Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/AUD Forecast: Struggles Ahead of ECB Decision

- 【XM Group】--EUR/USD Analysis: Reasons for the Euro’s Decline Against the Dollar

- 【XM Forex】--Gold Analysis: Global Tensions Support Buying Sentiment

- 【XM Market Review】--EUR/USD Forecast: Faces Resistance Near 1.06

- 【XM Group】--DAX Forecast: Rebounds Near 19,750

market news

ECB resolution speaks to Fed officials, gold markets face tests again

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The European Central Bank's resolution speaks with Federal Reserve officials, and the gold market is facing the test again." Hope it will be helpful to you! The original content is as follows:

Macro

On Wednesday (June 4), international gold prices rose significantly by 0.56%, a fluctuation stemming from the xmserving.complex trend of the global economy. The US economic data was poor, such as the ISM non-manufacturing PMI fell to 49.9, and the increase in ADP jobs was far below expectations, which caused investors' confidence to frustrate and turned to gold safe-haven. During the session, gold prices once hit $3,384.55 per ounce. At the same time, the US dollar index fell 0.5%, and the 10-year U.S. Treasury yield fell, reducing the opportunity cost of holding gold and enhancing the attractiveness of gold.

The Trump administration's tariff policies impacted the global economy and financial markets. On June 4, the import tariffs on steel and aluminum doubled, seriously affecting the global supply chain, causing market unrest and further highlighting the safe-haven value of gold. The market's expectations for the Fed's interest rate cut have also heated up sharply, with the possibility of a rate cut in September reaching 77%. ADP employment data and inflation pressure provide support for the rate cut expectations. Investors are looking forward to the US non-farm employment report on June 6, which will affect market expectations of the Federal Reserve's monetary policy and in turn affect the trend of gold prices. In addition, factors such as the ECB interest rate resolution and the number of initial unemployment claims in the United States will continue to affect the price of gold.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a downward and upward trend on Wednesday. The price of the US dollar index rose to 99.372 on the day, and fell to 98.646 at the lowest, and finally closed at 98.789. Looking back at the market performance on Wednesday, the price fluctuated and rose in the short term during the early trading session, but the overall market continuity was poor. The price was under pressure and then fell again, and finally closed at a low level, with a big negative ending at the daily level. The market price has continued to fluctuate at a low level recently, and subsequentlyWe should pay attention to the daily resistance and the gains and losses of the previous support below. The market is currently waiting for data guidance.

From a multi-cycle analysis, the price is suppressed in the 101.10 area resistance at the weekly level, so from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the key price resistance position is at 99.40 as time goes by. Currently, the price continues to be under pressure in the daily resistance linear line, so it is still treated as short-term. At the same time, the price advancement of the four-hour upper hour has remained at the four-hour watershed position in the near future, suppressing the daily resistance above and supporting the recent low point below, so it is temporarily necessary to pay attention to the subsequent breaking continuation. For short-term focus on upward adjustment performance first, and do not chase orders for the time being.

The US dollar index has a long range of 98.60-70, with a defense of 5 US dollars, and a target of 99-99.40

Gold

In terms of gold, the overall price of gold showed an upward trend on Wednesday. The price rose to the highest point of 3384.55 on the same day, and fell to the lowest point of 3343.68 on the spot, and closed at 3372.24 on the spot. Regarding the price of gold fluctuated first during the early trading session on Wednesday, and the intraday price has not actually broken through the early trading low for a long time. After the US market, the price rose again and finally closed at a high level. As for the current daily alternation of yin and yang in the gold market, the price continuity is poor, so today we focus on whether the alternation of yin and yang can continue.

From multi-cycle analysis, first observe the monthly rhythm. The price runs at the rhythm in May as the author said, and the final cross state. For June, the long-term watershed is at 2780. From the weekly level, gold prices are supported by the support level in the 3190 area. So from the mid-term perspective, we can continue to maintain a bullish view. The price decline is only a correction in the medium-term rise, and the price will be further under pressure only if it breaks the weekly support. From the daily level, the current daily level is supported in the 3320-3322 area. This position is the key to the trend of the gold band. Due to the recent upward breakthrough, the price has been retracement many times and finally closed above the daily support. Therefore, the gains and losses of the daily support are still the key. Before the break, the band is temporarily large. At the same time, the daily line currently remains fluctuating in a large range. The price daily line currently alternates yin and yang, focusing on the continuation of the rhythm. From the four-hour level, we need to pay attention to the 3360 regional support for the time being. This position determines the strength of the short-term trend. Although the price is above this position, the price has fallen below the four-hour level again, so be cautious to chase long for the time being. Once it falls below the four-hour support, it is expected to continue further.

