Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--USD/MXN Forecast: Stuck in Range

- 【XM Forex】--USD/SGD Analysis: Reactive Range as Outlooks Suffer Loud Agitation

- 【XM Decision Analysis】--Silver Forecast: Silver Continues to Find Buyers on Dips

- 【XM Forex】--USD/MYR Forecast: US Dollar Finds Support Against Ringgit

- 【XM Market Review】--EUR/USD Forecast : Euro Simply Cannot Rally

market news

After gold hit 3154 lows, the daily b wave began to rise

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: After the 3154 lows of gold are hit, the daily b wave will start to rise." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: After the 3154 lows of gold were hit, the daily b wave began to rise.

Review yesterday's market trend:

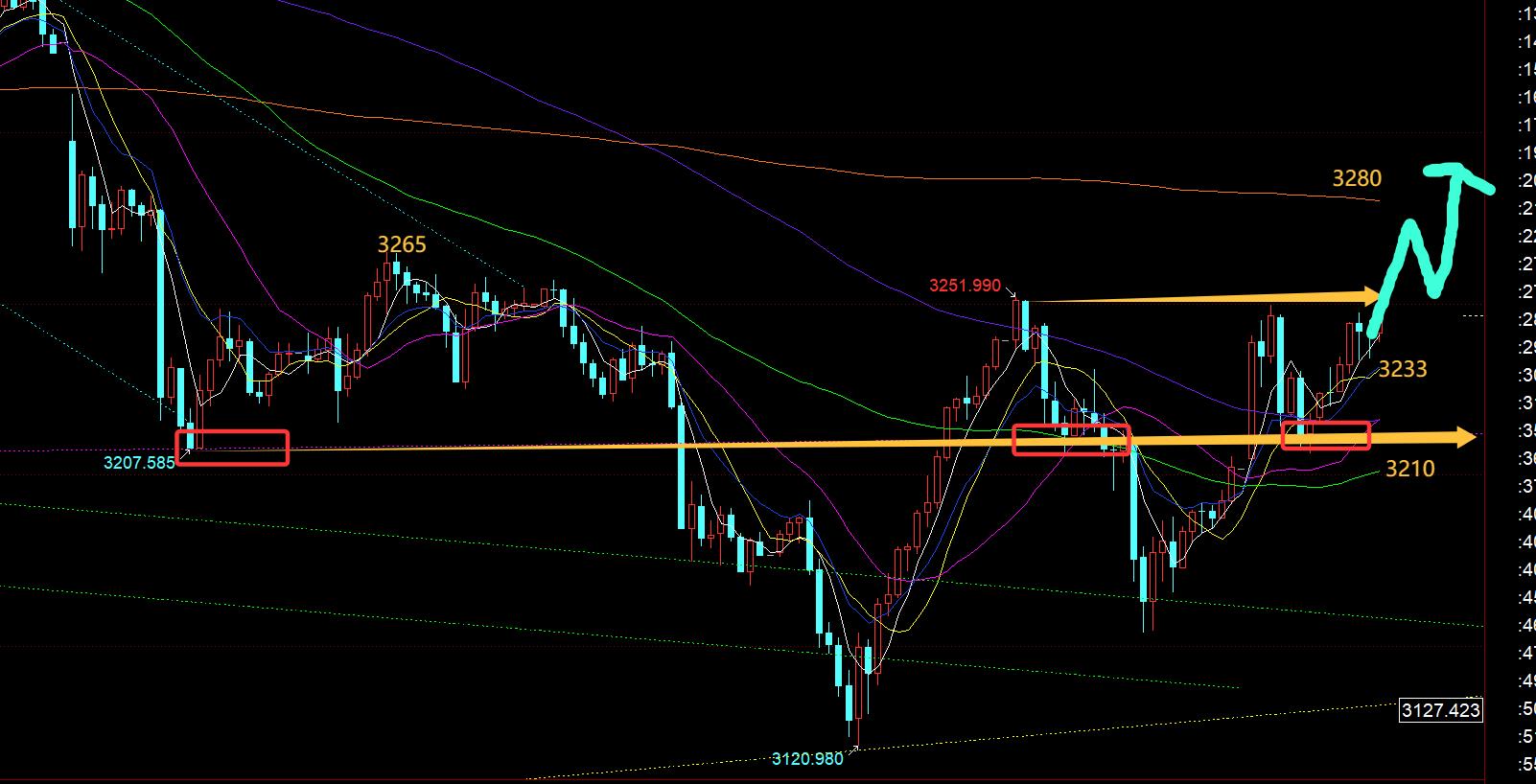

First, gold: Last Thursday, the late trading session rose strongly, and tried to continue the rise in the morning last Friday, but unfortunately it only hit 3252 and quickly rose and fell; in the afternoon, it