Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Nasdaq 100 Forecast: Holds Key Support

- 【XM Market Review】--GBP/AUD Forecast: Continues to Drift Lower but Looks Ready t

- 【XM Market Analysis】--USD/MYR Forecast: US Dollar Drops Against the Ringgit

- 【XM Market Analysis】--USD/INR Analysis: Surges Higher and the Need for Perspecti

- 【XM Market Review】--USD/MXN Forecast: Rally Continues

market news

US credit rating downgrades, gold becomes a safe haven for investors

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The credit rating of the United States has been downgraded, and gold has become a safe haven for investors." Hope it will be helpful to you! The original content is as follows:

Macro

The global financial and geopolitical situation has fluctuated violently recently, and the value of gold investment is highlighted. Moody's downgraded the US AAA credit rating and predicted that the US debt/GDP ratio will rise to 134% in 2035, causing US Treasury yields to rise, and the US dollar trust crisis has emerged. Investors use a dual hedge xmserving.combination to resist risks through gold and US Treasury bonds. The geopolitical crisis continues to ferment. In the Middle East, Israel launched a "Gideon tank" operation against the Gaza Strip, cracking down on more than 670 Hamas targets, and the ceasefire negotiations were deadlocked; in the Russian-Ukrainian conflict, after the two sides failed to talk, Russia launched a large-scale drone air strike, Putin expressed his hinting that the operation was escalated, and the dual geopolitical risks drove gold prices to soar at US$40 in the early trading of the Asian market on Monday. The diplomatic and trade sectors are also turbulent. Iran insists on negotiations on uranium enrichment rights, the United States threatens to resume tariffs and puts pressure on trading partners, and France criticizes U.S. policy uncertainty for dragging investment. Looking ahead to the future market, this week's economic data such as unemployment benefits, PMI, and Fed officials' speeches will become the key basis for the market to judge the direction of the economy and policy.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend last Friday. The price of the US dollar index rose to 101.234 on the day, and fell to 100.493 at the lowest, and finally closed at 100.966. Looking back at the market performance last Friday, the price was suppressed at the four-hour resistance position in the early trading period first, and then the European session rose again and broke through the four-hour resistance position. At present, we need to pay attention to the gains and losses of the daily support 100.20-40 watershed. From a multi-cycle analysis, the price suppresses resistance in the 102.40 area at the weekly level. Then, from a medium-term perspective, the US dollar index will move.The trend will be more bearish. At the daily level, the key price support position is in the range of 100.20-40 over time, and the subsequent focus is on the gains and losses of this position. At the same time, according to the four-hour level, as time goes by, the current four-hour key position is in the 100.80 area. There is further pressure in one hour. Therefore, xmserving.comprehensive analysis temporarily focuses on the gains and losses of the daily watershed position.

The US dollar index focuses on the gains and losses of the daily line 100.20-100.40 range in the short term

