Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--USD/MXN Forecast: Greenback Continues to Pressure Mexican Pe

- 【XM Forex】--USD/ZAR Analysis: Sentiment Causing Some Jitters but Calm Prevails

- 【XM Market Analysis】--USD/CAD Forecast: Greenback Strong

- 【XM Market Review】--EUR/USD Forecast: Euro Drops on Tariff News

- 【XM Market Analysis】--EUR/USD Forex Signal: Reluctant to Fall After Filling Week

market analysis

The Federal Reserve decided to "double king bomb" with Powell, and the watershed of multiple varieties is here to expand

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The Federal Reserve's resolution and Powell, "Double King Blast", the watershed of multiple varieties is here to gain a watershed." Hope it will be helpful to you! The original content is as follows:

Macro

In the global financial market, gold's "king of risk aversion" attribute is prominent, and it bottoms out and rebounds under the impact of geopolitical and economic uncertainty. Gold prices hit a low of $3366.07 on Tuesday and rebounded to around $3388.39, with the K-line crossing and silver prices soaring to a new high since 2012.

The situation in the Middle East is the main reason for the rebound of gold prices. The conflict between Israel and Iran continues, the United States' military intervention intensifies, risk aversion is heating up, and gold's attractiveness increases greatly. However, the US dollar index rose 0.7% in a single day, suppressing the rise of gold prices; US retail data in May was weak, and economic slowdown signals appeared.

The Federal Reserve's interest rate resolution has attracted much attention, and market expectations remain unchanged from 4.25%-4.50%, and Trump's demand for interest rate cuts has been treated with caution. Looking ahead to the future market, geopolitical risks provide support for gold, but the strength of the US dollar and the Fed's attitude may limit gains. Investors need to keep a close eye on the Federal Reserve policy, the US dollar trend and the situation in the Middle East, and operate cautiously in a market with intensifying volatility.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend on Tuesday. The price of the US dollar index rose to 98.845 on the day, and fell to 97.972 at the lowest, and finally closed at 98.805. Looking back on Tuesday's market performance, the price fluctuated in the early trading period in the short term. The price rose upwards in the US after consolidation in the support area we analyzed. In the end, the price soared strongly to the daily resistance position. For the future, we will continue to pay attention to the US index's steady daily resistance and further rise according to the previous viewpoint.

From the multi-cycle analysis, price suppression at the weekly levelIn the 100.35 area resistance, from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the key price resistance position is at 98.70 position over time. The current price is as the author said to further test this area. For the future, we need to focus on the performance of daily resistance breakthrough and steady progress. At the same time, the price on the four-hour upper side soared after fluctuating at the four-hour key position yesterday. It has now stabilized for four-hour resistance in the short term. We will follow the support for the four-hour support range of 98.30-40. At the same time, the price on the one-hour market continued to soar after yesterday's US trading. Currently, there is a short-term correction in the one-hour market, so wait for the price to be tested to the lower support before layout. Focus on the 98.70-99-99.40 area above.

The US dollar index has a long range of 98.30-40, with a defense of 5 US dollars, and a target of 98.70-99-99.40

