Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--ETH/USD Forecast : Ethereum Continues to See Noise on Holida

- 【XM Market Analysis】--USD/PHP Forecast: Stays Resilient

- 【XM Market Review】--Gold Forecast: Gold Threatens a Significant Breakout

- 【XM Group】--USD/MXN Analysis: Momentum Lower Takes Shape as Key Data Anticipated

- 【XM Market Review】--USD/MXN Monthly Forecast: December 2024

market analysis

Gold is under pressure for short-term node pressure 3370, tonight is the key

Wonderful introduction:

Walk out of the thorns, there is a bright road covered with flowers; when you reach the top of the mountain, you will see the cloudy mountain scenery like green clouds. In this world, a star falls and cannot dim the starry sky, a flower withers and cannot desolate the whole spring.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Gold is under pressure at short-term node pressure of 3370, and tonight is the key." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold is under pressure at short-term node pressure 3370, tonight is the key

Review last Friday's market trend and technical points:

First, gold: Last Thursday night, 3298 and 3290 are still on the low level bullish. Due to the poor position of 3298, the upward capital protection is protected, and 3290 can enter the market , held until last Friday, and continued to follow the bullishness after breaking through 3305 on Friday morning, because it was expected to break through the mid-track of the hourly line at that time, and then the European session rose all the way. After the 3315 resistance broke through the positive trend, it was a pity that the retracement did not give 3315 a chance to continue bullishness. The US session continued to rise for the second time, reaching the highest level of 3366. In fact, it was already close to the key trend resistance line 3500-3438, but it was always at a high level at that time. The weekend is about to pass, so I will not test the resistance and look at the pressure; the low level of the hand I hold is bullish, and it is also smoothly harvested at 3330 and 3345, and the low level of 3192 continues to hold, including the medium and long-term bullish ones in the previous period of 3000, 2735 and 2753;

Second, silver: the overall fluctuation and slow rise, reaching the highest level of 33.5;

Third, crude oil: the operating range indicated by the research report is 60 -61.7 is more perfect;

Today's market analysis interpretation:

