Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--Nasdaq Forecast: Holding Support

- 【XM Decision Analysis】--EUR/USD Forecast: Euro Rallies in Thin Liquidity

- 【XM Market Analysis】--USD/ILS Analysis: Holds Near Lows Amid Light Volumes

- 【XM Market Analysis】--USD/JPY Analysis: The Buy Strategy Remains in Place

- 【XM Decision Analysis】--GBP/CHF Forecast: Bounces After Dropping

market news

Eurozone inflation is lower than target, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on June 3

Wonderful Introduction:

I missed more in life than I have not missed, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have xmserving.comfort; missing xmserving.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Eurozone inflation is lower than the target, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on June 3rd". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The three major U.S. stock index futures fell, Dow futures fell 0.21%, S&P 500 futures fell 0.14%, and Nasdaq futures fell 0.04%. The German DAX index rose 0.02%, the UK FTSE 100 index rose 0.13%, the French CAC40 index fell 0.24%, and the European Stoke 50 index fell 0.21%.

2. Market news interpretation

Eurozone inflation is below the target, and the ECB may continue to cut interest rates

⑴ The inflation rate in the euro zone fell to 1.9% in May, lower than the ECB target, down from 2.2% in April. ⑵ Economists surveyed by the Wall Street Journal had previously expected inflation to be 2.0% in May. ⑶ The decline in inflation in May was mainly due to the decline in service inflation from 4.0% in April to 3.2%, the lowest level since March 2022, due in part to late Easter time and lower wages. ⑷ The euro zone's unemployment rate fell to a record low of 6.2% in April. ⑸ Investors expect the ECB to cut interest rates by 25 basis points to 2.0% on Thursday, which will be the eighth rate cut since June last year. ⑹The U.S. inflation fell slightly to 2.3% in April, close to the Federal Reserve's target, but Trump's tariff remarks sparked market concerns about rising inflation. ⑺The euro zone imposes tariffs on U.S. imports may reduce inflation as this will curb demand for European goods and may lead to cheaper exportsCommodities enter European market. ⑻The appreciation of the euro against the US dollar and the decline in energy prices due to expectations of slowing global economic growth have also driven down euro zone inflation in the near future.

The turnout rate of South Korea's general election has reached 77.8% and set a record since 1997

On June 3 local time, South Korea held the 21st presidential election. The turnout rate continues to rise, setting a record for the highest turnout rate in the presidential election since 1997. According to the latest statistics from the South Korean Central Election Management xmserving.committee, as of 19:00 local time on the 3rd, the turnout rate of the general election was 77.8%, which has exceeded the final turnout rate of the previous general election by 0.7 percentage points. A total of 34.5524 million voters have xmserving.completed the vote.

The market expects the vacancies in the United States to decrease, focusing on the labor market and the trend of the US dollar

⑴ The market expects the vacancies in the United States to drop slightly to 7.1 million on the last working day of April. ⑵As uncertainty over the potential impact of President Trump’s trade policy on the economy and inflation outlook increases, Fed officials expressed concerns about the possible cooling of the labor market. ⑶ Minutes of the Federal Reserve's May 6-7 meeting showed that policy makers believe that the risk of unemployment increased, but Dallas Fed Chairman Logan believes that the risks of employment and inflation targets are "a roughly balanced" and that the shift in risk balance may take "a considerable time." ⑷JOLTS reports reflect data in late April, while the official employment report will be released on Friday, measuring data in May. Despite the lag of JOLTS data, if job openings drop significantly, below 7 million, it may intensify concerns about weak labor markets, which in turn leads to the dollar facing new selling pressure. ⑸ On the contrary, if the vacancies increase significantly, reach or exceed 7.7 million, it may indicate that the labor market is relatively stable. ⑹CME Fed observation tool shows that the market expects the Fed to cut interest rates at its June meeting, but the probability of a 25 basis point cut in July is close to 25%. In this case, if the data exceeds expectations, the dollar may be supported, as investors may tend to postpone interest rate cuts until September.

Ukraine denies that the head of the Ukrainian delegation held separate talks before negotiations

On June 3 local time, the Ukrainian National Security and Defense xmserving.commission's Anti-False Information Center reported that Russia's statement that Russian President Assistant Mekinsky held so-called bilateral talks with Ukrainian Defense Minister Umerov before the talks in Istanbul on the 2nd was untrue. The notice stated, "In fact, the talks were held with the participation of Turkish Foreign Minister Fedan as a mediator. The statement that the meeting reached a so-called "secret agreement" was a manipulation, aiming to undermine the trust in the Ukrainian negotiating delegation." According to previous news from TASS, before the talks between the two countries officially began, the head of the Russian delegation Mekinsky and Umerov, the head of the Ukrainian delegation, had a separate meeting for about 2.5 hours.

