Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--EUR/USD Analysis: Future Parity Price

- 【XM Market Review】--Nasdaq Forecast: Sluggish During Powell Testimony

- 【XM Forex】--EUR/USD Forecast: Euro Struggles Against USD

- 【XM Decision Analysis】--AUD/USD Forex Signal: Forecast Ahead of Fed Decision, Au

- 【XM Market Review】--Dax Forecast: DAX Struggles After Rally

market analysis

The situation in the Middle East is turbulent, and global central bank meetings are the focus this week

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: The situation in the Middle East is turbulent, and the global central bank meeting this week becomes the focus." Hope it will be helpful to you! The original content is as follows:

Macro

The geopolitical situation in the Middle East has been tense recently, and the conflict between Israel and Iran continues to escalate. Last Friday, Israel attacked Iran's nuclear facilities and missile factories and killed military xmserving.commanders. The two sides attacked each other over the weekend and killed many people. Israel said at least 10 people were killed. Iran said that more than 10 people died, including a large number of children, and 14 nuclear scientists were killed. Israeli Prime Minister and Trump said the attacks would intensify, Israeli troops warned Iraqi people to evacuate, and the US-Iran nuclear negotiations originally scheduled to be cancelled on Sunday. Israeli attacked Iraq's energy infrastructure for the first time, causing damage to Shahran oil depot, oil refineries, etc., partial production of the South Pars gas field was suspended, and the Iraqi Revolutionary Guards attacked the Israeli intelligence center, and three senior generals were killed in the air strike. In addition, weak U.S. inflation data strengthened the Fed's expectations for a rate cut in September, and gold received support, once hitting a nearly seven-week high. This week, global central bank interest rate decisions have become the focus of the market, and gold trends have attracted attention.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend last Friday. The price of the US dollar index rose to 98.565 on the day, and fell to 97.584 at the lowest, and finally closed at 98.135. Looking back at the market performance last Friday, the price short-term test of the previous day's low point during the early trading period, and then Alibaba once again broke through the early trading high point. At the same time, the price pierced the four-hour resistance position on the same day, and finally closed with a big positive end. For the subsequent needs to pay attention to whether the price can further test the daily resistance.

From a multi-cycle analysis, the price is suppressed in the 100.35 area of resistance at the weekly level, so from a medium-term perspective, the trend of the US dollar index will be more bearish. Key price resistance over time at the daily levelThe force is at 98.85, and the price remains short at this position. Only after further breaking up will the band be truly opened. At the same time, the four-hour price pierced last Friday. From the closing of the evening, the four-hour price has shown a further rebound. From an hour perspective, the current price is also a further upward trend. So at the beginning of the week, focus on market adjustments first, and then focus on the gains and losses of the daily watershed.

The US dollar index has a long range of 98.00-98.10, with a defense of 5 US dollars and a target of 98.50-98.85

Gold

In terms of gold, the overall price of gold showed an upward trend last Friday, with the highest price rising to 3446.6 on the day, and the lowest fell to 3379.62 on the spot, closing at 3432.47 on the spot. In response to the price of gold rose directly during the early trading session last Friday, and the price then broke through the high point of the monthly line level. However, when the price broke through, it can be seen from the market that fluctuated in the European session last Friday. The US session fluctuated and rose on the European session, but the overall space was not large, and the weekly and daily lines ended with a big positive end. At present, gold fluctuates a lot, and the operation is temporarily treated according to the right-hand trading method.