Gold

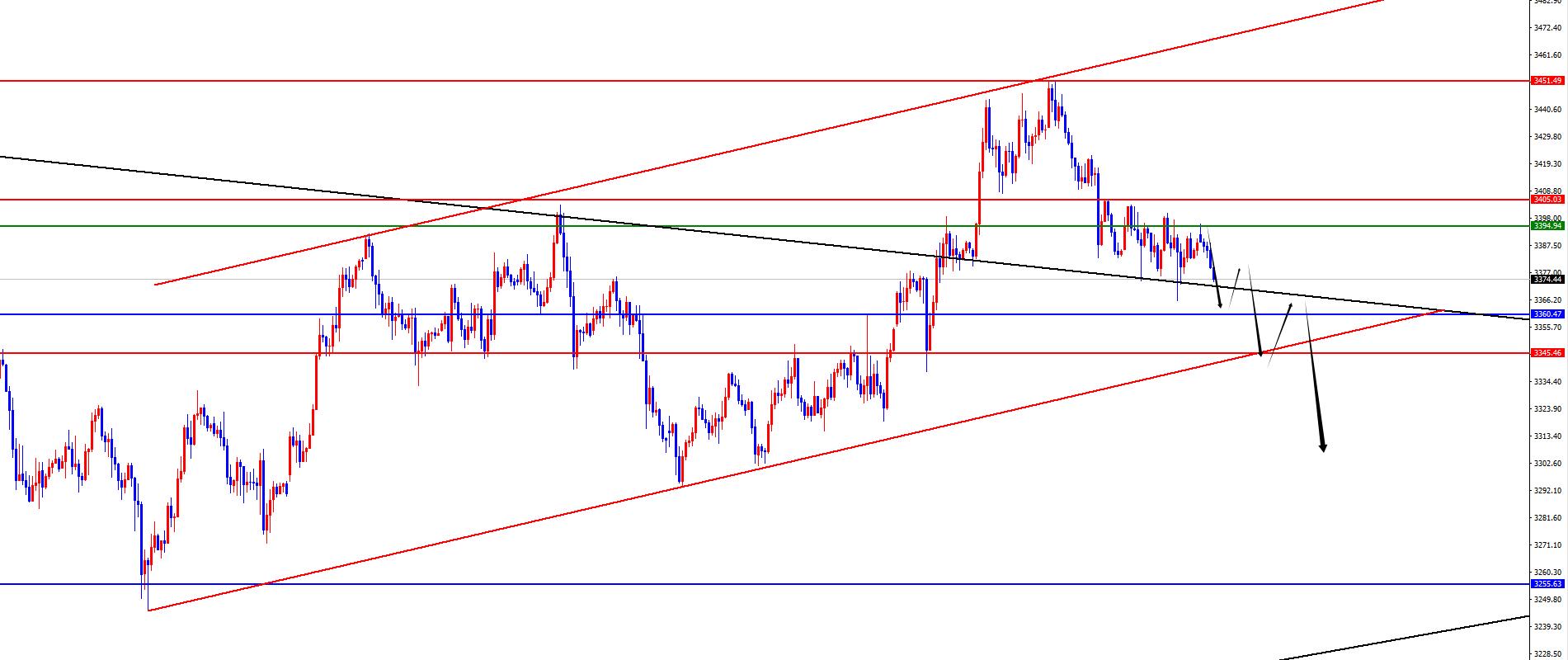

In terms of gold, the overall gold price was fluctuating on Tuesday. The price rose to the highest point of 3403.18 on the day, and fell to the lowest point of 3366.07 on the spot, closing at 3388.39. In response to the rapid short-term correction of gold during the early morning session on Tuesday, the price suppressed the high point of the retreat in the early morning of the previous day, and then the price broke through the low point of the previous day under weak conditions. At the same time, the fluctuation was under pressure during the European session, and the US retreat did not break through the high point of the early morning session, and then continued to fluctuate. At present, yesterday's market fluctuation was an adjustment to the decline on Monday. In the future, we need to pay attention to further pressure and the gains and losses of daily support. Once it breaks down, we need to pay attention to further continuation in the future.

From multi-cycle analysis, first observe the monthly rhythm. The price runs at the rhythm in May as the author said, and the final cross state. For June, focus on the gains and losses of May high and low points, the price will only be a real break at this position, and the long-term watershed is at 2780. From the weekly level, gold prices are supported by the support level in the 3255-60 area. So from the perspective of the medium-term, it is still in the mid-term bull market, and only the price will be further under pressure if it breaks the weekly support. From the daily level, the price broke through the daily resistance again last Wednesday and continued to soar after the breakthrough. After the price pierced the high point of the monthly line, it quickly under pressure and returned to the range. At the same time, the daily line is dark, and the focus will be on further oscillating and under pressure. The daily line watershed below is in the 3360 area. Once the price breaks through the daily line watershed, it will open up the band pressure. At the same time, according to the four-hour level, as time goes by, today's high point in the morning trading is the key resistance, and the price continues to be under pressure below this position. At the same time, the price is currently short based on one hour, so we wait for the price to improve in the future and under pressure.