stabilized above 3210, and 3217 followed a wave of pull-up and reached the 3230 line Take it; the European session surges and falls back again, and loses 3200, so you cannot be bullish, which is easy to suppress downward; the European session is weak, and the US session rebounds first at 3190 and plans to bearish first, but it is under pressure for 3185 to fall two or three times, and the low at 3140-30 has not been given a good band sniper point; after 22 points, you can't suppress it when going to 3190, because time has passed; as the late trading gradually fluctuates and stabilizes, it is recommended to use the low point within 3154 days as the band defense Hold on, look forward to the bullish wave, believing that 3154 is likely to be the second low point, and will expand the daily b wave to pull up. Today, it is indeed in line with the prediction and will soon hit the 3250 line;

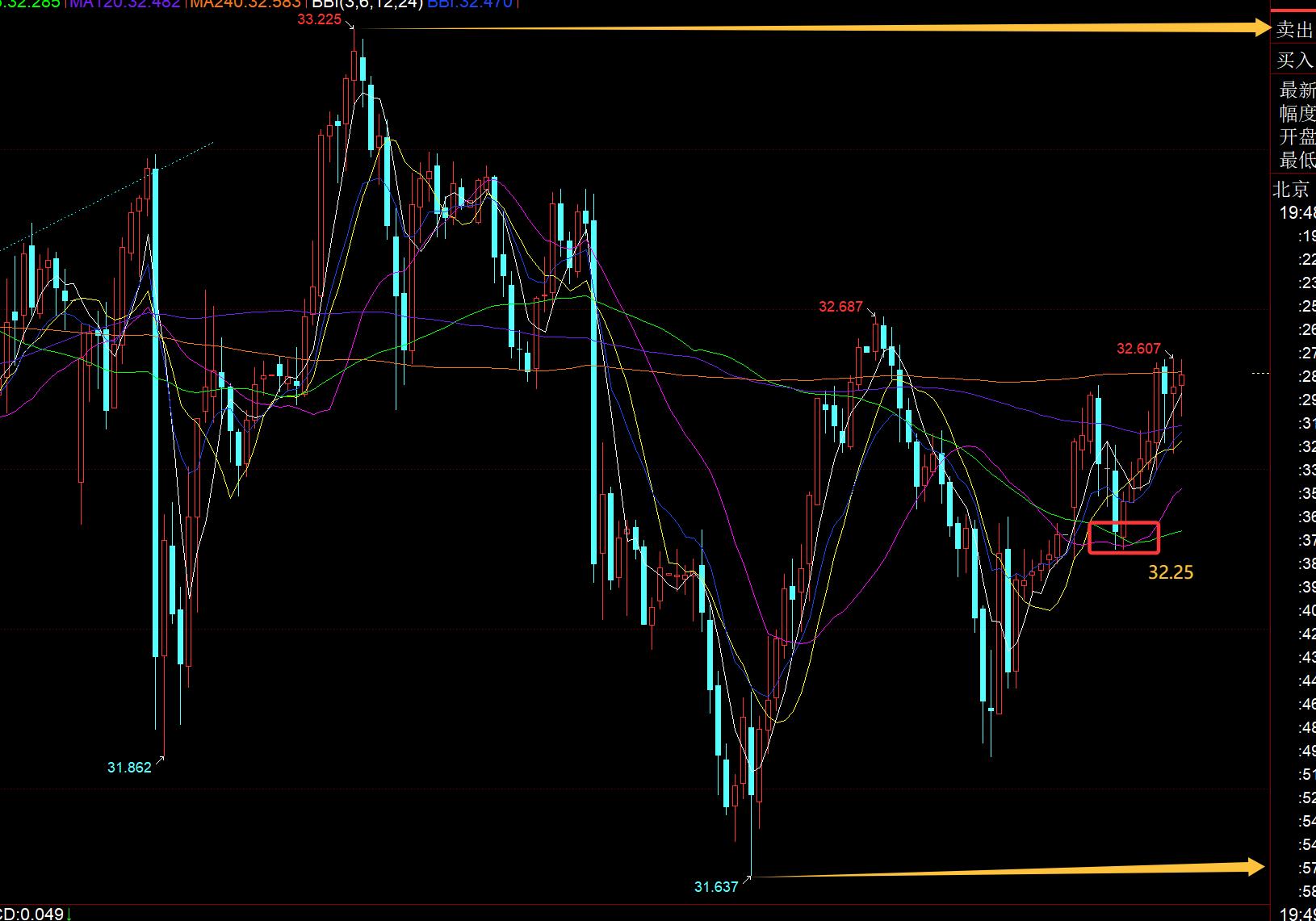

Second, silver: it is still in the midst of 31.65-33.25 and consolidation;

