Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

Gold 3405 platform fluctuates and falls, Europe and the United States maintain their views unchanged

Wonderful introduction:

Don't learn to be sad in the years of youth, what xmserving.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Gold 3405 platform fluctuates and falls, and Europe and the United States maintain their views unchanged." Hope it will be helpful to you! The original content is as follows:

Macro

The US military launched a precise strike on three nuclear facilities in Iran, Natanz, Isfahan and Fordo, focusing on attacking the Fordo nuclear facilities deep in the mountains, using B-2 bombers to drop six ground-based bombs, launching 30 Tomahawk missiles, and 125 aircraft participated in the operation. Trump said the operation was successful. Iran said it had evacuated and transferred enriched uranium in advance, and IAEA said the facilities were damaged but the underground was unclear. The United States said its goal was to destroy Iran's nuclear program, and Israel coordinated xmserving.comprehensively with the United States and praised the operation. Iran condemned the aggression and launched a missile attack on Israel on the 22nd. The Israeli army then attacked many places in Iran. The Iraqi parliament recommended closing the Strait of Hormuz. The United Nations said the situation worsened, the United States called for a diplomatic solution but was rejected, and Iran said it would continue to fight back. Conflicts trigger global market fluctuations, gold and crude oil prices rise, the dollar strengthens, and the stock market is under pressure. Investors need to pay attention to the development of the situation and this week's US PCE data.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend last Friday. The price of the US dollar index rose to 98.874 on the day, and fell to 98.511 at the lowest, and finally closed at 98.748. Looking back on the market performance last Friday, the price maintained its pressure performance in the early trading period first, and then stopped before the European trading session. At the same time, the price did not break the Asian low after the European trading session, and then rose again, and the US market continued, with a long lead below the closing of the day. Overall, the US index still maintained our previous view and continued to watch the bulls continue.

From a multi-cycle analysis, the price is suppressed in the 100-area resistance at the weekly level, so from a medium-term perspective, the trend of the US dollar index will be more bearish. On SundayThe key price resistance position at the line level is at 98.70. As the author said, the price is further tested and has risen again. Therefore, the subsequent price is bullish on the band above the daily support, and the subsequent focus is on the test weekly resistance area. At the same time, the price in the four-hour market has now broken through the four-hour resistance position again, so this position has become a short-term key support area, and the position is focused on the 98.80 area. At the same time, the price is also bullish on one hour, so the subsequent range of 98.70-80 will continue to be treated more, and pay attention to the subsequent bands to continue to rise.

The US dollar index has a long range of 98.70-80, with a defense of 5 US dollars, and a target of 99.30-99.50

Gold

In terms of gold, the gold price overall showed a fluctuation last Friday, with the highest price rising to 3374.34 on the day, falling to 3340.24 on the lowest price, and closing at 3368.59 on the market. In response to the short-term pressure on gold during the early trading session last Friday, the price fell weakly and gained support before the European session. The US rose strongly after the market, but the price is still below the platform resistance. We have recently emphasized that as long as the price is below the 3405 position, it will continue to be short-term. We will pay attention to the weak decline after a short-term fluctuation.

From multi-cycle analysis, first observe the monthly rhythm. The price runs at the rhythm in May as the author said, and the final cross state. For June, focus on the gains and losses of May high and low points, the price will only be a real break at this position, and the long-term watershed is at 2780. From the weekly level, gold prices are supported by the 3280 regional support level. So from the perspective of the medium-term, it is still in the mid-term bull market, and only the price will be further under pressure if it breaks the weekly support. From the daily level, the price has fallen below the 3365 daily line watershed. Overall, the pressure performance will still be under consideration, and the following focus will be on the support of the weekly line. At the same time, according to the four-hour level, you need to pay attention to the 3365 position. This position resonates with the daily watershed, but overall it still fluctuates and is relatively empty. At the same time, it is temporarily focused on further pressure on one hour. In summary, the price is kept short below the 3405 position, and then the daily line will actually close below the 3365 position and focus on continuing decline. Among them, 3365 is the middle position of short-term oscillation.

The gold 3365-70 area appears to be under pressure after the anti-K appears, and the target is 3340-3320-3310

