Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

market news

Golden Retriever is looking forward to lower interest rates, gold and silver hammer head shortens much

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Golden Retriever is looking forward to lower interest rates, and gold and silver hammer heads are shorter and longer." Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market opened at 3388.8 in the morning and then rose slightly. The market fluctuated and fell strongly. The daily line was at the lowest point of 3351.1 and then the market rose strongly during the US session. The market was given a position of 3377.4 and then the market was consolidated. The daily line finally closed at 3368.3. The daily line closed with a very long lower shadow line. After this pattern ended, the stop loss of 3354's long positions was still held at 3351 at 3351 today. The target was 3365 and 3372 and 3377, and the breaking position was 3383 and 3391-3395.

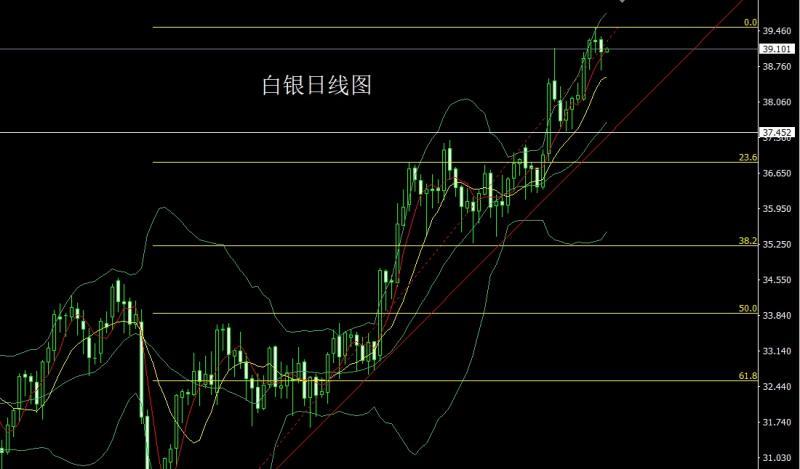

The silver market opened higher at 39.297 yesterday and then rose slightly. The market fell sharply. The daily line was at the lowest point of 38.678 and then the market rose at the end of the trading session. The daily line finally closed at 39.047 and then closed in a hammer-like pattern with a very long lower shadow line. After this pattern ended, it fell back to 38.8 and stopped loss at 38.6 today. The targets were 39.1 and 39.3 and 39.5.

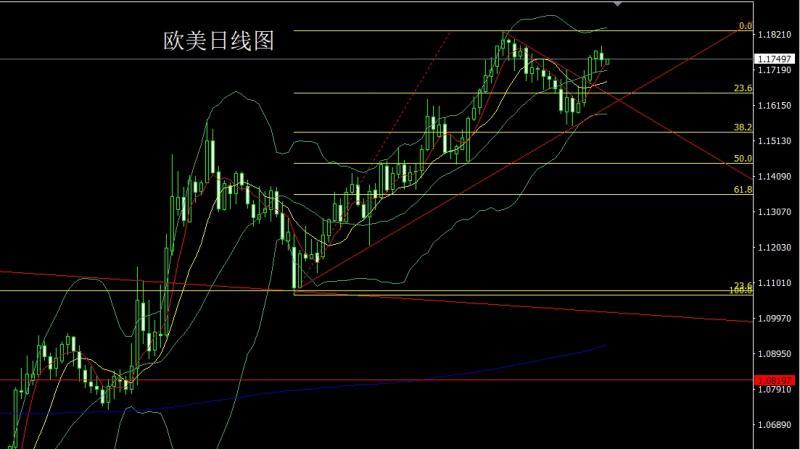

The European and American markets opened at 1.17672 yesterdayAfter the position, the market rose slightly and gave the position of 1.17802, the market fluctuated strongly. After the daily line was at the lowest point of 1.17295, the market rose strongly. After the daily line reached the highest point of 1.17891, the market consolidated. The daily line finally closed at the position of 1.17485, and the market closed with a long upper and lower shadow line. After this pattern ended, today, the short stop loss of 1.17850 was 1.17850, and the target was 1.17400 and 1.17200 and 1.17000.

