Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--DAX Forecast: DAX Continues to Shoot Straight Up in the Air

- 【XM Group】--BTC/USD Forex Signal: Bitcoin Stabilizes as Bulls Target All-Time Hi

- 【XM Group】--CAD/JPY Forecast: CAD/JPY Surges as Yen Weakens

- 【XM Market Review】--USD/ZAR Analysis: Higher Range Sustained as Holiday Trading

- 【XM Decision Analysis】--USD/MYR Analysis: Strong Jump Higher as Nervousness Prov

market news

Gold repeatedly throws down and jumps up, and the daily C wave pullback is limited

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and xmserving.companionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Gold repeatedly throws down and jumps, and the daily C wave pullback is limited." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold repeatedly jumps downward, and the daily C wave pullback is limited

Review yesterday's market trend and technical points:

First, gold: When it continued to fall sharply during the day on Tuesday, the key support of 3317 was broken, the short-term decisively changed its thinking, and changed from last week's bullish to a volatile bearish pullback, and gave it that night The small band with a high of 3300 is bearish, and today's first target of 3260 is in place; yesterday, relying on the top and bottom resistance and 618 split resistance, it pointed out that 3317 is suppressed, and 3323 is suppressed in the evening, and finally successfully suppressed and fell, reaching the 3300 mark one after another; and then directly washed back in the middle of the night, breaking the lower track of the short-term flag-shaped channel 3296-97, which indicates that 3300 is a resistance, and is expected to go further. Weak, the result was that it fell sharply to 3245 this morning; it proved that it was right to insist on the idea of oscillating and bearish pullback;

Second, silver: its trend has been fluctuating continuously for nearly a month, and its continuity is relatively poor and not suitable for trend viewing, and it runs around the large range of 33.65-31.65;

Interpretation of today's market analysis:

First, gold daily line level Don't: Yesterday, the 5 moving average rose and fell and closed negative, and continued to fluctuate in the short term. Today, the morning dived directly to 40 US dollars, with a low of 3245. Originally, the 10 moving average basically broke and lost. However, at this time, all V in the European session rose back, which was more violent than yesterday's bulls and bears. If it cannot be suppressed tonight, the closing of the long and lower shadow K, which means that the strength of this round of C wave pullback is not big, and there is still the last one tomorrow before the Dragon Boat Festival holiday.On the day, the pullback time is approaching. See if you can give a relatively low position in the past two days, or you can consider ambushing a low position before next Monday to the band to look bullish, and see how the closing line is today; if it is similar to yesterday's move, the European market fluctuates and pulls up, and the US market fluctuates and suppresses it all the way, then it should still close below the 10th. Then there is still hope to give a low position tomorrow and Friday, with an extreme pullback of 3200-3190 (consider the bottom at this position to prepare for the pullback after the Dragon Boat Festival holiday). This is an early prediction analysis by the weekly video. Now look at the opportunities given It is difficult, take a step by step; what we need to pay attention to today is whether to close above or below 3290 on the 10th, and decide whether to end this wave of pullback ahead of schedule;