Gold focuses on the gains and losses of the 3360 position, and once it breaks, focus on testing around 3320

Europe and the United States

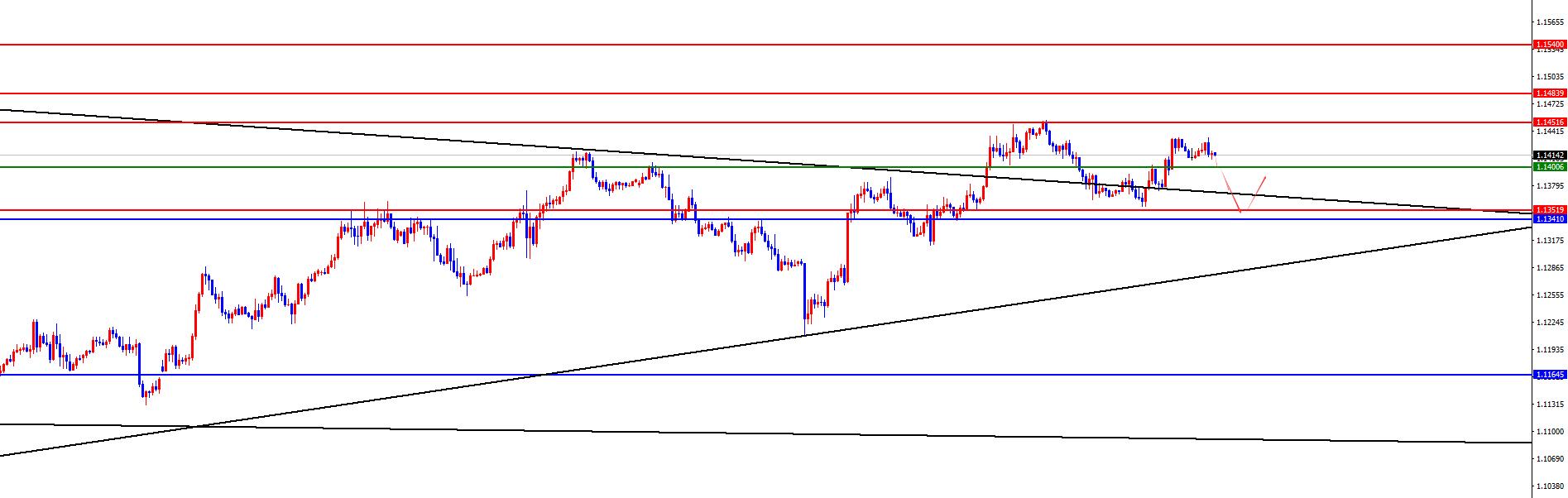

Europe and the United States, prices in Europe and the United States generally showed an upward trend on Wednesday. The price fell to 1.1356 on the day and rose to 1.1434 on the spot and closed at 1.1412 on the spot. Looking back at the performance of European and American markets on Wednesday, the price was suppressed at the four-hour resistance position in the early trading period first, but the US price broke through the four-hour resistance upwards, and finally closed above the four-hour key position, with a big sun on the daily line ending. Since the current price remains at a four-hour key position, the European and American operations are still focusing on the daily support layout.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0850, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1160 area, and continues to look bullish from the perspective of the mid-line. The price decline is temporarily treated as a correction in the mid-line rise. From the daily level, the price broke through the daily resistance on May 19, and at the same time it fell back and pulled up last Thursday, indicating that there is still a lot above the daily support. At present, the daily line is temporarily focused on the 1.1340-50 area. The price is more treated at this position, and the price is bearish above this position, but once it breaks down, you need to be wary of further pressure. The short-term four-hour support position is 1.1400 as a watershed.

Europe and the United States have a range of 1.1340-50, with a defense of 50 points, and a target of 1.1400-1.1450

[Finance data and events that are focused today] Thursday, June 5, 2025

①09:45 China's May Caixin Service Industry PMI

②13:45 Switzerland's May seasonally adjusted unemployment rate

③17:00 Eurozone April PPI monthly rate

④19:30 US May challenger xmserving.companies layoffs

⑤20:15 European Central Bank announced interest rate resolution

⑥20:30 US April trade account

⑦20:30 US to May 31 Number of initial unemployment claims in the week of the day

⑧20:45 European Central Bank Governor Lagarde held a press conference

⑨22:00 US Global Supply Chain Pressure Index in May

⑩22:30 US to May 30 EIA Natural Gas Inventory

00:00 Fed Director Kugler delivered a speech

01:30 Fed Hack delivered a speech on the economic outlook

01:30 the next day

01:30 the next day

01:30 the next day

01:30 the next day

Schmidt delivered a speech on banking policies

Note: The above is only personal opinions and strategies, for review and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is about "[XM Foreign Exchange]: ECB's resolution speaks with Fed officials, and the gold market is facing another testThe entire content of "test" was carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thank you for your support!

Due to the author's limited ability and time tightness, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here