UK Treasury yields fell, following the euro zone bond trend

⑴UK Treasury yields fell, following the euro zone government bondsThe trend of securities, as trade policy uncertainty and economic data deteriorated, investors turned to safe assets. ⑵ The weak data on the US May Supply Management Institute manufacturing survey released on Monday further boosted risk aversion. ⑶XTB analyst Kathleen Brooks said inflation and stagflation concerns have not yet put pressure on the global bond market. ⑷ Japan's 10-year Treasury bond auction demand is strong, and the UK plans to auction 2063 Treasury bonds at 0900 Greenwich Time, which also provides support for UK Treasury bonds. ⑸ According to Tradeweb data, the UK's 10-year Treasury bond yield fell by 3 basis points to 4.618%.

Eurozone inflation is lower than the ECB target, supporting the expectation of interest rate cuts

⑴Eurozone inflation rate fell to 1.9% in May, lower than the ECB target and market expectations of 2.0%, mainly affected by the decline in energy prices and a sharp decline in service inflation. ⑵ Core inflation rate (excluding energy and food prices) fell from 2.7% to 2.3%, and service price growth fell from 4.0% to 3.2%. ⑶ The ECB has cut interest rates seven times since June last year, and the market almost fully expects to cut interest rates again this Thursday. ⑷ The inflation outlook remains weak due to slow wage growth, falling energy prices, strengthening the euro and moderate economic growth. ⑸ Some economists expect inflation to continue to fall below the ECB’s 2% target this year and will not rebound until 2026. ⑹ Investors believe that the ECB will suspend further interest rate cuts after cutting interest rates to 2% in June, and may only cut interest rates again this year in the fall, reducing deposit rates to 1.5%.

The Swiss National Bank is expected to maintain its 25 basis point interest rate cut plan, although inflation is negative

⑴ The Swiss Consumer Price Index (CPI) fell to -0.1%, in line with market expectations and the lowest level since March 2021. ⑵ Nevertheless, the market still expects the Swiss National Bank to cut interest rates by 25 basis points rather than 50 basis points. ⑶ Market pricing shows that the probability of supporting a 25 basis point interest rate cut is 66%, and the probability of supporting a 50 basis point interest rate cut is 34%. ⑷ The Swiss National Bank chairman said inflation may continue to be negative in the xmserving.coming months, but the central bank does not necessarily need to respond. ⑸ This shows that the Swiss National Bank is more inclined to adhere to a 25 basis point rate cut.

Ukraine expects a decline in grain harvest in 2025

⑴ Ukrainian Minister of Agriculture said that Ukraine's total grain output may drop by 10% in 2025, to about 51 million tons. ⑵ Among them, corn production is expected to be 26 million tons and barley production is expected to be 4.5 million tons. ⑶The sunflower seed production is expected to be 11.5 million tons, and the beet production is expected to be 11 million tons.

UK 10-year Treasury yield fell to three-week low

⑴UK 10-year Treasury yield fell to 4.611%, the lowest level in more than three weeks. ⑵The decline came amid strong demand in the £1.25 billion 40-year Treasury auction, with bid multiples rising from the previous 2.80 to 3.51. ⑶ The yield on the 30-year treasury bond fell by 8 basis points, while the yield on the shorter-term treasury bond fell by about 4 basis points. ⑷Bank of England's monetary policy xmserving.committee member Catherine Mann pointed out that there is a conflict between the interest rate cut and the central bank's bond sale plan, warning that the impact of asset sales on long-term yields is different from interest rates, and recommended rethinking the speed of Treasury bond sale. ⑸ The OECD lowered its UK economic growth forecast for 2025 to 1.3% and 1.0% in 2026, due to trade policies, tight government budgets and continued inflation. The report warns that weak consumer confidence and fragile public finances have left the UK vulnerable to shocks.

Germany Treasury yields fell due to weak inflation and the ECB's expectation of a rate cut

⑴Germany 10-year Treasury yield fell to 2.5%, close to its lowest level since May 7. ⑵ Eurozone's inflation rate fell from 2.2% in April to 1.9%, lower than expected 2.0%, the first time since September 2024, strengthening market expectations for the ECB's 25 basis points cut this week. ⑶ Service inflation fell to its lowest level since March 2022, and the core inflation rate also fell to its lowest level since January 2022. ⑷ Market sentiment remained sluggish due to the OECD lowering global growth expectations, political turmoil caused by the collapse of the Dutch government and continued trade uncertainty.

