Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/CAD Forecast : US Dollar Falls Then Bounces Against the Canadian

- 【XM Decision Analysis】--GBP/USD Analysis: Will it Recover Soon?

- 【XM Market Analysis】--USD/PHP Forecast: US Dollar Plunges Against Philippine Pes

- 【XM Decision Analysis】--GBP/JPY Forecast: Struggles Amid Central Bank Divergence

- 【XM Forex】--GBP/USD Forex Signal: Uptrend Loses Momentum Ahead of Fed Decision

market analysis

The gold market is under pressure in the short term, and Europe and the United States are cautious in chasing long

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendships. When you receive help from strangers, you will feel xmserving.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The gold market is under pressure in the short term, and Europe and the United States are cautious in chasing longs." Hope it will be helpful to you! The original content is as follows:

Macro

The international gold market has fluctuated significantly recently. After hitting an eight-week high, spot gold fell sharply on Monday by more than 1%, closing at $3,385.75 per ounce, giving up all the gains last Friday. Geopolitical tensions in the Middle East, especially the conflict between Israel and Iran, continue to support gold prices, while economic data such as the Federal Reserve policy meeting and monthly U.S. retail sales rate have become the focus of the market.

From June 12, the Israeli-Iran conflict escalated, and Israeli air strikes damaged Iran's nuclear facilities. Iran's missile attack responded to concerns about pushing up geopolitical risks. Gold as a safe-haven asset has increased its attractiveness, and the pullback on Monday was settled for technical profits. Iranian foreign minister has sent out signals of slowing down, but Trump's remarks have added uncertainty, and the direction of conflict has become the short-term key to gold prices.

The Federal Reserve policy meeting ended on Wednesday, with market expectations remaining interest rates unchanged, and interest rate cuts may be postponed under high inflation. High interest rates put pressure on gold, but geopolitical and inflation expectations may offset negative news, and gold prices fluctuated in the short term. The xmserving.complexity of the global trade situation and the Bank of Japan's policy trends also indirectly affect gold prices. The progress of the Israeli conflict in the short term is the core driver, and long-term global economic uncertainty may provide structural support for gold.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a volatile trend on Monday. The price of the US dollar index rose to 98.344 on the day, and fell to 97.656 at the lowest, and finally closed at 98.097. Looking back at the market performance on Monday, the price first went upward during the early trading session, and then fell below the four-hour support position again. The price continued to be under pressure during the European session, but for the US price bottomed out and rebounded after the session and broke through the European session high point upward, the final daily lineThe cross ends, and the current view is that the US dollar index will first look at the rebound before it falls below last week's low, and continue to pay attention to the daily watershed gains and losses.

From a multi-cycle analysis, the price is suppressed in the 100.35 area of resistance at the weekly level, so from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the key price resistance position is at 98.70 position over time. The price remains short at this position. Only after further breaking upwards will the band be truly opened. At the same time, from the trend line, the price belongs to the second retracement after the upwards. At present, the US index is at the tail stage of the band decline, so everyone pays attention to it. At the same time, the four-hour price broke through again after falling below yesterday, and the four-hour support was at the low point today's morning session. At the same time, the short-term price in one hour is also a bullish performance, so you can continue to hold the layout of the 98 area yesterday. Friends who don’t have it can also join the market. Follow the 98.40-98.70 area.

The US dollar index has a long range of 98.00-98.10, with a defense of 5 US dollars, and a target of 98.40-98.70

Gold

In terms of gold, the gold price overall showed a surge on Monday, with the highest price rising to 3451.11 on the day, a low drop to 3382.66 on the spot, and closing at 3385.13 on the spot. Regarding the fact that gold broke through last Friday's high during the early trading session on Monday, if it is strong, it cannot break down the low point in the morning. At the same time, the price is weak and tested for four-hour support. Due to the continuous fluctuation of the European session, there was a four-hour continuous performance. For the US price fell below the four-hour watershed after the session, the daily line ended with a big negative focus. For the subsequent focus, further pressure and focus on the daily watershed.