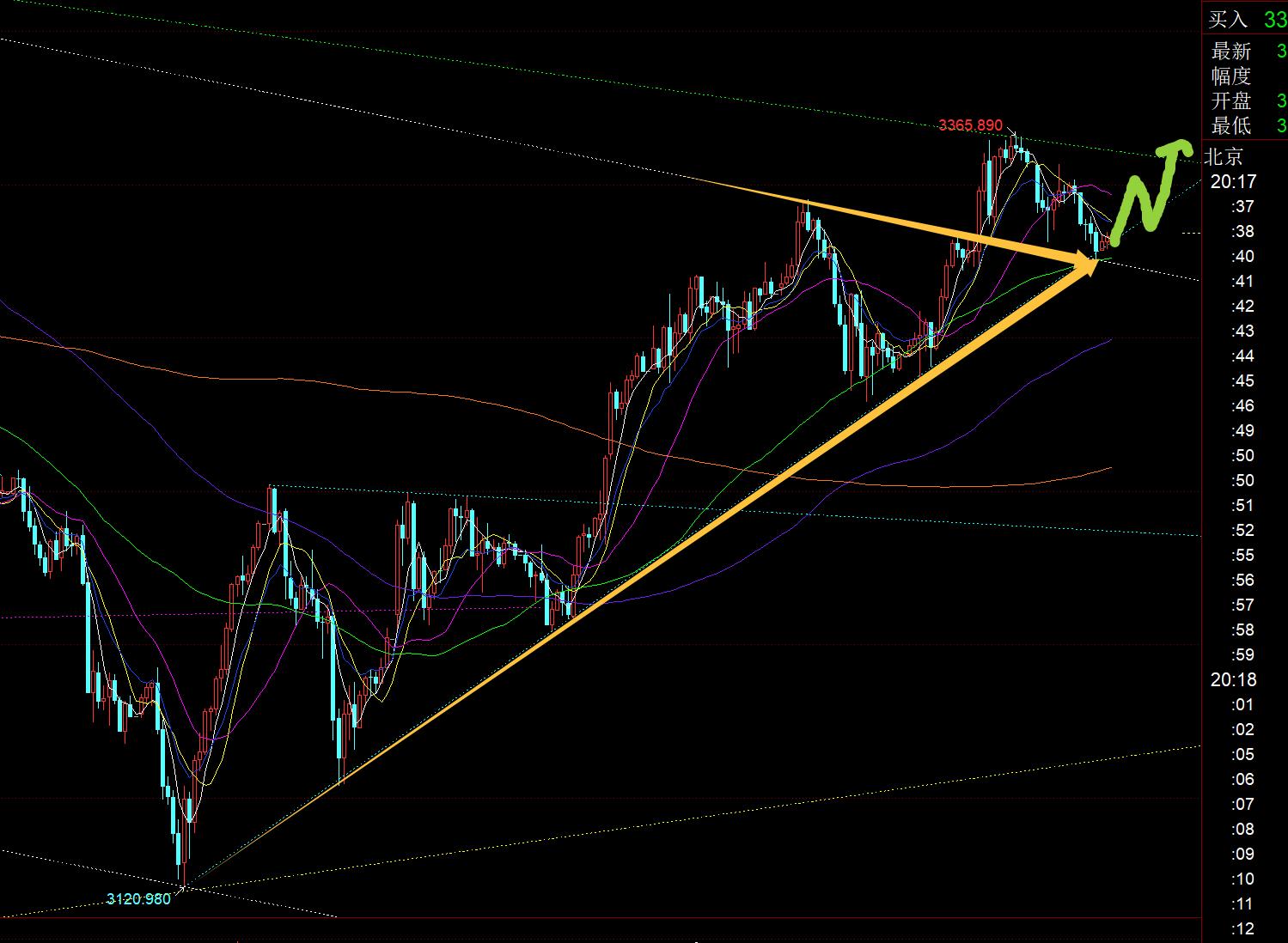

First, Golden Weekly Level: Last week, it was predicted to be a wide-ranging of the Yin-Yang cycle, and it is expected to close last week's positive. It is currently in line with it, and it closes that a full and big positive swallowed the big negative of the previous week. The lower rail support of the upward channel just stabilizes and pulls up. In the medium term, the trend continues to remain bullish; then is the Yin-Yang cycle still continuing?? This depends on the gains and losses of a key support 3317. If this position cannot be held this week and continues to decline, it is possible that it will close negative this week and continue to consolidate wide. Then the low point of the extreme pullback is above the lower track of the channel, that is, about 3190-3200, and it will still be a good medium-term stabilization point; of course, if you keep 3317, continue upward and break through to 3370, it may produce a continuous positive pattern, which may be a wave of bull market;

Second, the daily gold line level: 3438 falls to 3120, which is a wave of a decline, and 3120 rises to 3370, which is a wave of b wave rebound. The key at the beginning of this week is to xmserving.compete for the gains and losses of the resistance line of 3500-3438, that is, 3365-3370; if suppressed here, a large number of people will appear. If there is a negative or continuous negative, then it is likely that the C wave will begin to fall. After the ABC adjustment wave is over, a round of unilateral trend rise will be launched to continue the bull market development and break through 3500; if the bull market is broken up here, there are two ways to move: one is to end the adjustment and directly expand the bull trend to continue; the other is to continue a wave of pulling upward, but the pressure is under 3440, or double tops below 3500, and then a wave of decline will appear and return to the original downward adjustment channel, and then a certain position will stabilize to start the trend upward attack (once this situation occurs, the market is basically prone to long and short being beaten, because the inducement of long and short being more powerful than expected, which is also in line with the methods of the main force of the institutions); then the first thing to observe now is whether the resistance line 3500-3438 can be suppressed successfully? This requires testing an important support of 3317, which happens to be the 5 moving average. Once the market closes below the 5th day, it is highly likely that it will be under pressure and will develop a downward trend of C waves. If it continues to run above the 5th day, it is hard to say, and it is still in a short-term pull-up, and the probability of an upward breakthrough will increase;

Third, gold 4-hour level: This cycle will focus on two tonight, one is the middle track 3322 and the other is the 618 split position 3317. If you can hold them, you will maintain a strong bullish attitude; on the contrary, if you lose them, you will be weak and bearish.

Fourth, golden hourly line level: Today, both Asian and European sessions are fluctuating and falling all the way. There may be secondary suppression in the US session, but the European session low of 3323 has touched the support of the key trend line above, and it is close to 3322 last Friday, which is also a 50% split support of 3279-3366, and the 66-day moving average support; so there are already many resonances above 3322, and the more critical node support tonight; on the one hand, there is a possibility of secondary suppression, and on the other hand, there is a possibility of stabilizing and pulling up at any time, and there is currently some conflict; but there is a trend that can perfectly interpret, including both situations: the Asian and European sessions are weak, and the US session first shows a wave of pull-up to test the middle track 3345, and then the middle track is under pressure for secondary suppression., but the second decline still does not break through 3322, and then stabilizes and attacks upward in the second half of the night. This way of moving is the most ideal; or the second suppression of the US after the market is to defend above 3322 and then push the bottom and rise upward;

