the same time, although the price adjusted upward after the US session, it did not break the early trading high. At the same time, the Federal Reserve's interest rate decision fluctuated sharply. After that, Powell's speech, gold accelerated and sharply fell, and the daily line ended in a big negative state.

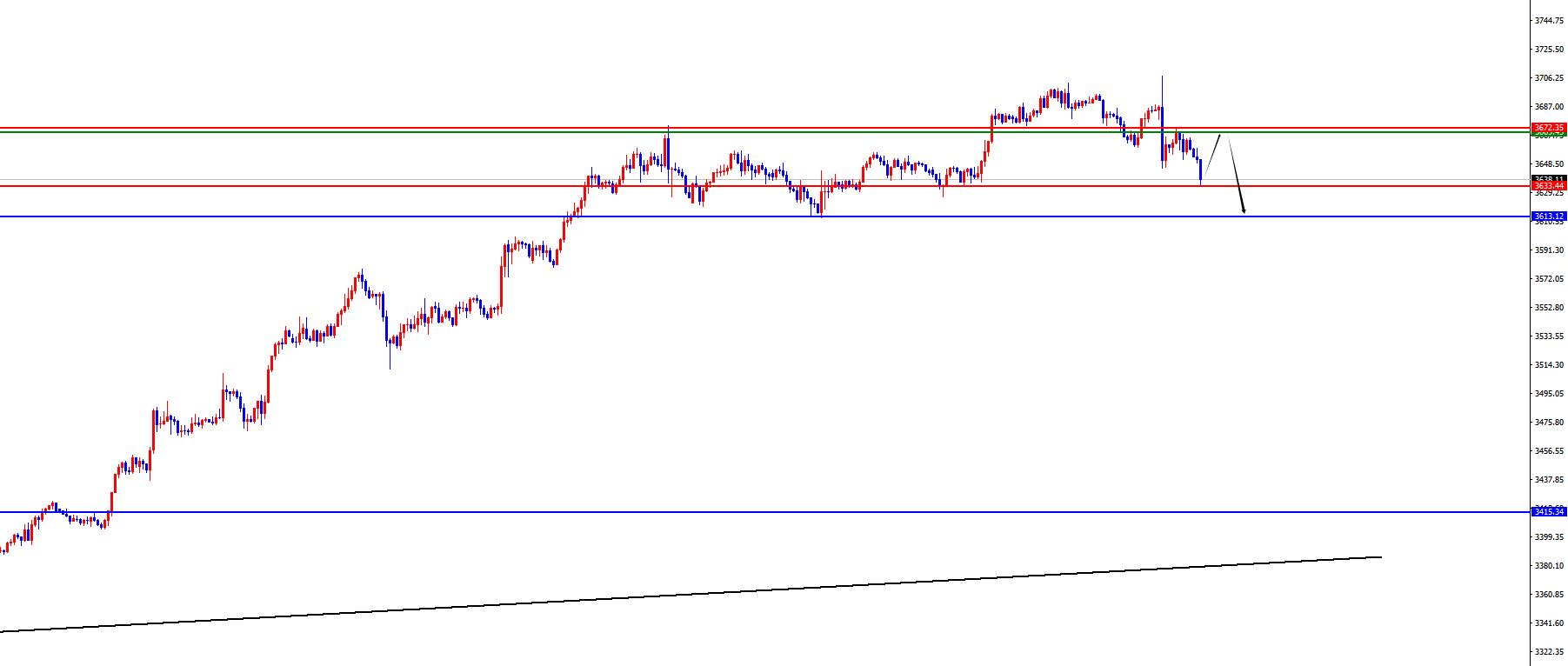

From a multi-cycle analysis, first observe the monthly rhythm. The monthly price ended in August. Overall, the price is still running bullishly. From the long-term perspective, the 3000 position is the watershed of the long-term trend. The price can be treated more on the long-term. From the weekly level, the price has broken through key resistance after recent continuous fluctuations and has continued to hit a new historical high. Currently, the weekly long and short watershed is at 3415. The price is above this position and the medium line is treated more. From the daily level, we need to pay attention to the regional support of 3610-3613 for the time being, and the band above this position should be treated more frequently. From the four-hour perspective, the price has continued to rise after breaking through the four-hour resistance on Monday. As time goes by, it is currently supported at the 3674 position for four hours. This position is a key watershed in the short term. Yesterday, the price broke below this position as scheduled. With time, the current four-hour resistance is in the 3670-3672 range. The price is short-term. Pay attention to the 3633-3613 area below, and then focus on the gains and losses of the daily watershed.

Gold 3670-3672 is empty in the range, with a defense of US$10, and a target of 3633-3613

European and American

European and American prices generally showed a decline on Wednesday. The price fell to 1.1807 on the day and rose to 1.1918 at the highest, closing at 1.1811 at the end. Looking back at the performance of European and American markets on Wednesday, prices fluctuated under pressure during the early trading period, and then remained weak during the day. However, regarding the overnight Federal Reserve interest rate resolution and Powell's speech, Europe and the United States rose and fell, and finally the daily line ended with a big negative end. Overall, the daily line will continue to pay attention to the gains and losses of the daily line.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.1060, so the price is treated with long-term bulls above this position. From the weekly level, the price is supported by the 1.1690 area. This position is the long-shoulder watershed in the mid-term trend. Look at the medium-term long before breaking. From the daily level, the daily line is currently supported at the 1.1730 position over time. This position is a key watershed in the band trend. The price is above this area and the number of bands is first seen. At the same time, according to the four-hour level, as time goes by, the current four-hour resistance is in the 1.1830-40 range. If you do not break this position in the future, pay attention to further retracement of the daily support area of 1.1730.

Europe and the United States have a gap of 1.1830-40, defense is 40 points, target 1.1780-1.1730

[Finance data and events that are focused today] Thursday, September 18, 2025

①14:00 Swiss August Trade Account

②15:00 Ministry of xmserving.commerce held its first regular press conference in September

③16:00 Eurozone July current account

④19:00 Bank of England announced interest rate resolution and meeting minutes

⑤20:3 0 Number of initial unemployment claims for the week from the United States to September 13

⑥20:30 US Philadelphia Fed Manufacturing Index in September

⑦21:20 US President Trump held a press conference with British Prime Minister Stamer

⑧22:00 US Consultative Conference Chamber of xmserving.commerce Leading Monthly Rate

⑨22:30 US to September 12

Note: The above is only personal opinion and strategy, for reference and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Forex Official Website]: Gold is under pressure near the high point of the morning session, Europe and the United States pay attention to daily support". It is carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here