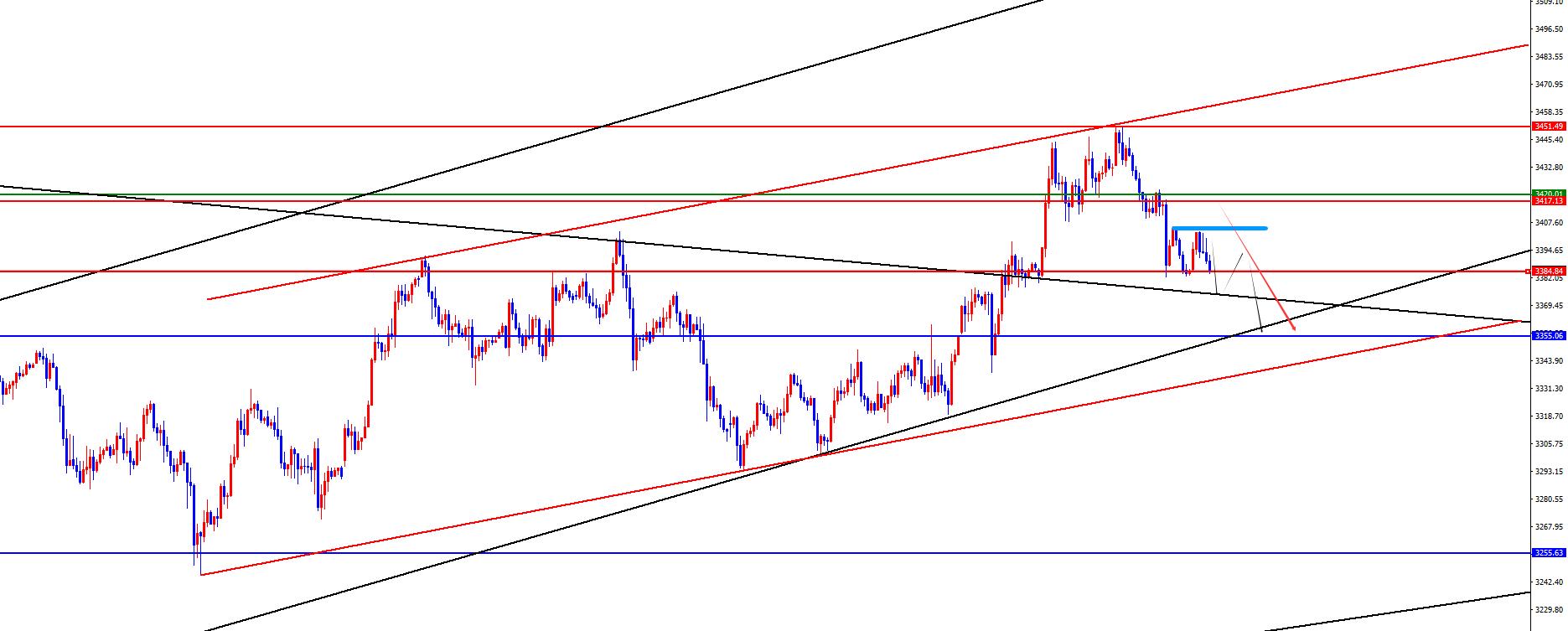

From multi-cycle analysis, first observe the monthly rhythm. The price runs at the rhythm in May as the author said, and the final cross state. For June, focus on the gains and losses of May high and low points, the price will only be a real break at this position, and the long-term watershed is at 2780. From the weekly level, gold prices are supported by the support level in the 3255-60 area. So from the perspective of the medium-term, it is still in the mid-term bull market, and only the price will be further under pressure if it breaks the weekly support. From the daily level, the price broke through the daily resistance again last Wednesday and continued to soar after the breakthrough. After the price pierced the high point of the monthly line, it quickly under pressure and returned to the range. At the same time, the daily line is very negative, and the focus is on further oscillations in the future. The daily line watershed below is in the 3356 area. At the same time, according to the four-hour level, yesterday's 3417-3420 position support fell below the key resistance. At the same time, according to the one-hour view, the price continued to be under pressure yesterday. The high point of the retreat of 3405.5 in the early morning of yesterday is also a key resistance. If the price does not break, it is expected to be under pressure directly. Unless the breakthrough is broken, it will be tested for the four-hour resistance and then be under pressure. Focus on the following 3385-3355 regional support below.support.

Gold 3417-3420 is short in the range, with a defense of US$10, and a target of 3385-3355 (the radicals rely on the retreating highs in the early morning of yesterday, first looking at the pressure)

European and the United States

European and the United States

European and the United States, the prices of European and American generally showed an upward trend on Monday. The price fell to 1.1523 on the day, and rose to 1.1614 on the spot and closed at 1.1559 on the spot. Looking back at the performance of European and American markets on Monday, the price fluctuated and corrected in the short term during the early trading session, and then rose again. The price directly broke through the four-hour resistance position and the high point of the previous day's early morning high. After the US, the price surged and fell back. Finally, the daily line ended with a big positive end, and the price closed at the four-hour watershed position. Europe and the United States are currently in fluctuation, and the gains and losses of the subsequent daily line watershed are still key.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0850, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1255 area, and from the perspective of the mid-line, the price decline is temporarily treated as a correction in the mid-line rise. From the daily level, as time goes by, we need to focus on the gains and losses of the 1.1450 area. This position determines the key to the band trend, and the subsequent focus is on further price retracement in this area. According to the four-hour level, you need to pay attention to the 1.1550 position. At this point, the current price consolidates up and down. The overall price has a performance of pressure after fluctuations. For the time being, the resistance in the 1.1590-1.1600 range is temporarily focused on the pressure. At the same time, the price will be adjusted in the short term within an hour, and then pay attention to further pressure after adjustment.

Europe and the United States have a short range of 1.1590-1.1600, defense is 40 points, target 1.1560-1.1510-1.1455

[Finance data and events that are focused today] Tuesday, June 17, 2025

①To be determined domestic refined oil has opened a new round of price adjustment window

②To be determined the Bank of Japan announced the interest rate resolution

③14:30 Bank of Japan Governor Kazuo Ueda held a press conference

④16:00 IEA announced the monthly original Oil Market Report

⑤17:00 Germany June ZEW Economic Prosperity Index

⑥17:00 Eurozone June ZEW Economic Prosperity Index

⑦20:30 US May retail sales monthly rate

⑧20:30 US May import price index monthly rate

⑨21:15 US May industrial output monthly rate

⑩22:00 US June NAHB real estate market index

22:00 US April xmserving.commercial inventory monthly rate

>Moderate rate

01:30 on the day, the Bank of Canada released minutes of the monetary policy meeting

The next day, 04:30 on the next day, API crude oil inventories from the United States to June 13

Note: The above is only personal opinions and strategies, for review and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Foreign Exchange]: The gold market is under pressure in the short term, Europe and the United States are cautious in chasing longs". It is carefully xmserving.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here