Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/JPY Forecast: USD Continues to Threaten Yen

- 【XM Group】--BTC/USD Forecast: Bitcoin Continues to Test 100K

- 【XM Group】--USD/CHF Forecast: Near Breakout Zone

- 【XM Market Review】--EUR/USD Analysis: Bullish Rebound Attempts Still Weak

- 【XM Market Review】--USD/ZAR Analysis: Range Trading as Some Troubling Shadows Re

market news

Gold continues to consolidate long and short positions, pay attention to 3308-3355 in today's range

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Gold continues to consolidate long and short, pay attention to 3308-3355 in the range today". Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold continues to consolidate long and short, pay attention to 3308-3355

65

Review yesterday's market trend and technical points:

First, in terms of gold: gold still went through a volatile cycle yesterday, first fluctuating and rising in the Asian and European sessions, the US session turned directly to suppress and lower, consolidating at a low level before closing, and the Asian session the next day It is the first move first; the movement that does not continue to fluctuate, usually takes less action, and once it catches once; the night before 3350 is bullish, and the Asian session rose by 3360 yesterday; the resistance level of 3374 was not tested yesterday, so it was waiting until there was support on 3330, and then 3325 was bullish and rebounded one after another, and 3340 is in place today;

Second, silver: yesterday morning If it breaks through 38 and bottoms and pulls up K, it will not continue, which will bring some rebound in the afternoon, but the strength is not large, only touching the 38.35 line; the US market fell after the inflation data was suppressed, but the research report pointed out that 37.6 and 37.3 have support, and there is indeed some rebound strength when touching 37.6;

Interpretation of today's market analysis:

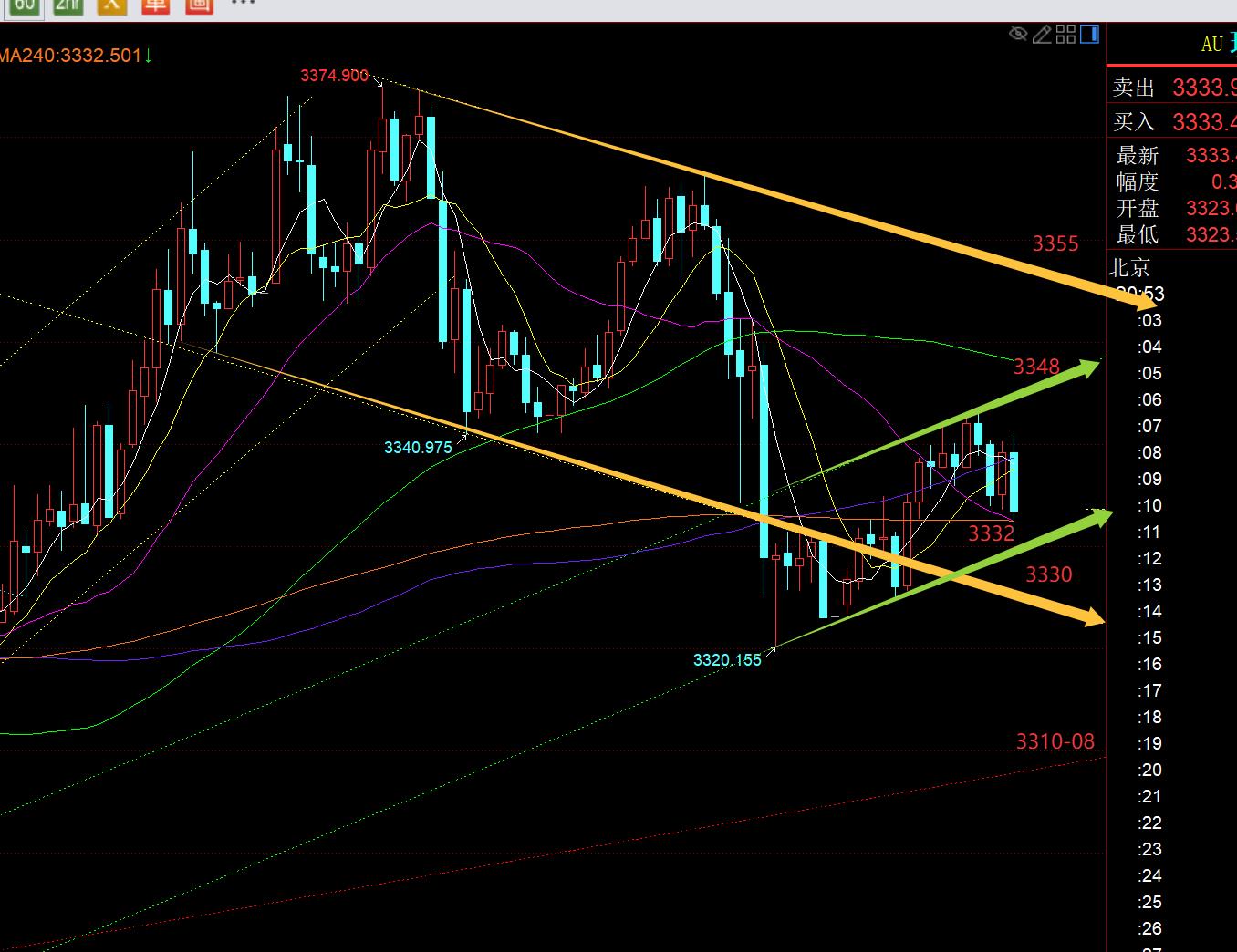

First, gold daily line level: yesterday rose and fell again, closing with an upward trend The shadow line is negative K, and it hits the middle track again. This way of moving is a typical oscillation, advances, retreats, and slowly consumes the patience of market investors. After supporting 3247 in early July, it ushered in three consecutive positive rebounds, and then under pressure 3365 made a five-day fluctuation and slow decline. On July 9, it stabilized at 3282 and showed three consecutive positive rebounds. This week, suppressing 3375 and then showed another oscillation suppression. The focus below is to test the convergence triangle lower track line, and it has moved up to 330 today.8. If you can stabilize this position, it is still easy to bottom out and continue to fluctuate and continue to oscillate and organize the convergence end. As the hole gradually shrinks, it is expected that you must be careful to break through at any time within two weeks of operation and usher in large unilateral fluctuations. In recent times, every time you approach the lower track of the convergence triangle, it is a good short-term bottom point, such as 3247, and 3282, basically every time you will bring about an increase of around 100 meters. This time, it will be at the 3308-3310 line, and you will still try to touch it;

Second, gold hourly line level: Today, the fluctuation cycle has gone through the past few days. In the morning, the Asian session rose first, the European session consolidated sideways, and the US session suppressed; tonight's PPI data can be said to be inverse with the CPI last night, and the announcement was significantly lower than expected. The previous value was lower, but gold did not support it for the time being, but instead suppressed it downward. Next, the gains and losses of the mid-track position of the hourly line 3332 are more critical, and there is also the small channel lower rail 333 in the figure above. 0 line; If it can stabilize 3332-30, it may lead to a bottoming up and pull up to break the intraday high point, but the resistance of the upper rail of the yellow channel 3355 line is still not small. When it touches pressure, it will look at a high and fall, and continue to fluctuate within the range; of course, if it cannot stabilize 3332-30, then pay attention to the support of 3325-20 below, strong support 3310-08, you must dare to try to bullish at a low level, which may be another good short-term bottoming low;

Silver: From the daily level, I said yesterday that it is likely to enter the range consolidation and correction in the next few weeks; the resistance above is 38.8-39, and the strong support below is 37-36.8, which will slowly move upward with time; for today, the up and down will not test immediately. Pay attention to the area, support 37.5-37.3., resistance 38.2-38.45, and treat oscillatingly;

Crude oil: Yesterday, I repeatedly tested the downward pressure of the channel, and repeatedly under pressure fell. There was a certain resistance below 67, but because the short-term macd brewed a certain bottom divergence, it was easy to bottom and pull up after the price was lowered. Tonight, it was easy to bottom and pull up; pay attention to the support of 65.5, and it can stabilize around 22 points, and the hourly line low point slowly moved upward. Then consider watching a rebound and then test the reverse pressure point of the channel 67.2 line;

The above are several points of the author's technical analysis, as a reference, and it is also the summary of technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and with text and video interpretations, friends who want to learn can xmserving.compare and reference based on the actual trend; those who recognize ideas canReference operation, lead the defense well, risk control first; if you don’t agree, just float by; thank everyone for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmserving.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Forex Official Website]: Gold continues to organize long and short, pay attention to 3308-3355 in today's range", which is carefully xmserving.compiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here