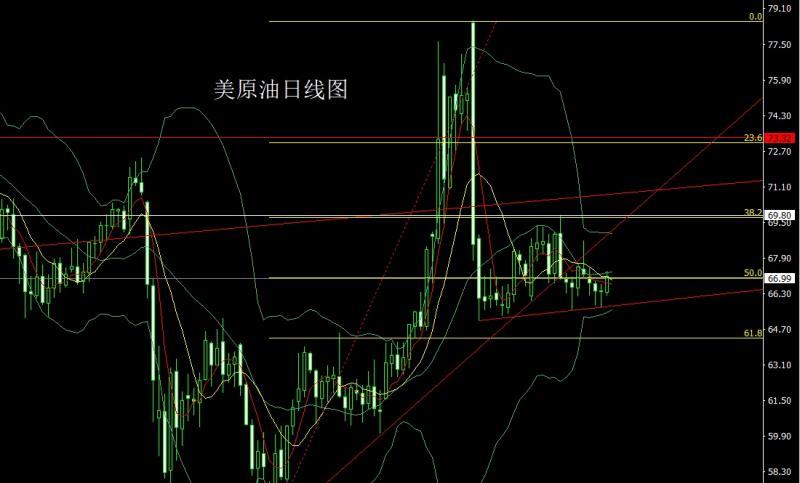

The US crude oil market continued to rise yesterday. After opening at 66.35 in the morning, the market first fell back, and then the market rose strongly. The daily high of 67.3 was given, and the market fell strongly. The daily line was at the lowest point of 66.23 and then rose in the late trading. The daily line finally closed at 67.09 and then the daily line closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, 66.55 was more than 66.2 today, and the target was 67 and 67.3 and 67.6 and 68.

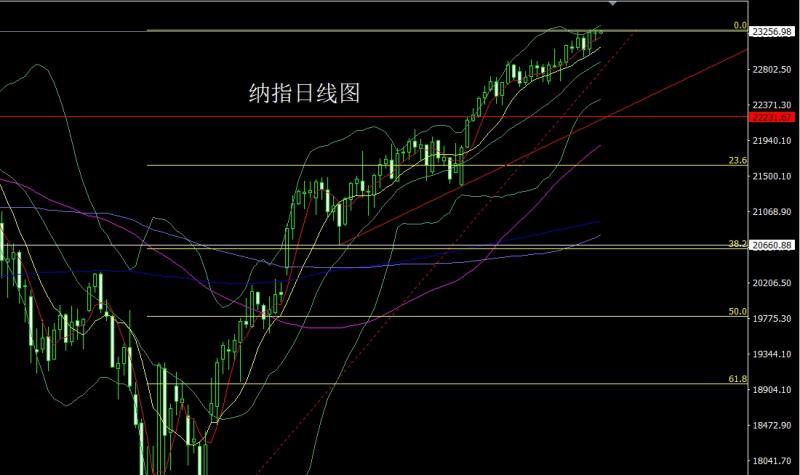

Yesterday, the Nasdaq market opened at 23240.31 in the morning and then the market first rose to give the daily high of 23271.96, and then fell back strongly. The daily line was at the lowest point of 23146.13 and then rose twice at the end of the trading session. The market finally closed at 23241.09, and then closed in a star pattern with a very long lower shadow line. After this pattern ended, the stop loss of 23110 more than 23170 today, with the target of 23270 and 23320 and 23360 and 23400.

Fundamentals, yesterday's fundamentals. The US President asked Powell to cut interest rates in person. When the US President quoted the budget data for the Fed's headquarters renovation, Powell kept shaking his head. The US president also said there is no need to fire Powell, and he is about to expire. U.S. presidential allies sued Powell, demanding that the FOMC hold a public meeting. Since the Fed Chairman has insisted on not cutting interest rates, his policies and the current US government have had a serious conflict. Yesterday's remarks can show that the confrontation between the two sides has become very clear. In the geopolitical situation, there was a firefight in the disputed area of the Thailand-Cambodia border, and both sides said that the other party opened fire first. The senior executives of both sides expressed that they did not want to expand the war at present, so the risk aversion factors were not strong. The European Central Bank announced that it would remain unchanged in the three key interest rates, reiterated its dependence on data, warned that the external environment was highly uncertain, and Governor Lagarde did not rule out the possibility of future interest rate hikes. Traders cut their ECB bets on interest rate cuts. The EU has passed a tariff countermeasure plan against the United States with a total of 93 billion euros. If an agreement is not reached, the measures will take effect on August 7. It shows that Europe is stronger than Japan, and at least it has a little bit of resistance. todayThe fundamentals focus mainly on the monthly rate of durable goods orders in the United States in June at 20:30.

In terms of operation, gold: yesterday's long positions of 3352 and 3354 still holds 3356 long stop loss 3351 at 3351, the target is 3365 and 3372 and 3377, the break is 3383 and 3391-3395.

Silver: Today is 38.8 and 38.6, the target is 39.1 and 39.3 and 39.5

Europe and the United States: Today's 1.17750 short stop loss 1.1 7850, target 1.17400 and 1.17200 and 1.17000.

U.S. crude oil: 66.55 long stop loss today 66.2, target 67 and 67.3 and 67.6 and 68.

Nasdaq: 23170 long stop loss today 23110, target 23270 and 23320 and 23360 and 23400.

Yesterday 3351 and 3354 long

The above content is all about "[XM Forex Official Website]: Golden Retriever is looking forward to a rate cut, and gold and silver hammer heads are shortened and long", which is carefully xmserving.compiled and edited by the XM Forex editor. I hope it will be helpful to your transactions! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here