Indian states raised funds through loans, but failed to meet their target

⑴ The Central Bank of India reported that 12 states raised Rs 28,177 crore through loans, but failed to meet the target of Rs 29,400 crore. ⑵The cut-off yields for bond issuance in Indian states are as follows: Himachal Pradesh, Madrid and West Bengal are 6.92%; Goa is 6.63%, Meghalaya is 6.64%; Tamil Nadu is 6.40%. ⑶ The deadline for the 9-year bonds in Andhra Pradesh is 6.61%, 6.82% for the 11-year period, 6.78% for the 12-year period, and 6.84% for the 13-year period and 14-year period. ⑷ Kerala's 12-year bond yield is 6.77%, 6.94% for 37 years; Rajasthan's 10-year period is 6.64%; Telangana's 19-year period and 20-year period are 6.92%. ⑸ The deadline for Tamil Nadu’s 20-year bonds is 6.92%, and the 30-year bonds is 6.94%. ⑹The implied yield of the 2029 bonds due to Zhengtisgarh is 6.1318%, the 2046 bonds due to Punjab is 6.9345%, and the 2048 bonds due to Rajasthan is 6.9322%.

Ukraine failed to pay sovereign bonds, causing debt default

⑴Ukraine suffered a sovereign debt default due to failure to pay the US$2.6 billion in debt securities due on Monday. ⑵ The Ministry of Finance said that the non-payment was a strategy adopted by Ukraine to xmserving.complete a xmserving.comprehensive debt restructuring, aiming to ensure long-term debt sustainability without affecting the country's recovery and reconstruction. ⑶ These debt securities are with UkraineThe warrants linked to GDP growth were not included in the sovereign bond restructuring last year. ⑷ Ukraine negotiates with foreign institutional investors on warrants, but no agreement has been reached. Investors said they were disappointed with the default but were still willing to negotiate a solution with Ukraine. ⑸ These warrants were issued in 2015. When Ukraine's GDP growth rate exceeds 3%, warrant holders are entitled to payment. Ukraine's GDP growth rate in 2023 is 5.3%. ⑹ The International Monetary Fund (IMF) said that failure to reorganize these warrants would pose significant risks to other financing agreements in Ukraine, including the IMF’s $15.5 billion loan and the $20 billion reorganization agreement reached with other creditors.