Gold

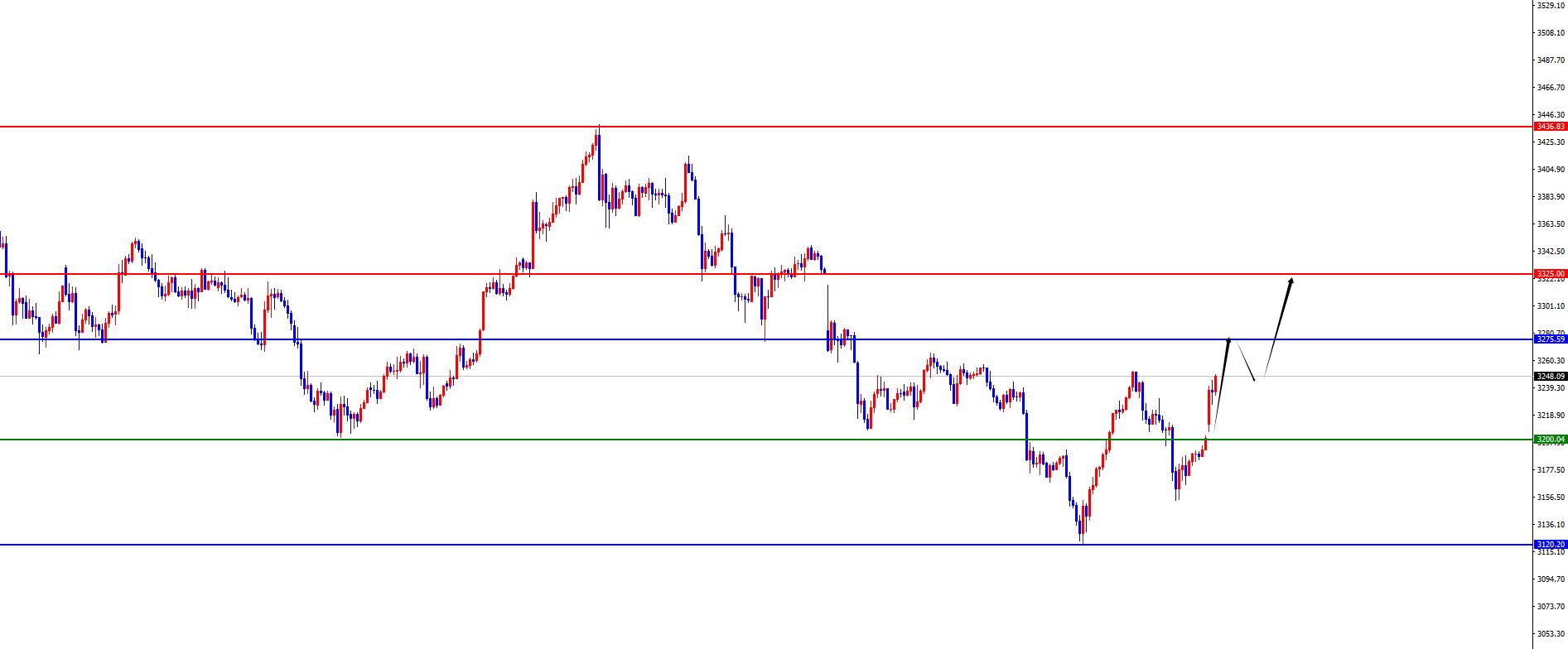

In terms of gold, the gold price overall showed a decline last Friday, with the highest price rising to 3252.02 on the day, falling to 3154.14 on the lowest price, and closing at 3201.06 on the day. In response to the short-term pressure decline of gold during the early trading session last Friday, the weak fell below the four-hour support, and the low point on Friday was exactly the position where the previous downward trend line broke and then retraceeded twice. Finally, the closing was above the four-hour resistance, so the short-term price was relatively high. Today's morning session rose again, and we will pay attention to testing the daily resistance and gap replenishment.

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four-month period, so according to the rhythm, there have been four consecutive positives. For the current May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3120 area. So from the mid-term perspective, we can continue to maintain a bullish view. The price decline is only a correction in the medium-term rise, and the price will be further under pressure only if it breaks the weekly support. Judging from the daily level, the current daily level resistance is in the 3275 area. We will pay attention to further testing this area in the future. At the same time, we also need to pay attention to the 3325 area of the gap last week. At the same time, from the four-hour level, the price broke through last Friday and closed above the four-hour resistance, so the early trading session continued to rise today. At present, the four-hour support is temporarily focused on the 3200 position, and the price is relatively large above this position. The daily line 3275 and the gap 3325 area above.

Gold has a large area of 3200, with a defense of 10 US dollars, and a target of 3250-3275-3325

European and the United States

European and the United States, prices in Europe and the United States generally showed a decline last Friday. The price fell to the lowest level of 1.1130 on the day, and rose to the highest level of 1.1219 on the spot, closing at 1.1160 on the spot. Looking back at the performance of European and American markets last Friday, the price opened in the morning fluctuated and rose again after a short-term upward trend. From the perspective of position, the price has been consolidated up and down at a four-hour key position in recent days. The 1.1260 position is temporarily focused on the 1.1130 position below, and the 1.1130 area below, and the 1.1130 area later.Follow the price after breaking the range.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0800, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1010 area and continues to be bullish from the perspective of the mid-line. The price decline is temporarily treated as a correction in the mid-line rise. From the daily level, the price breaks the daily support after the recent high fluctuation, and at the same time, the price continues to suppress the daily resistance after the breakdown. For short-term short-term treatment at 1.1240 on the band, it will only turn upward after the subsequent breakdown, otherwise it will be short-term treatment on the right. Judging from the short-term four-hour level, European and American market prices have remained in a volatile pattern in recent days, and the long and short prices have not continued, so we should pay attention to the gains and losses of the daily resistance above. At the same time, according to the one-hour view, Europe and the United States are in short-term fluctuations, so it is currently divided into two ways to treat it. First, if the price does not break the daily resistance, first pay attention to the pressure, and once it breaks, it will be treated with the backhand. The second is to follow the layout after the price breaks through the range of 1.1130-1.1260.

Europe and the United States fluctuate from 1.1260 to 1.1130, and follow after breaking the level

[Finance data and events that are focused today] Monday, May 19, 2025

①To be determined Domestic refined oil opens a new round of price adjustment window

②09:30 Monthly report on residential price prices in 70 large and medium-sized cities in China

③10:00 China's total retail sales of consumer goods in April year-on-year

④10:00 China's industrial added value above scale in April year-on-year

⑤11:00 Nvidia CEO Huang Renxun delivered a speech

⑥17:00Eurozone April CPI annual rate final value

⑦17:00Eurozone April CPI monthly rate final value

⑧20:45F Vice Chairman Jefferson delivered a speech

⑨20:45F Williams delivered a speech

⑩22:00Eurozone April CPC Leading Index Monthly Rate

22:00Trump has spoken with Putin, Zelensky and others in succession

Note: The above is only personal opinions and strategies, for reference and xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Forex Decision Analysis]: The credit rating of the United States has been downgraded, and gold has become a safe haven for investors". It was carefully xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here