Europe and the United States

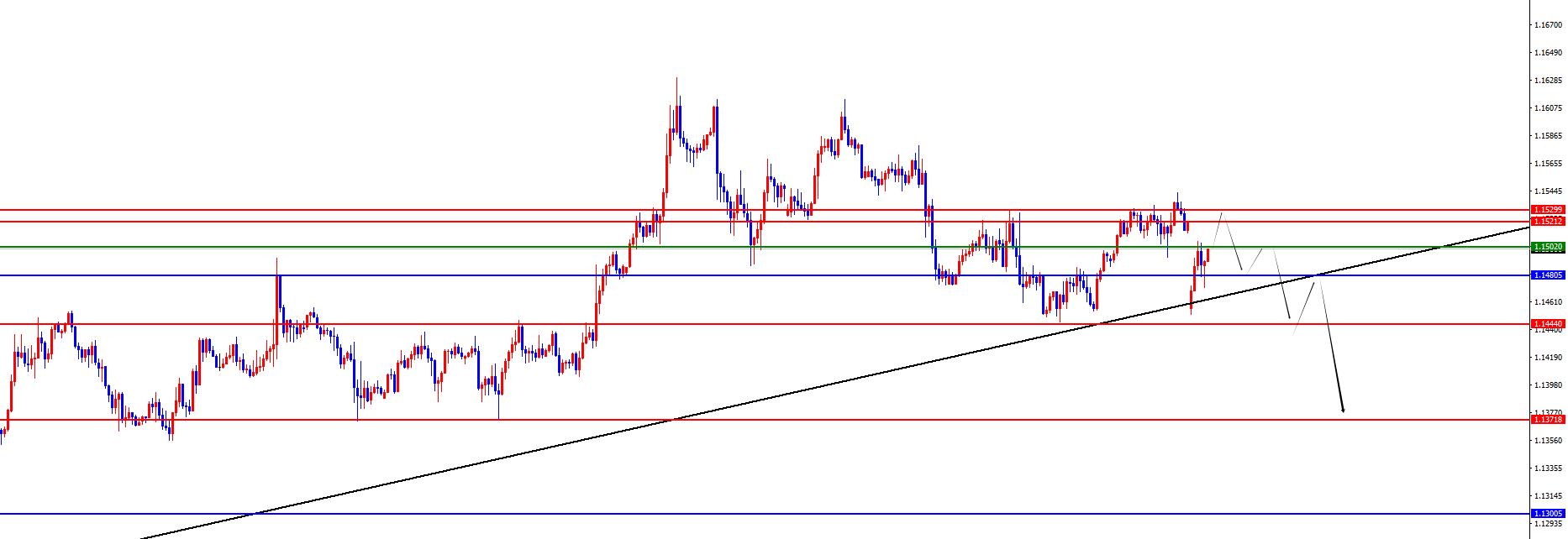

In terms of Europe and the United States, prices in Europe and the United States generally showed a fluctuating and rising last Friday. The price fell to 1.1487 on the day and rose to 1.1543 on the spot and closed at 1.1521 on the spot. Review of last Friday EuropeThe performance of the US market, the price first went upward during the early trading session, and then tested the key resistance fluctuations we mentioned. Although the daily line ended with a big positive, the overall weekly line closed with a negative cross, which means that it is difficult for the bulls to continue at a certain level. At the same time, the price opened low during the morning trading session today, and the short-term price remained at the daily line and the four-hour key positions to consolidate up and down. We will pay attention to further pressure performance after consolidation.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0850, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1300 area, and from the perspective of the mid-line, the price decline is temporarily treated as a correction in the mid-line rise. From the daily level, as time goes by, we need to focus on the 1.1480 regional watershed, and follow the gains and losses of this position. The gains and losses of this position determine the direction of the subsequent band. According to the four-hour level, you need to pay attention to the 1.1500 position. The price is currently consolidating at this position, so you cannot temporarily lay out in this position. The price temporarily fluctuates between 1.1450-1.1530, and follow up on the upper edge of the oscillation to further oscillate under pressure. At the same time, one hour last Monday, the market opened lower at a low price. We will follow the follow-up attention and then look at the pressure after the rebound.

Europe and the United States have a short range of 1.1520-30, defense is 40 points, target 1.1480-1.1450

[Finance data and events that are focused today] Monday, June 23, 2025

①To be determined the United States imposes tariffs on a variety of steel appliances

②To be determined Iranian Foreign Minister Aragic holds talks with Russian President Putin

③15:15France in June manufacturing PMI initial value

④15:30German in June manufacturing PMI initial value

⑤16:00Eurozone in June manufacturing PMI initial value

⑥16:30Eurozone in June manufacturing PMI initial value

⑦16:30Eurozone in June manufacturing PMI initial value

⑦16:30Eurozone in June manufacturing PMI initial value

⑦16:30Eurozone in June manufacturing PMI initial value

⑦16:30Eurozone in June manufacturing PMI initial value

⑤16:30Eurozone in June manufacturing PMI initial value

⑦16:30Eurozone in June manufacturing PMI initial value

⑦16:30Eurozone in June manufacturing Initial value of industry PMI

⑧21:00 European Central Bank Governor Lagarde made an introductory speech

⑨21:45 Initial value of S&P Global Manufacturing PMI in June

⑩21:45 Initial value of S&P Global Services PMI in June

22:00 Initial value of S&P Global Services PMI in June

22:00 Total number of existing home sales in May

22:00 Federal Reserve Director Bowman delivered a speech

01:10 The next day Fed Goulsby attended the event Q&A

02:30 the next day Fed Kugler and Williams hosted the event

Note: The above is only personal opinions and strategies, for reference and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is about "[XM Foreign Exchange Official Website]: Gold 3405 platform fluctuates and falls, EuropeThe entire content of "The Beauty maintains its viewpoint" was carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thank you for your support!

Every successful person has a start. Only by being brave enough to start can you find the way to success. Read the next article quickly!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--BTC/USD Forex Signal: Bullish Flag Points to a Jump to ATH

- 【XM Group】--CHF/JPY Forecast: Swiss Franc Powers Higher Against Japanese Yen

- 【XM Forex】--USD/TRY Forecast: Reports Reveal Lira's Significant Appreciation in

- 【XM Market Review】--GBP/USD Analysis: GBP/USD Faces Key Week

- 【XM Market Analysis】--ETH/USD Forecast: Can ETH Break $4,000?