Third, crude oil: After 61.9 is under pressure, there is not much room for decline, and it is only given to 61.1. It is believed that it has fluctuated, because of poor entry, it is Tips for guaranteed capital out;

Interpretation of today's market analysis:

First, golden weekly level: Last week, a negative K with a lower shadow line, the low point just tests the lower track support of the channel mentioned in the weekly video, and closes above the 10th. In addition, in the past few weeks, there is reason to think that the yin and yang cycle may close this week;

Second, golden weekly level: 3438 fell to 3120 as a wave pullback, 3120Starting to stabilize, a b-wave rebound will be launched, and the height is expected to point to the resistance line of 3500-3438, about 3370-3380, and then the pressure cannot be raised, and then the c-wave will eventually fall, and finally stable will start a new round of unilateral trend rise. This is the latest deduction script at present. In addition, Zhou Video also prepared another wave shape: if the key resistance line of 3500-3438 is gradually tested in the future market, it does not bear pressure, but continues to attack and stand up, then it means that 3438-3120 has xmserving.completed the abc pullback wave, and then it takes 2956 as the starting point to get the third upward wave. This probability is relatively low, but you must also be mentally prepared. After all, the final final will always continue the bull market; pay attention to it in the short term today. The 10 moving average and the middle track are the 3280 and 3300 lines respectively;

Third, gold 4-hour level: After the 3154 low points stabilize, it will continue to rise, stand firmly and further exert force, and the oscillating slow pull-up will be good. Once the 22-point closing line can stabilize the 3242 and the 3282 split resistance, the next one to test is the 3279-3280 line, the 50 split resistance is also close to the 66-day moving average;

Fourth, gold hourly level: Before the close of last Friday, Moody's announced a downgrade of the US rating, which is also the last AAA, which means that the US debt crisis has been aggravated, and the credit is reduced. Investors will focus on other safe-haven products, and gold will naturally be the first to bear the brunt; US stocks began to decline at a high level, which also led to some funds joining gold; in addition, the situation in the Middle East is still heating up, and the negotiation results of Russia-Ukraine are not ideal, and these will be conducive to the stabilization and rise of gold prices; therefore, today's opening directly jumped to the 3250 line; a wave of retracement in the afternoon confirmed 3210, and the European session stabilized and continued to fluctuate and rise, and today's technology is relatively xmserving.complete Midea; then once the US price is at the day high or breaks through the high point before the market, it will bring the second continuous pull-up momentum to the US market. The above can point to the previous high point of 3265 and the annual moving average of 3280; stabilize in the afternoon, the low point gradually moves upward, and the current support is 3233. Both touches are bottoming out and the lower shadow K, and the probability of breaking the high tonight is relatively high; tend to be 3233 as a support to defend, and continue to fluctuate and look bullish to rise to 3265, 3280, or even 3300 higher; on the contrary, if you lose 3233, it may turn to the back and forth oscillation again, which will easily not continue;

Silver: The large range still fluctuates repeatedly around 31.65-33.25; tonight, pay attention to the support of 32.25 and hold it, the oscillation rebounds upward and moves closer to 33-33.25; if it falls, the oscillation is weak and moves closer to 31.9-31.65;

In terms of crude oil: the daily middle track and the 10 moving average are concentrated in the 61 line, which is an important short-term support in the day. If it cannot be held, the daily line will continue to weaken and open up downward space; tonight, pay attention to the resistance below 62.2, 618 divides resistance, last Friday, suppresses resistance horizontally, and watch suppression when it fluctuates high;

The above are several points of the author's technical analysis, as a reference, and it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and the interpretation of text and videos will be interpreted. Friends who want to learn, Based on the actual trend, you can xmserving.compare and refer to it; those who recognize ideas can refer to it, lead the defense well, risk control first; those who do not recognize it should just be over; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmserving.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: After the low point of gold is hit, start the daily b wave rise", it is carefully xmserving.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here