Therefore, we tend to look at a wave of pull-up above 3322, target 3345, break through to stand on its or the middle track of the hourly line, so that we can test 3357-3360; if we lose 3322 and continue to suppress downward, or even break 3317, then we must change our thinking in the short term, rebound and follow the bearish, and expand the daily line c wave decline;

Silver: Tonight, pay attention to the support of the daily 5 moving average, which is also the 33.2 line. The support position of the trend line in the chart. If this position is stable, it will continue to fluctuate and bullish, with a target resistance of 33.5-33.7;

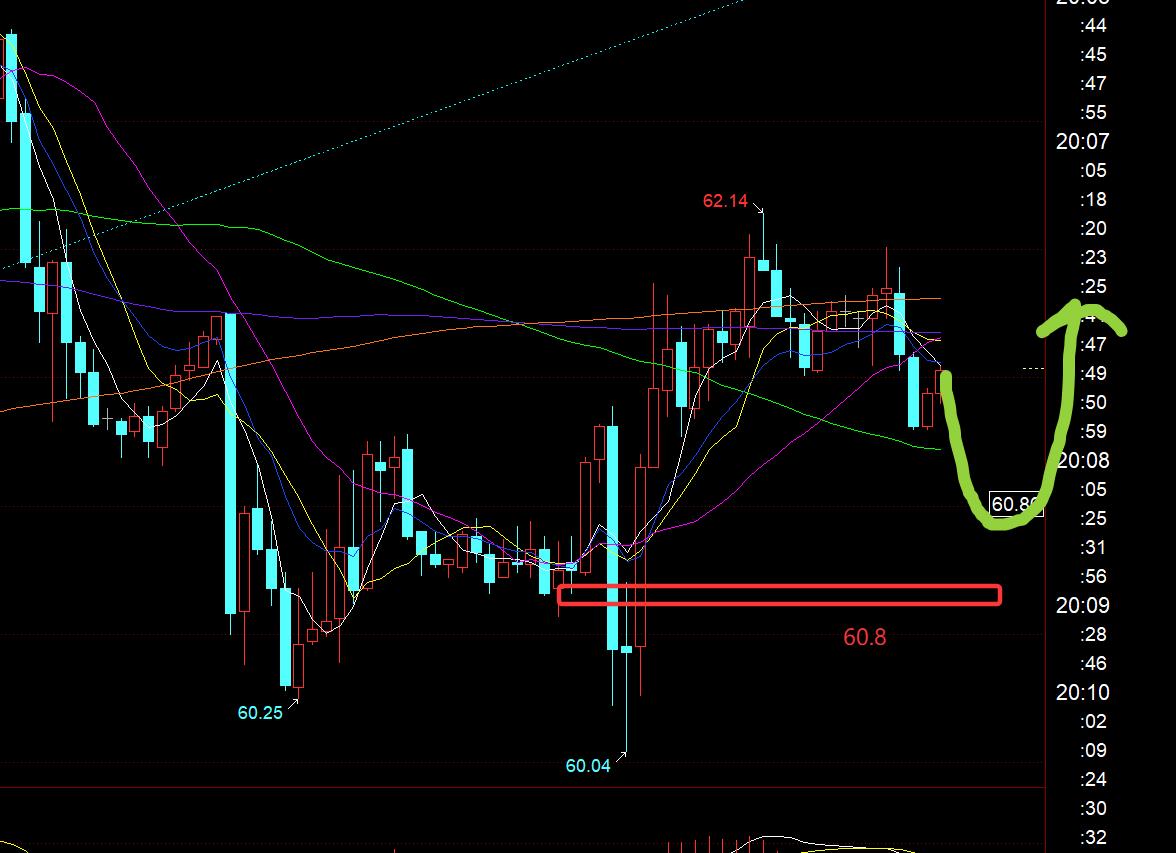

Crude oil: Last Friday's daily line closed positive, continue to organize, today's retracement is focused on the 618 segment support 60.8, stabilize and look at the rebound, resistance is 62.1, and the upward is bearish and fall below 63.2;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and they are xmserving.combined with text and video interpretation. Friends who want to learn can xmserving.compare and reference based on the actual trend; If you think about it, you can refer to the operation, lead the defense well, risk control first; if you don’t agree, just pretend to be bye bye; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You need to be cautious when entering the market, rationally operate, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmserving.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange]: Gold is under pressure and short-term node pressure is 3370, and tonight is the key" is carefully xmserving.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here