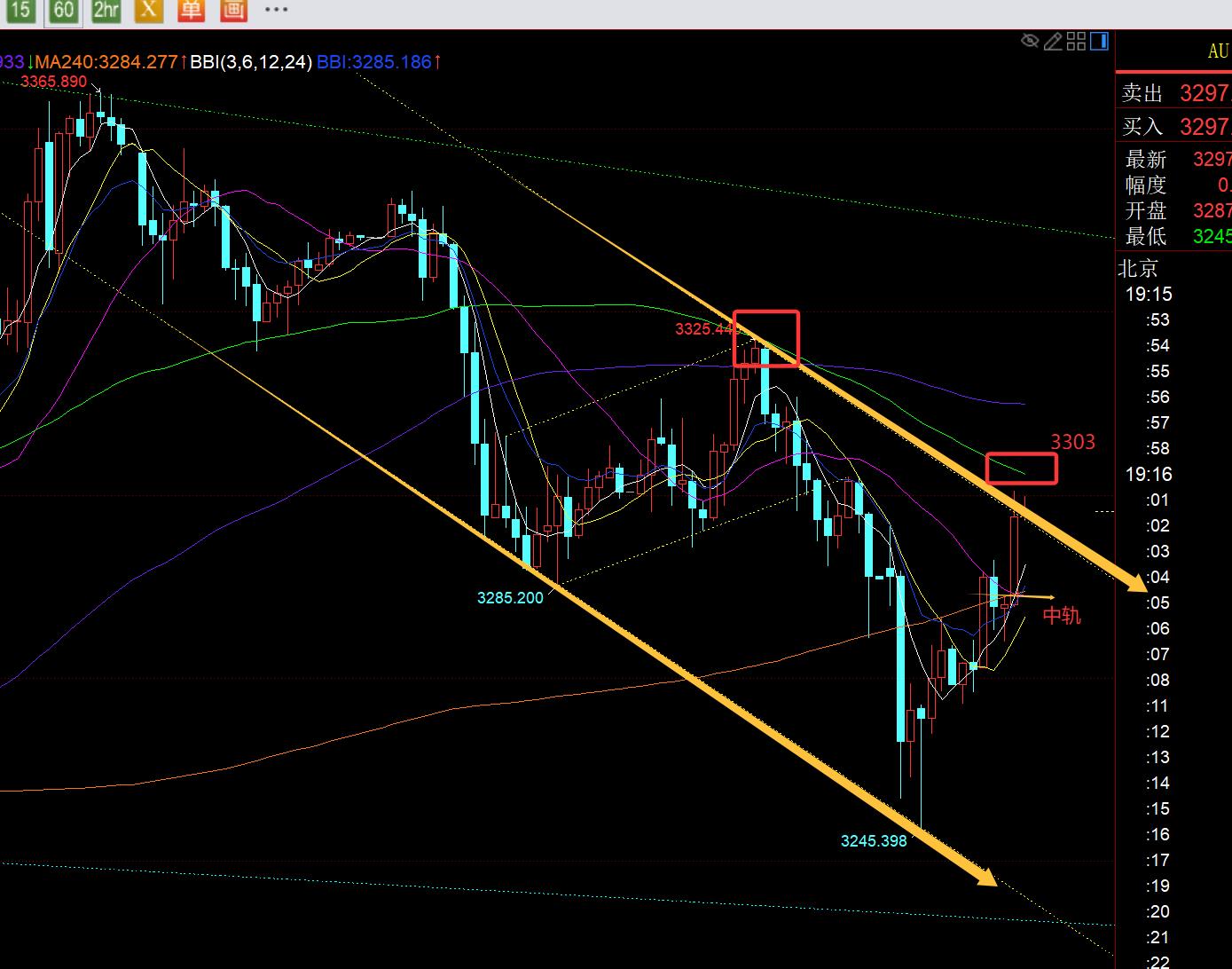

Second, gold 4-hour level: this cycle is still waiting for the closing of 22 points. If the rising and falling below the 10th, then there is still a chance to suppress a wave tonight. Yesterday, it was also 22 points to close a big negative and falling back to press the middle track, and then go down all the way; what we need to pay attention to today is whether it can rise and fall, and bear the 10 moving average;

Third, gold hourly level: Yesterday, the Asian session fell by 25 US dollars, the European session V rose by nearly 30 US dollars, and the US session V suppressed by nearly 50 US dollars. For the volatile market, the worst thing is continuity, and this back and forth V goes back and forth, the short-term strength will change very quickly; today, it is obvious that the xmserving.competition between bulls and bears is more intense, falling by 50 US dollars in the morning, and at this time, the European session V pulled up by nearly 60 US dollars. For tonight, whether to cycle yesterday's way of moving is the key; from the above chart, the price has touched the upper track of the key downward channel and slightly pierced, suppressing the 66-day moving average yesterday, and now this moving average moves down by 3303, which is just the back A drop in the middle of the night, temporarily see whether this resistance can be suppressed; and to confirm that the signal under pressure is to fall below the middle track again, so that there is a possibility of circulation and V back all the way; if the 66-day moving average continues to break upward and the station is upward, it will be difficult to cycle V tonight, and 3245 may become a low point in the c wave;

So under 3303, try to suppress the downward pullback first. If the fall successfully breaks and falls below the mid-line, the pressure will be effective and you can further fall to the low level; on the contrary, the breakthrough stand will be upward and further rise will be made at 3303. You should observe more tonight and find a position to follow the bullish position tomorrow;

Silver: Suppress downward this morning, pierce the lower rail of the converging triangle in the upper chart, and then oscillate and pull up all the way, similar to yesterday; at this time, pierce the resistance of the upper rail 33.35-33.4, then you should also observe whether it is a false break again; if there is a big negative reverse packet or a continuous negative reverse packet, then try to see the oscillation in the converging range; now you have to take a look first and wait for the signal;

In terms of crude oil: Crude oil has been repeatedly volatile and fluctuating recently, with poor continuity, and basically watching the show; it continued to rise first, but unfortunately it did not give a large-range resistance of 64, and the European session surged and fell. Pay attention to the 61.5 trend to confirm the stabilization signal;

The above are several points of the author's technical analysis, as a reference, and it is also the summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and they are used to interpret text and videos. Friends who want to learn can xmserving.compare and refer to them based on the actual trend; those who recognize ideas can refer to operations, lead defense well, and risk control is the first; those who do not agree should just be drifted by; thank everyone for their support and attention;

[The views of the article are for reference only. Investment is risky, and you need to enter the market with caution, rational operation, strict loss setting, control positions, and risk control is the first , bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

After reading the market for more than 12 hours a day, persisting for ten years, detailed technical interpretation is made public on the entire network, and serve the whole network with sincerity, sincerity, sincerity, perseverance and wholeheartedness! xmserving.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, division rules, and top and bottom rules; Student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Forex Official Website]: Gold repeatedly throws down and jumps, and the daily C-wave pullback is limited". It is carefully xmserving.compiled and edited by the XM Forex editor. I hope it will be helpful to your transaction! Thank you for your support!

Every successful person has a start. Only by being brave to start can you find the way to success. Read the next article quickly!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here