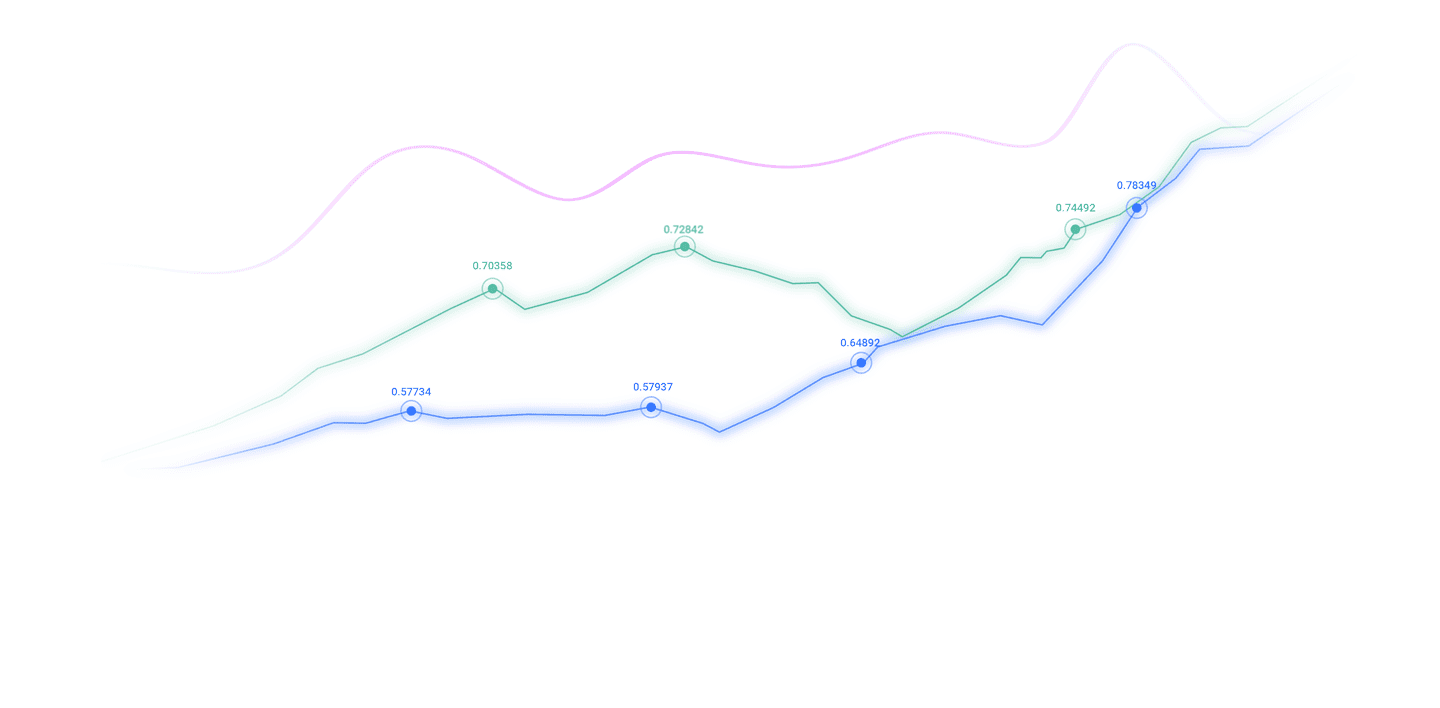

3. Trends of major currency pairs in the New York Stock Exchange before the New York Stock Exchange

Euro/USD: As of 20:20 Beijing time, the euro/USD fell and is now at 1.1384, a drop of 0.50%. Before the New York Stock Exchange, the price of (EURUSD) fell in recent intraday trading due to the stability of key resistance level 1.1420 and the emergence of negative signals on (RSI), which allowed the price to try to gain positive momentum to help it break through this resistance level, and trade along a smaller deviation line in the short term under the support of its continued trading above the EMA50, dominated by bullish trends.

GBP/USD: As of 20:20 Beijing time, GBP/USD fell and is now at 1.3496, a drop of 0.35%. Before the New York Stock Exchange, the (GBPUSD) price fell in the last intraday trading, trying to get positive momentum that could help it recover and rise again, and trying to unload some obvious overbought conditions on the (RSI), especially when the negative signal starts.

Spot gold: As of 20:20 Beijing time, spot gold fell, now at 3351.02, a drop of 0.90%. Before New York, the price of (gold) fell in recent intraday trading, trying to gain positive momentum, which could help it break through the current resistance at $3365 and noted that it successfully got rid of its previously obvious overbought state on (RSI).

Spot silver: As of 20:20 Beijing time, spot silver fell, now at 34.223, a drop of 1.46%. Before the New York market, the price of (silver) rose slightly in volatile trading, supported by its trading above EMA50. On the other hand, the stability of the key resistance at $34.50 is lowered by the stability of the price, as (RSI) negative signals appear, and after reaching the overbought area, the price tries to uninstall this overbought situation.

Crude oil market: As of 20:20 Beijing time, U.S. oil rose, now at 63.210, an increase of 1.12%. Before the New York Stock Exchange, the price of (crude oil) rose slightly in recent intraday trading, trying to recover after a volatility station aimed at gaining positive momentum to start a new wave of bullish waves, the price is trying to get rid of the obvious overbought situation on (RSI), and it has successfully done it, in the continued positive support of its EMA50 trading above.

4. Institutional view

UBS: Continue to be bullish on 10-year U.S. Treasury

UBS interest rate strategist said in the latest report that the bank continues to be bullish on 10-year U.S. Treasury due to the risks of economic growth still exist. "We believe that the market underestimates the risk of the slowdown, and relatively modest U.S. CPI data in May and June will also support the performance of 10-year U.S. Treasuries noted that despite rising household inflation expectations, it has not yet translated into obvious wage upward pressure. In addition, they also mentioned that if the U.S. Senate makes adjustments to the "Beautiful Great Act" proposed by the House of Representatives and further cuts in spending, it is also expected to alleviate market concerns about the widening of the fiscal deficit. However, UBS also believes that in the next few months, the 10-year U.S. Treasury yield may be difficult to fall below 4%.

JPMorgan Chase CEO once again warned: rising US Treasury bonds and deficits may lead to turmoil in the bond market

On June 2 local time, JPMorgan Chase CEO Jamie Dimon said in an interview that the continuous expansion of US Treasury bonds is a "big event" and may bring a "hard time" to the bond market. Dimon's remarks echo his previous warning that increased U.S. government spending could trigger market turmoil. He recently said that after the US government and the Federal Reserve "mass excessive" spending and quantitative easing, the US bond market will "rift" appear. Dimon believes that the large-scale tax and expenditure bill currently being promoted by the US Congress may cause the US Treasury bond to surge by trillions of dollars.

Goldman Sachs: Aluminum prices may fall to US$2,100 per ton due to the accelerated supply in Indonesia.

Goldman Sachs said that it is expected that aluminum prices will fall to a low of US$2,100 per ton by early 2026. Only when this level reaches this level will it suspend excessive investment in Indonesia's smelting capacity. Goldman Sachs said that Indonesia's three 500,000-ton smelting plants will be put into operation in mid-2026, earlier than expected. Increased output will result in an oversupply of 1 million tons in 2026, the largest surplus since 2020.

The above content is about "[XM Forex]: Eurozone inflation is lower thanTarget, the entire content of the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on June 3rd was carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thank you for your support!

Every successful person has a start. Only by being brave enough to start can you find the way to success. Read the next article quickly!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here