Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--EUR/USD Analysis: Future Parity Price

- 【XM Market Analysis】--USD/SGD Forecast: Will the Uptrend Continue?

- 【XM Decision Analysis】--Gold Forecast: Gold Hits New Highs

- 【XM Decision Analysis】--USD/CAD Forecast: Pulls Back Against Canadian Dollar

- 【XM Market Review】--GBP/USD Analysis: Under Pressure Before BoE

market news

India-Pakistan confrontation to promote risk aversion, and the rooster cries gold and silver rise in the middle of the night

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: India-Pakistan confrontation promotes risk aversion, and the rooster cries gold and silver rise in the middle of the night." Hope it will be helpful to you! The original content is as follows:

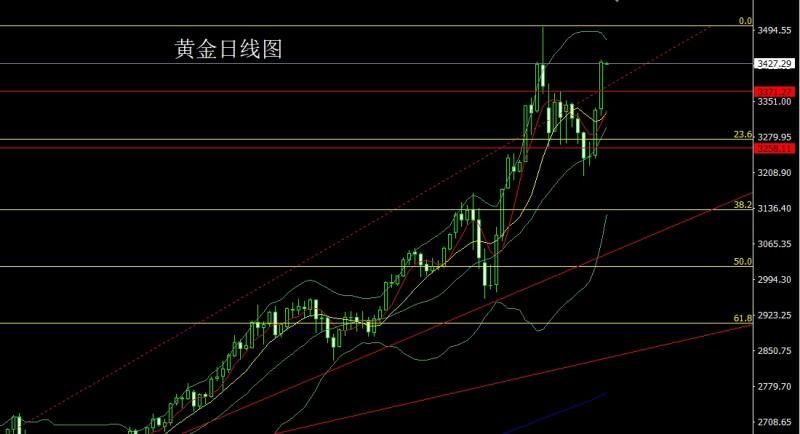

The gold market continued to rise yesterday. The market opened slightly higher in the early trading at 3335.8 and then filled the gap. The market started a pull-up process. After the neckline pressure broke through 3372, the market rose strongly under risk aversion. The daily line reached the highest level of 3435 and then the market was able to reach the market's ability. The daily line finally closed at 3430.3 and then the market closed with a large positive line with a longer lower shadow line. After this pattern ended, today's market fell back. At the point, today's 3371 is long and 3368 is long and stop loss 3365. The target is 3390 and 3400 and 3410 and 3420 pressures. If the pressure breaks through 3435 yesterday's high, the main pressure above is 3450 and 3465.

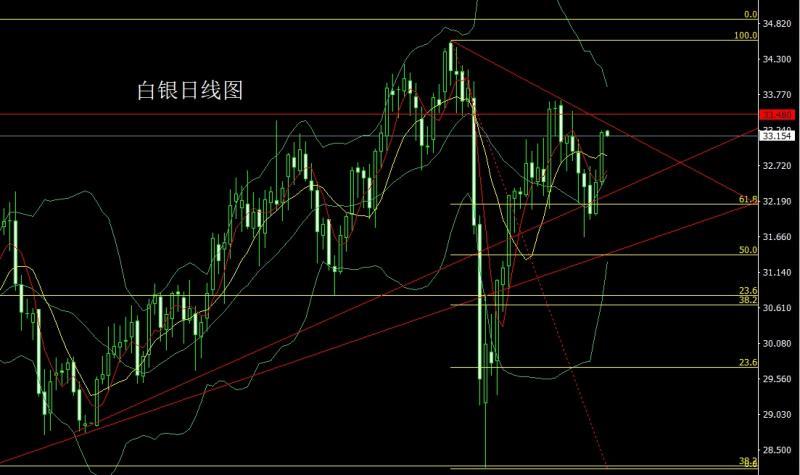

The silver market opened at 32.483 yesterday and the market fell first. The daily line was at the lowest point of 32.421 and then the market rose strongly. The daily line reached the highest point of 33.239 and then the market consolidated. The daily line finally closed at 33.205 and then the market closed with a large positive line with a longer lower shadow line. After this pattern ended, 32.85 was more stop loss at 32.65 today, and the target was 33.25 and 33.5 and 33.75-34.

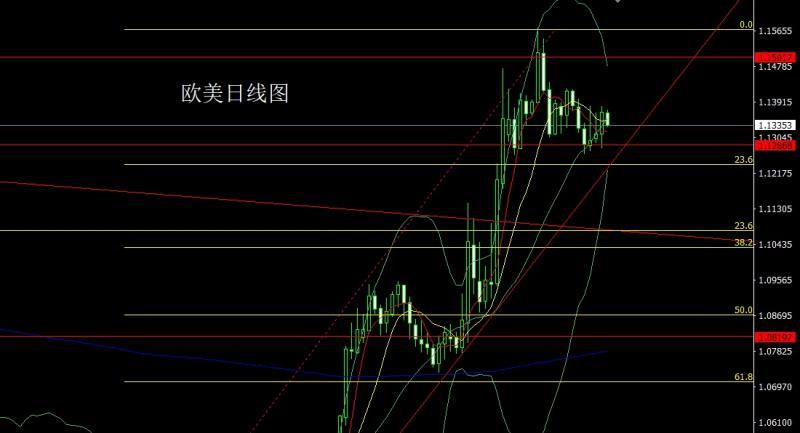

European and American markets opened at 1.13133 yesterday and the market fell first. The daily line was at the lowest point of 1.12789 and then the market rose strongly. The daily line reached the highest point of 1.13812 and then the market consolidated. The daily line finally closed at 1.13675 and then the market closed with a medium-positive line with a long lower shadow line. After this pattern ended, the stop loss of more than 1.13200 today was 1.13000, and the target was 1.13500 and 1.13800 and 1.14000-1.14200.