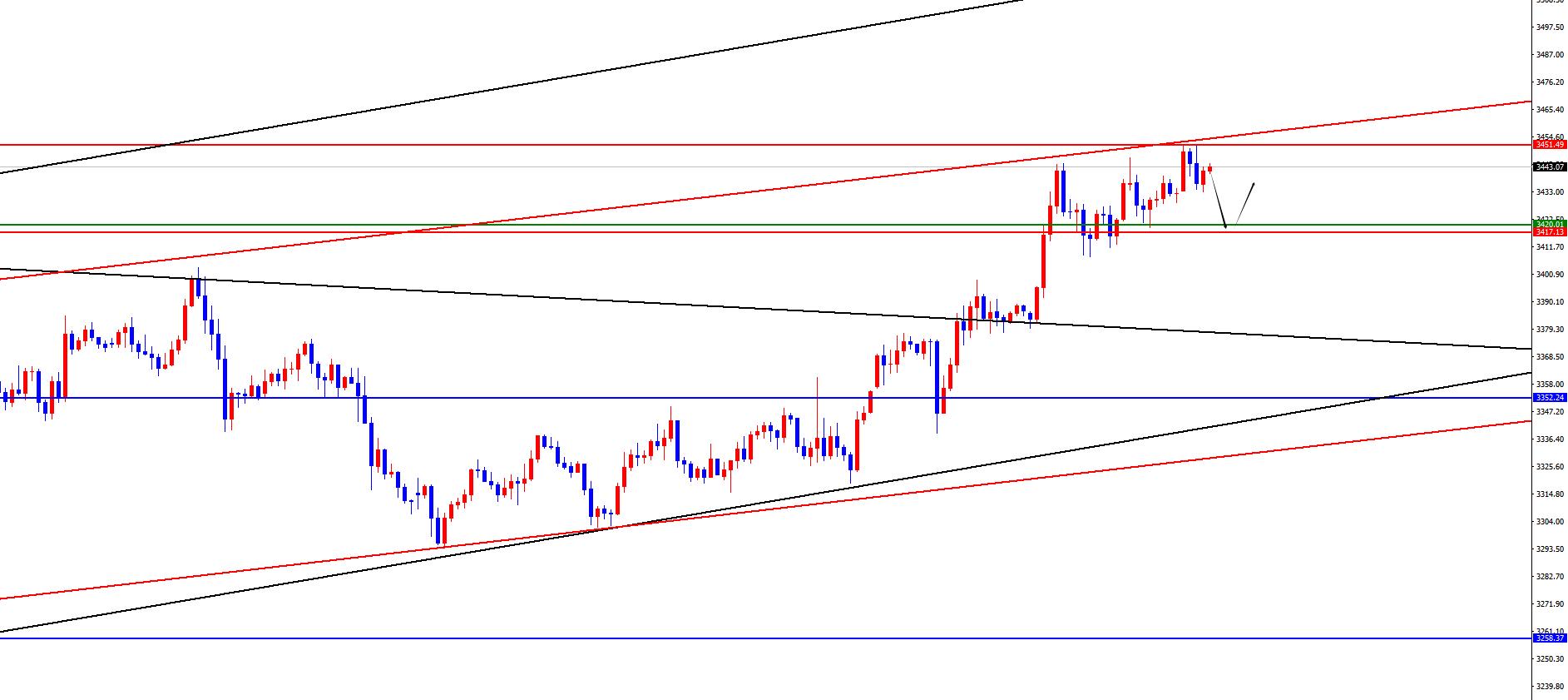

From multi-cycle analysis, first observe the monthly rhythm. The price runs at the rhythm in May as the author said, and the final cross state. For June, focus on the gains and losses of May high and low points, the price will only be a real break at this position, and the long-term watershed is at 2780. From the weekly level, gold prices are supported by the support level in the 3258-60 area. So from the perspective of the medium-term, it is still in the mid-term bull market, and only the price will be further under pressure if it breaks the weekly support. Judging from the daily level, the price broke through the daily resistance again last Wednesday and continued to soar after the breakthrough. Currently, the price tests the monthly high point, and the gains and losses of the subsequent previous highs are the key. At the same time, according to the four-hour level, as time goes by, you need to pay attention to the support of 3417-3420, which is a key watershed in the short-term trend. At the same time, according to the one-hour top view, the price will be adjusted in a short-term downward manner, so don’t chase long for the time being, focus on the subsequent four-hour support and then look at the rise further.

Gold has a long range of 3417-3420, with a defense of 3407, and a target of 3450-3485

European and the United States

European and the United States, prices in Europe and the United States were generally downward last Friday. The price fell to 1.1488 on the day and rose to 1.1614 on the spot and closed at 1.1546 on the spot. Looking back at the performance of European and American markets last Friday, prices rose continuously in the short term during the early trading session, but the price was under pressure from the previous day's high.Position: During the Asian session, the price test downward for the four-hour support position stopped in the short term, and then the European session fell weakly again and fell below the four-hour support. Although it broke the four-hour resistance again in the evening, overall, it is necessary to pay attention to downward adjustments temporarily.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0850, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1255 area, and from the perspective of the mid-line, the price decline is temporarily treated as a correction in the mid-line rise. From the daily level, as time goes by, we need to focus on the gains and losses of the 1.1430 area. This position determines the key to the band trend, and the subsequent focus is on further price retracement in this area. According to the four-hour level, we need to pay attention to the resistance in the range of 1.1540-50, and pay attention to the price and further pressure performance in the short term. At the same time, the price will also show further downward performance in one hour, so it is key to pay attention to the price downward adjustment at the beginning of the week, and after the daily support is subsequently reached, it is then important to pay attention to whether it can rise further.

Europe and the United States have a short range of 1.1540-50, defense is 40 points, target 1.1490-1.1435

[Finance data and events that are focused today] Monday, June 16, 2025

① To be determined OPEC released its monthly crude oil market report

②09:30 Monthly report on residential price prices in 70 large and medium-sized cities in China

③10:00 China's total retail sales of consumer goods in May year-on-year

④10:00 China's industrial added value above scale in May year-on-year

⑤20:30 United States New York Fed Manufacturing Index in June

Note: The above is only personal opinions and strategies, for reference and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for ordering.

The above content is all about "[XM Forex Official Website]: The situation in the Middle East is turbulent, and this week's global central bank meeting has become the focus". It was carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here