Gold 3395 is under pressure, defending US$10, targeting 3360-3345

European and American

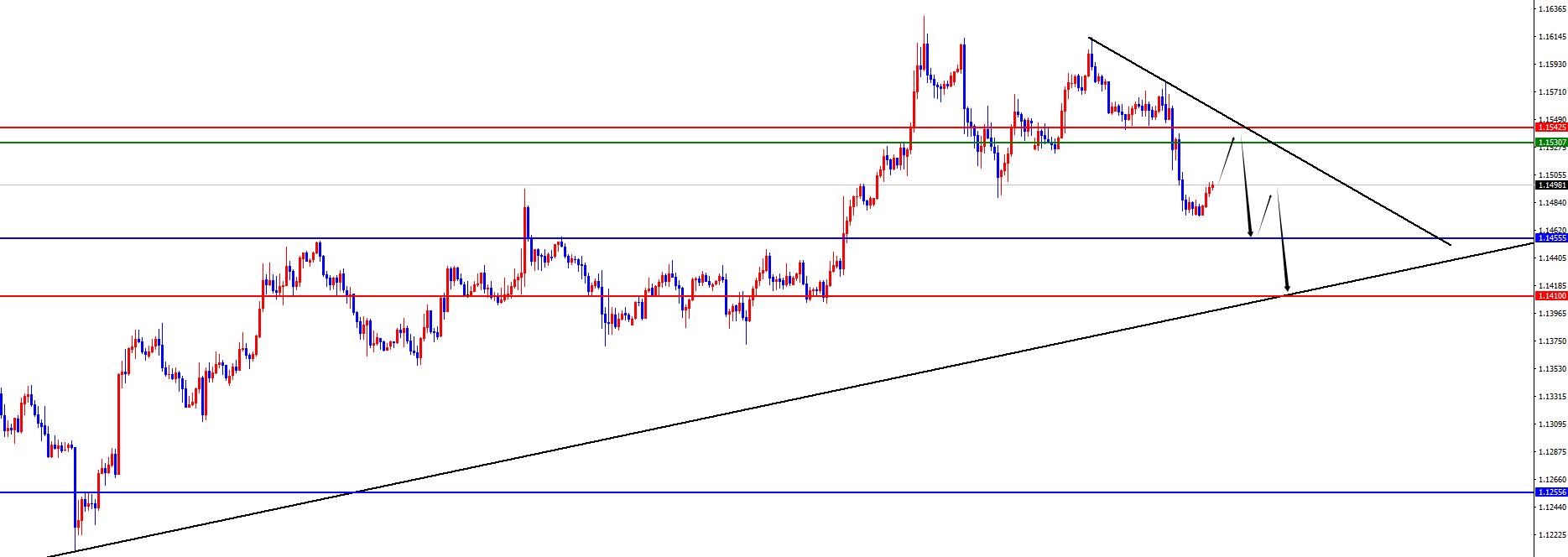

European and American prices generally showed a decline on Tuesday. The price fell to 1.1474 on the day and rose to 1.1579 on the lowest price, closing at 1.1479 on the market. Looking back at the performance of European and American markets on Tuesday, the price was under pressure in the short term during the early trading session, and then the price fluctuated above the four-hour watershed. As time went by, the price continued to be under pressure after the US market. The price fell below the four-hour support as scheduled, and finally the big yin state ended on that day. We need to pay attention to the gains and losses of the daily watershed position in the future.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0850, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1255 area, and from the perspective of the mid-line, the price decline is temporarily treated as a correction in the mid-line rise. From the daily level, as time goes by, we need to focus on the gains and losses of the 1.1455 area. This position determines the key to the band trend, and the subsequent focus is on the gains and losses of this position. According to the four-hour level, you need to pay attention to the range 1.1530-40. The target price is temporarily short-term short-term and short-term, and the price is close to the daily support. Therefore, the subsequent focus is on further continuing after the price breaks the range. From the one-hour level, it is timely to pursue short positions carefully. The market has adjusted its performance, so it will be laid out after subsequent adjustments.

Europe and the United States have a short range of 1.1530-40, defense is 40 points, target 1.1500-1.1455-1.1410

[Finance data and events that are focused today] Wednesday, June 18, 2025

① To be determined 2025 Lujiazui Forum was held in Shanghai

②14:00 UK May CPI monthly rate

③14:00 UK May retail price index monthly rate

④16:00 Eurozone April seasonally adjusted current account

⑤17:00 Eurozone May CPI annual rate final value

⑥17:00 Eurozone May CPI monthly rate final value

⑦20:30 Number of initial unemployment claims in the week from the United States to June 14

⑧20:30 Total new home starts in May

⑨20:30 Total U.S. construction permits in May

⑩22:30 EIA crude oil inventories in the week from the United States to June 13

22:30 EIA Cushing crude oil inventories in the week from the United States to June 13

22:30 EIA strategic oil reserve inventories in the week from the United States to June 13

23:15 Bank of Canada Governor McClum delivered a speech

00:00 EIA natural gas inventories in the week from the United States to June 13

Next day 00:00 EIA natural gas inventories in the week from the United States to June 13

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

Next day

G02:00 The Federal Reserve FOMC announced the summary of interest rate resolution and economic expectations

The next day, Fed Chairman Powell held a press conference on monetary policy

Note: The above is only personal opinions and strategies, for review and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM official website]: The Federal Reserve's resolution and Powell, "Double King Blast", the watershed of multiple varieties is here to explore". It is carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here