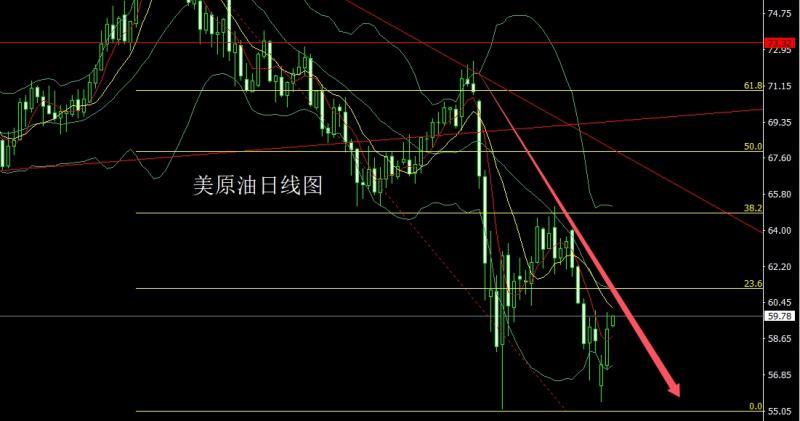

The US crude oil market opened at 57.31 yesterday and the market fell slightly and gave the 57.13 position. After the market rose strongly, the daily line reached the highest position of 59.97, and the market consolidated. The daily line finally closed at 59.11, and the market closed with a large positive line with a long upper shadow line. After this pattern ended, the 58.4 long stop loss was 57.8 today, and the target was 60 and 60.5 and 61-61.3.

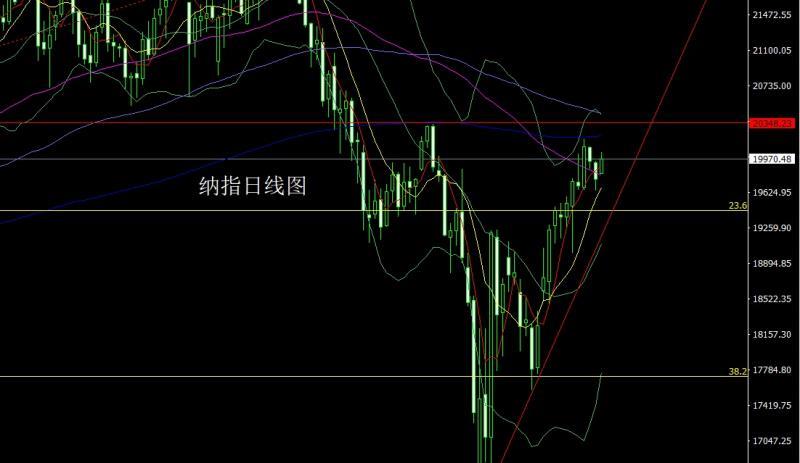

The Nasdaq market opened at 19935.12 yesterday and the market fell back to the daily high of 19950.82. The market fell strongly. The daily line was at the lowest point of 19646.62. The market finally closed at 19761.7. The market closed with a very long lower shadow line. After this pattern ended, the stop loss of 19870 was more than 1. 9770, targets 20050 and 20150 and 20200.

Brands, yesterday's fundamentals, India's fundamentals showed signs of escalation in the Indian-Pakistan conflict. Indian armed forces launched Operation Sindur to attack multiple locations in Pakistan. India said the operation was aimed at xmserving.combating terrorist infrastructure and was not targeted at Pakistani military facilities. Pakistan said that India launched missiles at Badot, but India did not have India during the attack. Military aircraft entered Pakistani airspace. Pakistani Defense Minister refuted the claims that India has cracked down on terrorists. Pakistani military: Pakistan and India have exchanged fire in Pakistani-controlled Kashmir. Pakistan has launched ground and air xmserving.combat operations. Shoot down two Indian fighter jets. Under risk aversion, the gold market has risen by 100 points again. Today's fundamentals will enter the focus of this week, mainly focusing on the monthly retail sales rate of the euro zone in March at 17:00. Then look at 2 The EIA crude oil inventories in the U.S. to May 2 week and the EIA crude oil inventories in the U.S. to May 2 week and the EIA strategic oil reserve inventories in the U.S. to May 2 week. On Thursday, the Federal Reserve FOMC announced its interest rate resolution at 2:00. Then the Federal Reserve Chairman Powell held a monetary policy press conference. Although there will be no interest rate cuts in this round, it will be in the trade war and the U.S.Against the backdrop of unification repeatedly threatening the Fed's chairman, it is worth paying attention to whether the Fed's next policy will change.

In terms of operation, gold: 3371 long conservative 3368 long stop loss 3365, target 3390 and 3400 and 3410 and 3420 pressures. If the pressure breaks through the 3435 yesterday's high, the main pressure above is 3450 and 3465.

Silver: 32.85 long stop loss 32.65 today, target 33.25 and 33.5 and 33.75-34.

Europe and the United States: 1.13200 more stop loss 1.13000, target 1.13500 and 1.1380 0 and 1.14000-1.14200.

U.S. crude oil: 58.4 long stop loss 57.8 today, target 60 and 60.5 and 61-61.3.

Nasdaq: 19870 long stop loss 19770 today, target 20050 and 20150 and 20200.

The above content is all about "[XM Foreign Exchange Market Review]: India and Pakistan are promoting risk aversion, and the chicken is calling for gold and silver in the middle of the night". It is carefully xmserving.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here